This is arguably the most helpful guide on how to climb the “credit card ladder” you will ever come across. By the end of this article you will know: how to go from the most basic to the most prestigious credit card, what is a credit card tier system, where you are on the “credit card ladder”, how to decide what card to apply for based on your financial goals and lifestyle preferences, and what to pass on in order to avoid unnecessary charges and fees.

Tier one through four is where most of us are and in tier five are the ultra exclusive, invitation-only credit cards. Let’s take a closer look at each tier and what it entails.

Tier One Credit Cards

These are secured credit cards and basic unsecured “credit builder” cards, that, for the most part, don’t have annual fees. These cards will give you a credit line of a few hundred dollars. No perks, points, rewards or benefits await you with these credit cards. Tier one cards’ main role is to help you build your credit score, and thus they especially cater toward people with subprime credit scores such as those with little credit history or bad credit.

Apply for a tier one credit card when

- You have little credit history

- You have bad credit

- Your income is significantly lower than the median household income in America ($61,937)

Examples of tier one credit cards include

Credit One basic cards, First Premier Bank, Ollo Card, Petal Card, and The Capital One Platinum Card (an easy approval, a low limit and a guaranteed credit limit increase after 5 months of on time payments).

If you can’t get approved for a basic card like the Capital One Platinum we’d recommend to go for one of the secured credit cards rather than something like Credit One which specifically target the subprime market and are often referred to as fee harvester cards. Check out this video about secured credit cards to learn more.

Tier Two Credit Cards

Tier two cards are credit cards with no annual fee, but do earn some type of rewards, points, but most often cash back. One of the features of some of these cards is “future proofing” e.g. the cards earn cash back, and the cash back can be transferred to other higher level cards where it becomes points. For example, from Chase Freedom to Chase Sapphire; points take on 25% more value when you redeem them for travel through Chase Ultimate Rewards. Another example, Citi brought in points transfer for the Citi Double Cash last year, enabling you to get more value out of your tier two card by transferring your cash back to Citi ThankYou points where it can can be used to book travel or transferred on to airline loyalty programs.

Typically, tier two cards have sign-up bonuses ranging between $100 to$150 in value, whether it be in points or in cash back, etc. The credit limits on these cards varies from $500 to the low thousands, for people who just meet the requirements to get approved.

Apply for a tier two credit card when

- Your credit score is in the mid to upper 600s

- Your income is about $25K-30K a year

If you’re not yet in the above categories, go to tier one, build your credit score and then apply for one of the tier two cards.

Examples of tier two credit cards include

Chase Freedom Unlimited – earn a $200 Bonus (after you spend $500 on purchases in your first 3 months) and an unlimited 1.5% cash back on all purchases. These Cash Back rewards do not expire. It is also a good idea to get Chase cards early on, because of the 5/24 rule–Chase generally will not approve applications for certain credit cards if you have already opened 5 or more credit card accounts (at any bank) in the last 24 months.

Chase Freedom Unlimited – earn a $200 Bonus (after you spend $500 on purchases in your first 3 months) and an unlimited 1.5% cash back on all purchases. These Cash Back rewards do not expire. It is also a good idea to get Chase cards early on, because of the 5/24 rule–Chase generally will not approve applications for certain credit cards if you have already opened 5 or more credit card accounts (at any bank) in the last 24 months.

Some other cards that are also in the tier two categories are the Discover it card, Citi Double Cash and Amex Everyday.

Tier Three Credit Cards

This is where it starts to get interesting in terms of rewards and sizable sign up bonuses. Tier three cards really allow you to earn a lot of points for airlines, hotels, local commute, and receive perks like free checked bags, priority boarding, coupons to complimentary lounge access (for a limited number per year), and more. The credit limits on these cards starts at around $5,000 and goes up to around $7,000-10,000.

These cards do have annual fees, averaging at $95, but can go as high as $250. Credit cards with higher annual fees usually have rewards where you can get a lot of that value back.

Apply for a tier three credit card when

- Your credit score is at least 700

- You have a bit more of a reasonable income, especially if your credit score is on the lower end of the 700s. Say your income is $10K lower than the median household income in America ($61,937), you would still most likely be able to qualify for opening one of these credit card accounts.

- Your credit history is at least 8 months to a year

Examples of tier three credit cards

Chase Sapphire Preferred – earn 60,000 sign up bonus points (after you spend $4,000 on purchases in the first 3 months), giving you $750 toward travel when you redeem through Chase Ultimate Rewards. Earn 5X points on Lyft rides through 3/31/2025, which is 3X points in addition to the 2X points you already earn on travel. Earn 2X points on travel and 3x on dining at restaurants worldwide and 1 point on all other purchases.

Chase Sapphire Preferred – earn 60,000 sign up bonus points (after you spend $4,000 on purchases in the first 3 months), giving you $750 toward travel when you redeem through Chase Ultimate Rewards. Earn 5X points on Lyft rides through 3/31/2025, which is 3X points in addition to the 2X points you already earn on travel. Earn 2X points on travel and 3x on dining at restaurants worldwide and 1 point on all other purchases.

American Express® Gold Card is the perfect tier three card for you if you dine often. You will earn 4X Membership Rewards points on every $1 spent at restaurants worldwide as well as at U.S. supermarkets (on up to $25,000 per year in purchases, then 1X). You can also earn up to $10 in statement credits monthly when you pay with the Gold Card at Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and select Shake Shack locations. (That is an annual saving of up to $120. (Terms Apply and enrollment required for select benefits)

American Express® Gold Card is the perfect tier three card for you if you dine often. You will earn 4X Membership Rewards points on every $1 spent at restaurants worldwide as well as at U.S. supermarkets (on up to $25,000 per year in purchases, then 1X). You can also earn up to $10 in statement credits monthly when you pay with the Gold Card at Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and select Shake Shack locations. (That is an annual saving of up to $120. (Terms Apply and enrollment required for select benefits)

American Express® Gold Card – Rates & Fees

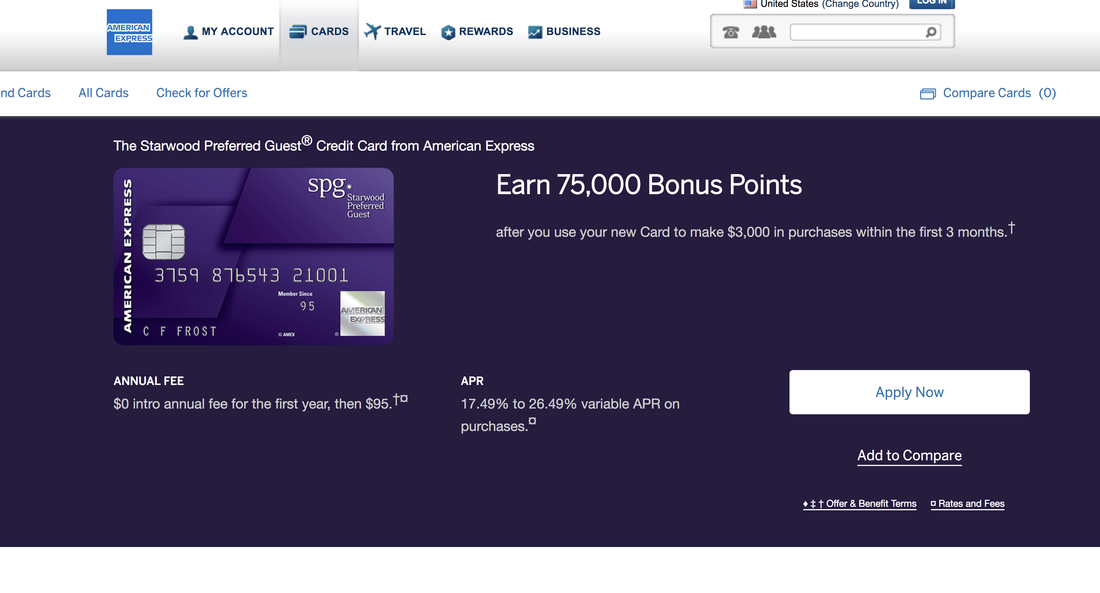

Tier three cards also include co-branded airways cards like United Explorer Card (50,000 intro bonus miles after you make purchases totaling $3,000 or more during the first 3 months and $0 introductory annual fee for the first year, then $95) and hotel cards that give you a free night – the free night offsets the annual fee – such as Marriott Bonvoy Boundless Credit Card, The World of Hyatt Credit Card, IHG Rewards Club Premier Credit Card.

Tier Four Credit Cards

With tier four cards it becomes all about the perks. One of the most valuable of which is airport lounge access, where you can sit down, stretch out, and enjoy complimentary drinks, refreshments, and preflight bites. At a minimum, all of the tier four credit cards will offer you access over to 1,300 lounges worldwide through Priority Pass. The Platinum Card from American Express features Priority Pass and it also has an added benefit of giving you access to Delta Sky Clubs and Amex’s own Centurion lounges.

In addition to airport lounge access, tier four credit cards will offer you global entry credit, hotel status, and some type of travel credit, which helps you redeem some of the annual fee. Annual fees on these cards are between $450 to $700 in general. The annual fees used to be $450, but now more and more cards are rising up above $450.

Apply for a tier four credit card when

- Your credit score is at least 720

- You have a reasonably solid income, as close as possible to the median household income in America ($61,937). If your income is lower but your credit score is higher, you should still be able to get approved for one of the tier four credit cards.

- You have 1.5-2 years of credit history

Examples of tier four credit cards

Chase Sapphire Reserve – earn 60,000 bonus points (after you spend $4,000 on purchases in the first 3 months) and 3X points on travel immediately after earning your $300 travel credit. You will also earn 3X points on dining at restaurants and 1X point per $1 spent on all other purchases. The annual fee is $550

Chase Sapphire Reserve – earn 60,000 bonus points (after you spend $4,000 on purchases in the first 3 months) and 3X points on travel immediately after earning your $300 travel credit. You will also earn 3X points on dining at restaurants and 1X point per $1 spent on all other purchases. The annual fee is $550

The Platinum Card® from American Express – earn 100,000 points after you use your new card to make $6,000 in purchases in the first 6 months, 5X points on flights booked directly with airlines or with American Express Travel and 5X points on prepaid hotels booked on amextravel.com. The annual fee is $695.

The Platinum Card® from American Express – earn 100,000 points after you use your new card to make $6,000 in purchases in the first 6 months, 5X points on flights booked directly with airlines or with American Express Travel and 5X points on prepaid hotels booked on amextravel.com. The annual fee is $695.

The Platinum Card® from American Express – Rates & Fees

There are cards with a lower annual fee in the tier four credit card category such as Citi Prestige ($495 – discontinued for new cardmembers), US Bank Altitude Reserve ($400).

Tier Five Credit Cards

Tier five credit cards are invitation-only cards. These credit cards are rarely – if ever – advertised, only available to top tier customers, and reportedly have no credit limit. You can’t apply for them, hence the invitation-only category and you’d need more than just a thick wallet to qualify. For example, you may need to be a royal family member or have a celebrity status. Fees for elite cards are likewise in the top tier category. The American Centurion, a.k.a. the quintessential black card, for instance, charges $10,000 to open the account (initiation fee) and a $5000 annual fee. Check out this video to learn more about Amex Centurion card and celebrities known to have this Black Card.

Another most famous examples of the invitation-only cards include J.P. Morgan Reserve Card, formerly known as the Palladium Card, that is reserved for Chase clients who have over $10 million under management through JPMorgan Chase & Co, Dubai First Royale, Citi Chairman Card, and Stratus Rewards Visa Card.

If you don’t spend that much money, don’t go to that many red-carpet-like events and don’t hang out with celebrities that often, it’s rather questionable how much value you’d get out of one of these cards.

***

This concludes our ultimate credit card tiers breakdown. We hope you’re well-versed now on the subject of the “credit ladder”, know exactly where you stand and how to go from the most basic, no perks credit card, to the most prestigious card, where you’ll be able to buy a $10 million yacht while on vacation.

- Editorial Disclosure: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

- User Generated Content Disclosure: The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.