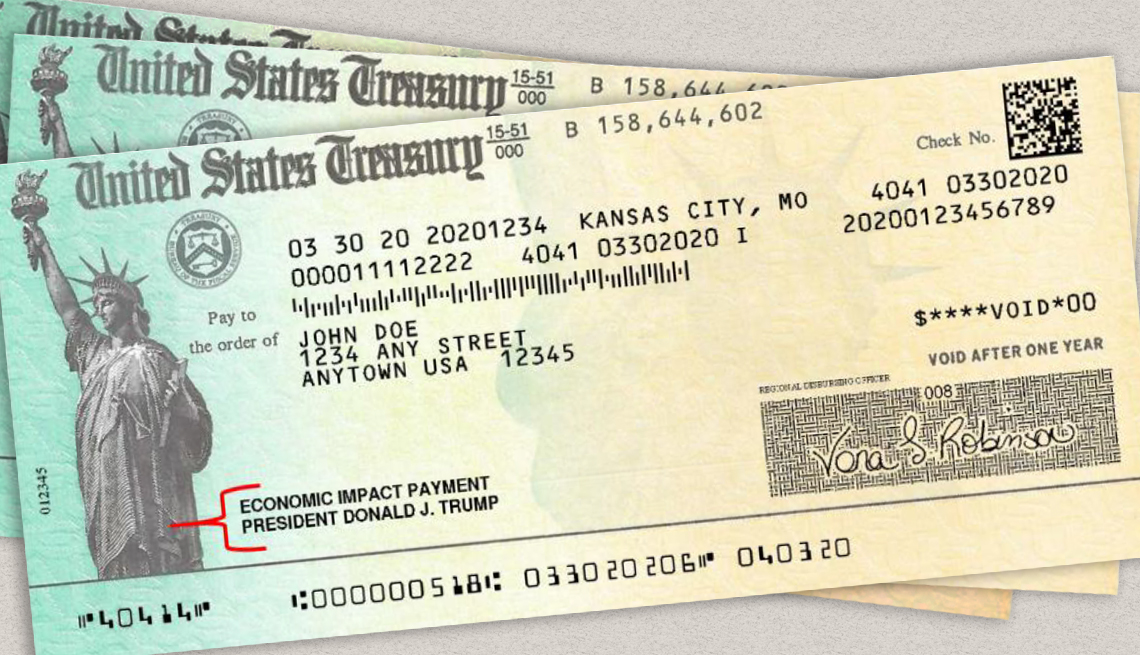

Following the President’s emergency declaration last week pursuant to the Stafford Act–a federal law designed to bring a systematic means of emergency assistance for state and local governments to aid citizens–the Treasury Department and Internal Revenue Service announced this past weekend that the federal income tax filing due date is extended from April 15, 2020, to July 15, 2020. You can also defer federal income tax payments to July 15, 2020, without penalties and interest, regardless of the amount owed.

The deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax. This federal tax filing and payment relief is automatic and you don’t need to file any additional forms or call the IRS to qualify for it. If you think you might need additional time to file beyond the July 15 deadline, you can request a filing extension by filing Form 4868 or Form 7004 for businesses.

If you are due a refund, it’s best to file as soon as possible. Most tax refunds are still being issued within 21 days. “Even with the filing deadline extended, we urge taxpayers who are owed refunds to file as soon as possible and file electronically,” said IRS Commissioner Chuck Rettig. “Filing electronically with direct deposit is the quickest way to get refunds.”

You can find the most up-date coronavirus tax relief information on the IRS special coronavirus page.

State Taxes

Although the federal tax filing date has been extended, you need to check with your state for any state filing changes. For example, New York has already extended to July 15 and so has Alabama.

“It is imperative we reduce the burden upon Alabamians and get folks back on their feet financially. The safety and wellbeing of Alabamians is the paramount priority as we do everything within our power to mitigate the spread of the Coronavirus,” said Governor Ivey.

New Jersey hasn’t yet announced the state tax filing extension, but it may extend to June 30. Check with your state’s Department of Revenue to see if there is a new deadline in your state.