There are endless advantages to using a credit card, as long as you use your credit card responsibly and don’t spend beyond your means. The advantages include cash back, rewards redeemable for your next travel adventure, insurance, convenience and more. There are a huge array of credit cards on the market, but you have to start somewhere. So today we’re going to be looking into secured vs unsecured credit cards and figuring out which card is right for you. This article is essentially a crash course that covers when you should apply for either of the cards, what is collateral, how to earn rewards, how secured and unsecured credit cards “behave” in each of their lifespan cycles and how this “behavior” affects you.

What Is a Secured Credit Card?

Secured credit cards require a refundable security deposit in exchange for your line of credit. Credit Shifu compares getting secured credit cards to renting an apartment: You give your landlord a security deposit and he/she gives it back to you when you move out. As long as you haven’t trashed the place, in which case the landlord will use it for repairs. That is exactly what you do with a secured credit card; you give the bank an amount of money, usually equal to the credit limit you have on the card. This is called collateral. The collateral is stored in a locked bank account and will be used to reimburse the bank if you don’t pay your bills.

Any secured credit card will always have the word “secured” in the name. Just like the Capital One® Secured Mastercard® Which is one of our recommended secured cards. With a secured credit card you can enjoy the convenience and security of a credit card, as well as any benefits or rewards that the card may offer.

What Is an Unsecured Credit Card?

An unsecured credit card is a credit card that doesn’t require a security deposit in order to approve you for the credit card. It also doesn’t require a security deposit for increasing your credit limit, once you’re approved. When people use the term credit card, what they’re referring to is exactly an unsecured credit card.

Most people would prefer an unsecured credit card because you don’t have to pay out money up front (security deposit) and you can put this money to use by investing or opening savings accounts and earning interest.

Credit Score Requirements

If you have poor credit, or none at all, you might not get an approval for an unsecured credit card. A secured credit card–often referred to as a credit card that won’t deny you–is right for you at this stage. If you commit to making on-time payments every month, which is an important factor that impacts your creditworthiness, having a secured credit card will help you build up your credit score fast. Check out this video on how to build up your credit score as fast as possible.

If your credit score is in the mid to upper 600s, you can apply for a tier two credit card. Tier two cards are credit cards with no annual fee, but do earn some type of rewards, points, and most often cash back. Examples of tier two credit cards include Chase Freedom Unlimited, Blue Cash Everyday Card from American Express, and the Hilton Honors American Express Card.

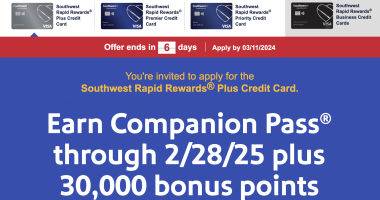

If your credit score is at least 700, you can apply for a tier three card. Tier three credit cards offer sizable sign up bonuses and really allow you to earn a lot of points for airlines, hotels, and receive perks like free checked bags, priority boarding, coupons to complimentary lounge access (for a limited number per year), and more. Examples of tier three credit cards include Chase Sapphire Preferred® Card, American Express® Gold Card, co-branded airline and hotel cards like United Explorer Card and Marriott Bonvoy Boundless Credit Card.

Applying for Secured vs Unsecured Credit Card

Applying for a secured credit card is similar to applying for an unsecured credit card in that it requires your basic financial information, as well as your permission to perform a credit check. However, when applying for a secured credit card you will also have to provide your bank account and routing number in order to submit a refundable security deposit.

Once you’ve been approved and put down your deposit, you will receive a statement each month, and you should try to pay your balance in full each month by the due date to avoid interest charges. This applies for both secured and unsecured credit cards.

Credit Limit

Secured credit cards, as a rule of thumb, will have lower or much lower credit limits than their unsecured counterparts. This is due to the security deposit requirement, which is usually equal to the amount of your credit limit. For example, if your collateral is $200, then your credit limit will also be $200. Although if your credit score is a littler higher, some secured cards will raise your credit limit beyond what you have put down as a deposit.

Unsecured credit cards offer credit limits ranging from a few hundred dollars with tier one credit cards, to unlimited credit lines with tier five credit cards. Check out An Ultimate Credit Card Tier System Guide to learn how to go from the most basic to the most prestigious credit card.

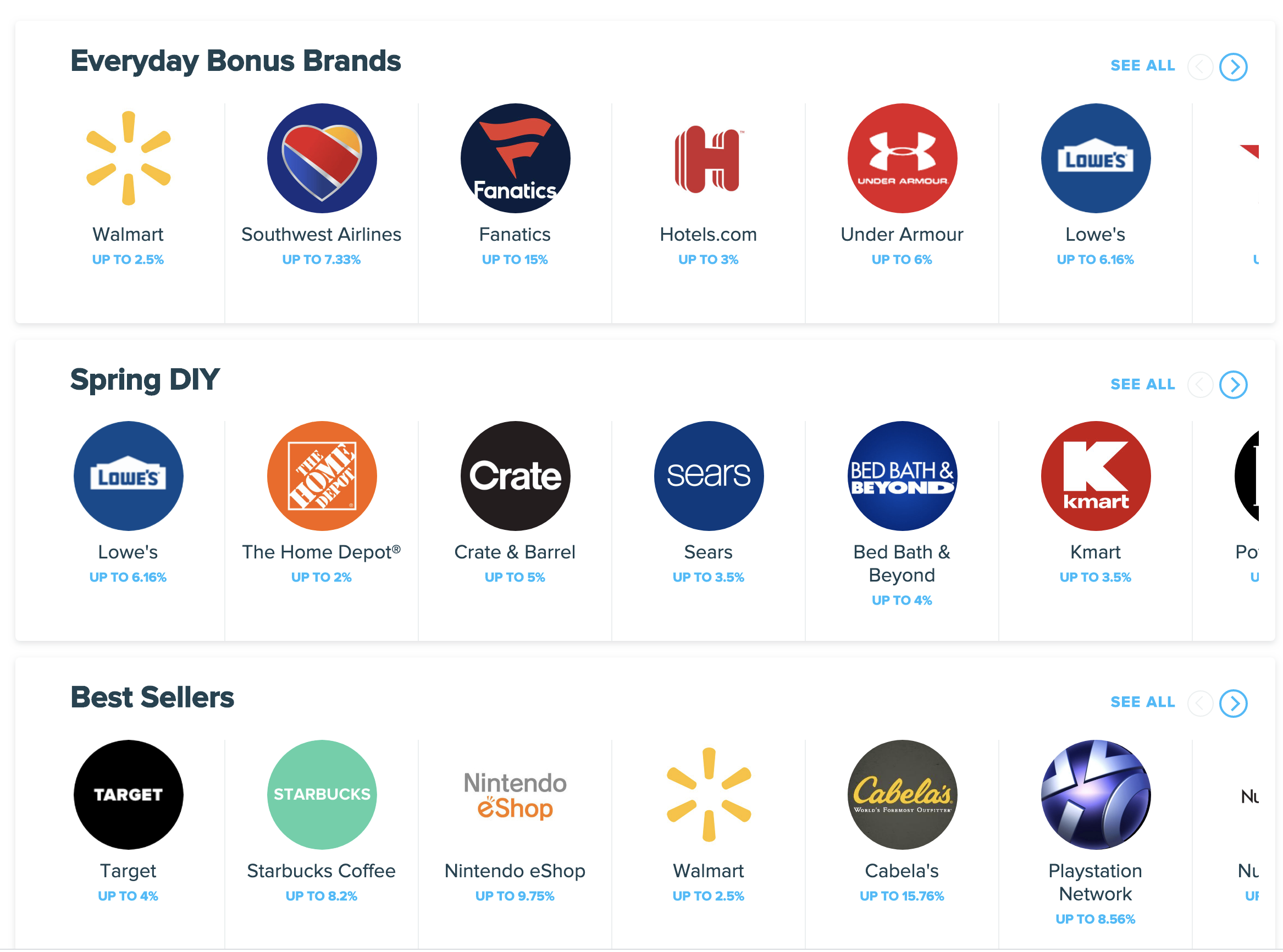

Rewards, Points, and Perks

Some secured credit cards offer cash back, and some also offer points and rewards. Due to the low credit limit, your potential earnings are much smaller than what you can earn with an unsecured credit card. Generally, secured credit cards don’t offer sign up bonuses.

Unsecured credit cards offer a wide range of perks, rewards, and points as well as sizable sign up bonuses, cash back, exclusive customer service and more, depending on your credit card tier. Avid credit card users get even more value out of their earned cash back by transferring it to other higher level cards where it becomes points, and the points could take on up to 25% more value when redeemed through a given credit card issuer rewards portal.

In summary, having a credit card can simplify many aspects of your life, for example when renting an apartment or car, booking a hotel or even signing with a utility service provider. It also allows you to earn back some of the processing fees we’re paying every time we make purchases. Having a credit card is convenient, regardless if it’s a secured or an unsecured credit card, as long as you don’t spend beyond your means. If your credit score is poor, you can start building or rebuilding your score with a secured credit card. If your credit score is around 600 and up you have a variety of unsecured credit cards to choose from and can enjoy many perks that come with using a credit card.