Hey credit warriors! In this article, we will teach you how to manage your wealth and great things to know about investment. And don’t worry, we’re not going to teach you some new-age nonsense like standing up repeating the millionaire’s mantra to yourself in front of the mirror every morning, “I will manifest great wealth, I will manifest great wealth” or meditating on your financial future or, you know, other ways. No, we are going to teach you seven practical tips for increasing your wealth

The Ultimate Guide to Wealth Management and Early Investment:

-

Understanding Assets and Liabilities

-

Start Investing Early

-

Optimize Your Tax Situation

-

Understand where you are on the wealth ladder

-

Be an early adopter

-

Have an emergency fund

-

Understand the macro-financial climate

Here we go!

1. Wealth Management: Understanding Assets and Liabilities

This is a great place to start. Traditionally, most people see a person’s primary residence that they own, as an asset, you build up equity in the property, you can use it as a savings account, you can borrow against it, etc. But in 1997, Robert Kiyosaki came out with the book Rich Dad Poor Dad, where he argued that a primary residence is a liability, not an asset. And this is because he was using a more strict method to define what an asset is, being that it must have cash flow. So if you own a rental property, for example, provided the rent covers the mortgage, the insurance, all of the expenses associated with it, and perhaps on top of that even delivers a little bit of profit, then that is going to be an asset. But the same property could become a liability if it went vacant, or if you had to lower the rent for some reason, and the cash flow coming in no longer covered the expenses, and it started costing you money each month instead. So it’s vital to understand the differences between assets and liabilities. And you aim to buy assets, not liabilities.

Let’s do a little test. Here are some examples of which one’s an asset and which one’s a liability:

- Your primary residence. This one’s easy. It’s a liability.

- Your Car. Another liability.

- A rental property delivering positive cash flow. That’s an asset.

- Boat for personal use. Of course, that’s a liability.

- Stocks. Now that’s an asset! And that’s because stocks don’t cost any money to keep. Maybe there’s a brokerage fee or something like that, depending on your account. But stocks are generally going up. And they do deliver a dividend depending on the stock. So they will be giving you probably some cash flow each month, awesome!

- Undeveloped land, this is a liability. Undeveloped land would be viewed as a liability

- because it’s not bringing you any cash flow, yet you have to pay the property taxes on it each year. And depending on where that is in the country, that could be quite a lot. However, as soon as you build a house on that land, or develop a farm, or I don’t know, set up your own paintball operation, or whatever you do with it, something where you can charge people money for using it, then it could become an asset.

- A Lamborghini that you rent out to people that generates profit. This one is an asset. I mean if your someone who actually runs a business renting out exotic cars, if you’re just someone who wants a Lamborghini, and you’re thinking, “Yeah, I’ll rent it out a bit on Turo, see if I can make the money back, see if I can make it pay for itself” You’re probably not going to generate a profit like that. And you know, it’s going to end up being a big liability.

- Cryptocurrency. That would also be an asset. And that’s pretty similar to stocks because cryptocurrency is generally going upwards, although it’s a lot more volatile. And you can stake it and get some interest from holding it.

I think you understand the difference between an asset and a liability. Apart from your primary residence and your car, you should make the effort to buy only assets. Of course, once you have made it rich, and you might want to splash out, but just make sure all of those toys like boats and Lamborghinis for personal use are paid for by the cash flow from your assets.

2. Early Investment tips: Start Investing Early

Jeff Bezos, CEO of Amazon, and former richest person in the world said to billionaire investor Warren Buffett: “Your style of investing is so simple. Why don’t people just copy you?” To which Buffett replied: “Because no one wants to get rich, slow.” Buffett has relied on the exponential power of compound interest to build his wealth. But this only works if you start very early. Buffett started at 11 years old and 99.7% of his wealth was earned after the age of 50. He is now worth $100 billion at 91 years old! So let’s look at how wealth builds over long periods. If you put away $500 per month and an 8% rate of return, you will be a millionaire in 33 years. But if you keep going, you will surpass 2 million in just nine more years, and in five more years, you’ll have 3 million! This is the exponential power of compound interest. It takes discipline to do this, though, because you have to go many years with your wealth only increasing a little bit in order to get those huge gains later on. The wait, however, is totally worth it.

So where do you need to put your money to make this happen? Well, that 8% gain that we mentioned earlier, is the average gain of the S&P 500 over the long term measured from 1957 to 2018. So you could put your money in an S&P 500 Index Fund, you could also look at different ETFs, or even individual stocks if you know what you’re doing. And you could see those kinds of returns. Now, if you’re going to invest in the stock market, you’re going to need an account to do that. And that brings me to the sponsor of today’s video Wealthfront. They are a super easy-to-use app that builds you a portfolio based on your own risk tolerance that they will manage for you if you want to be more hands-on. Wealthfront also specializes in letting you create a portfolio picking from hundreds of expert vetted ETFs. The minimum investment is $500. But, if you sign up using my link, you get your first $5,000 managed for free for life. After that, Wealthfront’s fee is 0.25% of your assets under management. But 96% of users using their classic recommended portfolio, make that amount back and often more just through the savings on their taxes. Basically, if you have an ETF in your account that goes down and you lose money on it, Wealthfront will sell that ETF to give you a realized loss that can offset your capital gains. Now, if Wealthfront was just to rebuy that ETF immediately, it would trigger the wash sale rule, and that loss would not be allowed. So what they do instead is they buy a very similar ETF, and thus the wash sale rule does not come into play. So you get a realized loss to save some money on your taxes. And you still maintain pretty much the same portfolio allocations. So, if you are interested in Wealthfront, click the link q

3. Optimize Your Tax Situation

Now there’s a reason most influencers on YouTube are located in Las Vegas. That is because of the 0% state tax rate. Except for me, I’m all left out over here in New York.

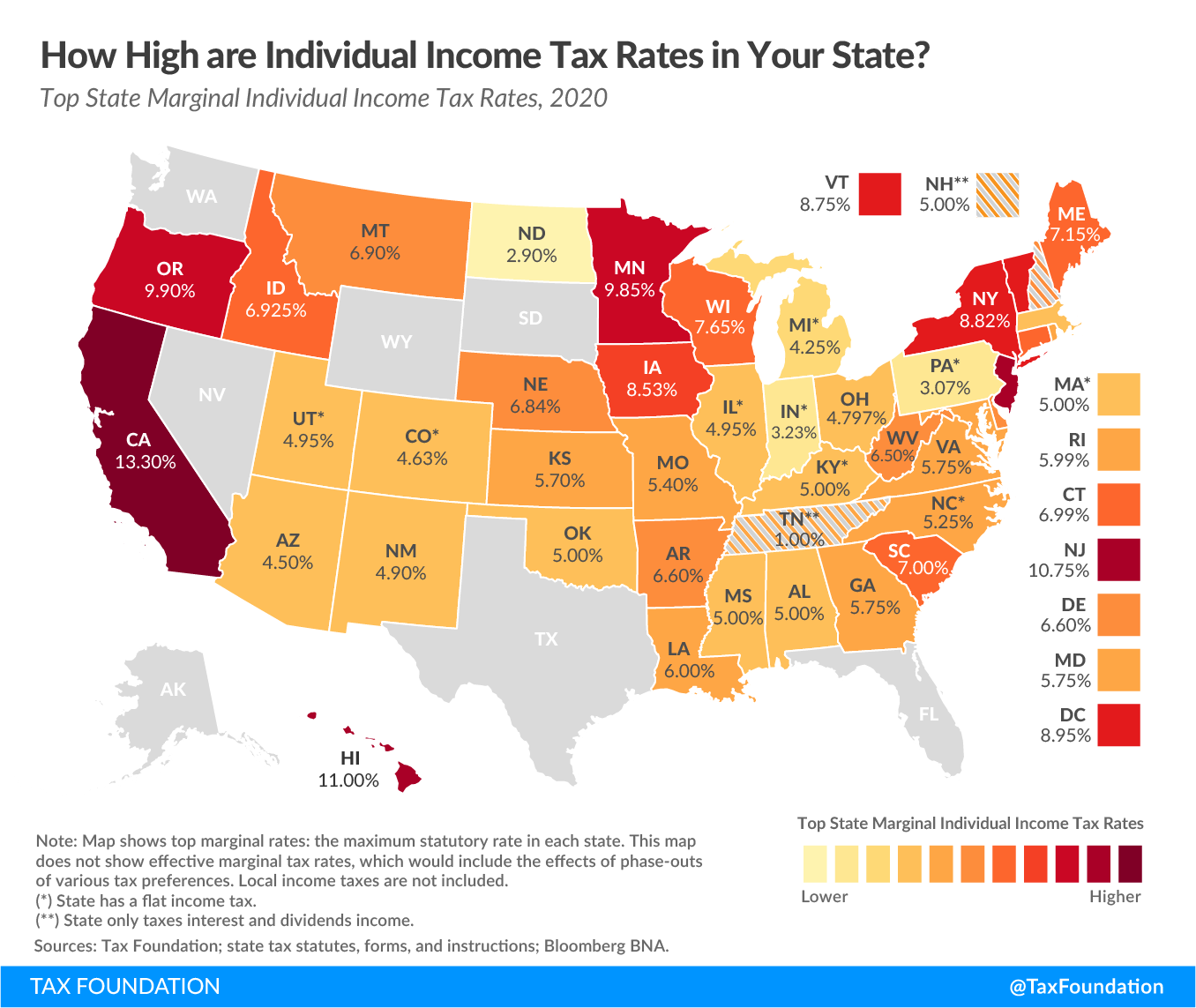

But although New York is a high tax state, there are other ways to optimize your tax situation. But first, let’s just look at how much I am getting ripped off by being located here in New York. Above is a map of all the top state income tax rates across the US.

And you can see that in New York state the rate is 8.82%. And that is actually already out of date because they just increased it to 10.9%. And that’s not even as high as California at 13%. But right next to California is Nevada. So you can see how easy it is for people from LA to just move over to Vegas and save a huge amount on their taxes. There are currently seven states that have no state income tax at all. And if you include two more that don’t tax regular income, but do tax dividends, you get nine but do remember, those are the top tax rates, you don’t pay those unless you’re a millionaire.

I’m not quite a millionaire yet, I’m merely earning hundreds of thousands of dollars a year. Every time I see videos, by other influencers with the title, “millionaire reacts,” I just want to curl up into a little ball because I can’t use that title yet. But anyway, in the mid-hundreds of thousands in annual income in New York State, I’m still paying 6.33%, which is still high. Now, what could I do? Well, I could move over to Vegas and enjoy 0% state tax. But actually a better solution for me personally that wouldn’t disrupt my life very much would be to move just 20 minutes across the border into Pennsylvania, where I would pay a 3% flat tax no matter how much money I earn. And I may well do that in the not too distant future. So the smart thing for people to do who can work remotely (a lot of people do now) is to just move to a state with a 0% state tax.

But there’s another way you can save on taxes no matter what state you live in, and this works for state and federal tax. This is how you structure your company personally. And this is the tax-saving strategy used by the President of the United States himself. What you do is you pay yourself a salary that is appropriate to your industry. And on that salary, you have to pay FICA taxes of 15.3% for Social Security and Medicare. But in addition to that salary, you can take a distribution of profits from your company. And on that portion, you do not have to pay those Social Security and Medicare taxes. So if you had an income of $150,000, you could pay yourself, say $50,000-year salary, and then take an additional 100,000 a year as a distribution of profits. And on that portion, you wouldn’t have to pay those extra taxes. This literally saves you like $10,000 a year now there are some more ins and outs than this. If you want to do this, you have to talk to a CPA first, what I’ve given you is just a very simplified version of it. But trust me, it does work. Let’s move on to our next Wealth Management part.

4.Understand where you are on the wealth ladder

This is really important for making sure that you do not overspend on your wealth-building journey. And trust me, I don’t think you’ve heard of this system I’m going to tell you about. So, Canadian billionaire Stewart Butterfield, co-founder of Flickr and Slack, described on a podcast what he saw as the three levels of wealth he went through as he was becoming a billionaire.

- First it was not being stressed about debt.

- Then he reached the level where he was not caring about what a restaurant check costs.

- And then finally, not caring about what a vacation costs.

Now, this idea has been expanded by other writers such as Nick Maggiulli, and Ben Carlson. And I do want to do another article about all this in detail. Anyway, they found that a measurement of 0.01% of your wealth is a pretty good measurement in looking at whether something will make a difference to us financially. For example, if your liquid net worth is $50,000 $5 would seem like a trivial amount to you. If something costs $5 More than you expected, you wouldn’t think very much about making that payment. Well, guess what $5 is 0.01% of 50,000 – your liquid net worth. You can do the math yourself, you just divide your net worth by 10,000 to get that 0.01% figure, which is your trivial amount. So if you have $1 million $100, should feel exactly the same as $1, to a person who only has $10,000 net worth, it’s that trivial amount that you could just throw around you don’t care about. If you have a billion dollars $100,000 would be the trivial amount that you could just throw around without caring.

People have done a lot of research on this. And they have linked it to real-world things. So if you have a net worth of over 10,000, but under 100,000, you won’t care what stuff costs in a grocery store, but you’d still care what stuff costs in a restaurant. Then once you’re above 100,000, you care less about restaurant prices, but you still care what a vacation costs. Above a million dollars, you start to not care about the price of a vacation, and above $10 million, you start to not care what a house costs. Because $1,000 is now your 0.01% your trivial number. So a few more thousand? Who cares, just add it to the bill, don’t even tell me. So you can use this 0.01% figure or divide your net worth by 10,000 to get the amount that you should see as trivial amounts, higher than that you definitely should not see as trivial. And this will really help speed up your wealth-building journey because you will not be overspending on things you’re not really high enough on that wealth-building ladder to afford.

5.Be an early adopter

Now you might think that this is the same as starting investing early, but it really isn’t. What we’re talking about here is investing early in new companies and new industries or new technologies, not just investing early in your life. So if you had bought 10 bitcoins back in November of 2015, which is the earliest Google will let me go back on the bitcoins price chart, you now have 590,000 US dollars, if you’d held until today. Oh, wish I’d done that, I’d be able to do millionaire reacts videos by now. But I did put $1,000 in Tesla stock about three years ago. And in 2020 I walked away with $10,000. And these 10x gains are possible because people now see electric cars as the future, and Tesla was one of the earliest companies to develop that. We also have had a huge gain in Metaverse cryptocurrencies.

I had another 10x gain investing in the cryptocurrency The Sandbox. I bought it at 73 cents. And it has blown up in the last few weeks, and I think we will see more gains in Metaverse-related projects into next year. So be an early adopter. Not every project or every company will turn into something big, but you need to have a bit of skin in the game, even if it’s just a few $100. Of course though, with these types of speculative investments, you can only invest money that you’re not going to need in an emergency. And that is our next wealth management practice.

6.Have an emergency fund

In addition to your investments, you need to have an emergency fund and this needs to be cold hard cash in a form that’s not going to fluctuate up and down in value and is not locked for a while. Now, most financial books recommend six months of your monthly expenses. In my experience, you can go as low as three months depending on your risk tolerance. So put some money in a savings account. Don’t worry about earning interest on it. Of course, it is great if you can find an account that does earn you some good interest. But most importantly, you need three to six months of your monthly expenses saved up in liquid cash that can be accessed at any time. So you’re not forced to sell out your stocks or Kryptos at an inconvenient time. Alright, now it’s time for our seventh and final wealth management tip.

7.Understand the macro-financial climate

Now for this, you need to keep up with the news, but it’s really worth it because it can help you plan your investments efficiently. For example, right now, the stock market is pretty much at all-time highs, but interest rates are historically low, and inflation is running reasonably high. So while it might not be the best time to plow loads of money into stocks, it is a good time to take out long-term debt. For example, a mortgage on a rental property, because interest rates are historically low, so you’re going to be paying very little money to borrow and inflation is running high. So you’ll actually kind of inflate out of your debt as your income rises relative to the money you’re paying each month in the repayments of that mortgage, and the value of your rental property will increase faster as well.

Now it’s understanding the macroeconomic climate that led me to plow loads of money into the stock market when it bottomed back in March of 2020. I’ve now taken profits on that money. And I put that into buying rental properties and also taken out additional mortgages because rates are so low to finance those properties as well. So while you won’t be able to time the market perfectly, you can just dollar cost average your way into stocks and Kryptos that is an advisable plan, however, you can look for opportunities when they present themselves to you if you’re in the right place at the right time. For example, the massive crash we had in 2020 due to the pandemic with the subsequent recovery, and now the low-interest rates and high inflation that we’re seeing. That’s the end of our ultimate guide on wealth management. Follow those and maybe one day you can be like me, almost a millionaire. Don’t worry. I’m sure I’ll be able to do my first millionaire reaction video sometime soon. Maybe next year. Who knows?