On Tuesday afternoon the Senate passed a bill re-funding the Paycheck Protection Program (PPP is a part of the first $2.2 trillion stimulus package), which was depleted in just two weeks. The PPP is designed to provide emergency loans to small businesses, as 48% of all US employees work for small businesses. According to the Census, 18 % of all US employees work for businesses with fewer than 20 employees.

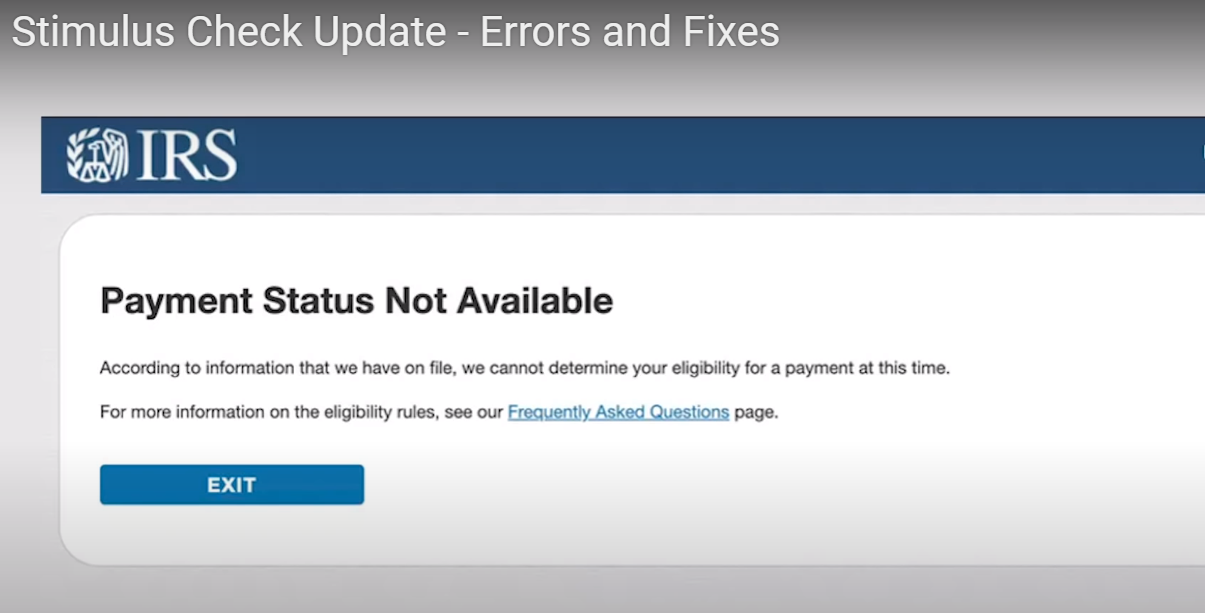

While the PPP being refunded is surely optimism inducing news, what we’re looking into today are things that put cold hard cash in the average American’s wallet, similar to the $1200 stimulus checks. Which, if you are having issues with, check out our errors and fixes video.

Another Massive Stimulus Bill Is Coming

There is another massive stimulus bill coming, and Chuck Schumer said yesterday that it should be similar in size to the CARES act, which cost our nation over $2 trillion!

What is pretty much guaranteed to be in this bill (because both democrats and republicans seem to agree on the need for these things) are listed below.

More stimulus checks

Both parties have expressed a wish to send more money to Americans as the COVID-19 situation continues to evolve and it becomes clear that the $1200 cash payments millions received under the last bill aren’t enough. One such proposal calls for monthly payments of $2,000 a month until employment returns to pre-crisis levels. The proposed bill would make more people eligible vs the $1200 checks, and the income limits are very high, e.g. $130K/year for single filers $260K/year filed jointly.

More details on who will be eligible under the proposed stimulus payment bill:

Rehiring bonus and 80% of wages covered by government

A new stimulus proposal from Republican senator Josh Hawley, suggests that because the government has taken the step of closing the economy to protect public health, it should be Congress’s responsibility to in turn protect every single job in America for the duration of the coronavirus crisis. Hawley argues that it’s better that money be spent on saving jobs now and getting Americans ready to work than on bailouts and mass unemployment claims for months and months to come.

“Beginning immediately, the federal government should cover 80 percent of wages for workers at any U.S. business, up to the national median wage, until this emergency is over. Further, it should offer businesses a bonus for rehiring workers laid off over the past month. The goal must be to get unemployment down — now — to secure American workers and their families, and to help businesses get ready to restart as soon as possible,” Hawley wrote in his opinion piece for the Washington Post.

The senator believes workers will benefit from the steady paycheck and the knowledge that their jobs are safe and businesses, able to retain their workforce at little cost, will be poised for success once the economy reopens.

“We must also move decisively to secure our critical supply chains and bring production back to this country. The present crisis has revealed just how vital domestic production is to our national life. And yet, for decades, an alliance of big government and big business conspired to outsource the manufacturing of our most crucial supplies and equipment to China and other overseas sites. Now, dangerous shortages of key medical supplies reveal just how self-serving and reckless those decisions were.”

Hazard pay

To support health care workers battling the coronavirus and their families, hazard payment is proposed to be included in the next stimulus package. Trump has embraced the idea, suggesting that the money could come in the form of bonuses. Senate Democrats push for similar bonuses so it’s very likely to make into the new stimulus aid bill.

Paycheck Security Act

This is a similar proposal to Hawley’s above, coming from several Democratic Senators, that would offer grants to companies to cover payroll for workers earning up to $90k a year. According to the proposal, the companies must show a drop in revenues of at least 20% due to the coronavirus outbreak.

“Congress recently passed over $25 billion in grants to the airlines, so that every worker in that industry will continue to receive their full paycheck and benefits through September 30th. We need a similar program to cover workers in America whose jobs have been negatively impacted by the health and economic crisis, and make it retroactive to when the pandemic began,” the proposal suggests.

Eligibility

- All employers who have suffered a month-over-month drop in revenues of at least 20 %

- Employers and non-profits of all sizes will be eligible—unless they hold more than 18 months of average payroll in cash or cash equivalents

- Employers will verify revenue losses. Those who cannot verify will pay an increased share of federal taxes during each year of profitability after the crisis until the grant is fully recovered.

- Businesses that have received a PPP loan or an Economic Injury Disaster Loan, or have otherwise accessed the Federal Reserve 13(3) facilities, will be for the most part ineligible.

Grants

- Grants will cover salaries and wages up to $90,000 for each furloughed or laid off employee, plus benefits, as well as up to an additional 20 % of revenues to cover fixed operating costs such as rent, utilities, insurance policies, and maintenance

- The operating costs portion of the grant will be verified using 2019 tax filings and delivered pro-rata basis through the term of the assistance.

- Grant amounts will be based on employers’ payroll and benefit costs on a monthly average from January 2018 through February 2019 or since they started, if in business less than a year. Businesses that apply for the grants can choose the measure they would like to use and give justification for that choice.

Funding For State and Local Governments

US states and localities have experienced a drop in tax revenues because of less people working, so this would be money to shore up state and local budgets. Democrats had hoped to pack this aid into yesterday’s aid package but Republicans didn’t show their support. However, Trump promised in his tweet that it would be in the next bill.

This proposal comes from Senators Bob Menendez (D-N.J.) and Bill Cassidy, M.D. (R-La.) and calls for an additional $500 billion in COVID-19 state stabilization funds.

“These funds can be used to help meet the current demand while helping communities transition towards reopening by expanding testing and contact tracing, providing additional resources to residents, local hospitals, small businesses and schools.”

Under the proposed bill the money would be divided into three branches and distributed to the states based upon their population, the number of coronavirus cases and revenue losses.

Funding For Infrastructure

President Trump and House Speaker Nancy Pelosi seemed to be particularly supportive of passing funding for infrastructure projects in the upcoming bill. Yesterday, Trump reiterated his desire for infrastructure investment, calling on Congress to fund projects for bridges, tunnels, and broadband and supporting such a job creation effort.

“With interest rates for the United States being at ZERO, this is the time to do our decades long awaited Infrastructure Bill. It should be VERY BIG & BOLD, Two Trillion Dollars, and be focused solely on jobs and rebuilding the once great infrastructure of our Country! Phase 4”

Nancy Pelosi seems to agree to fund rebuilding roads, mass transit, rail systems, wireless communications networks and water projects. Trump also wants some of the money to focus on rural America.

Incentives for Restaurants, Entertainment and Sports

Trump’s administration wants to bring back a full deduction for business meals; currently business meal expenses remain 50% deductible. There are also proposals for entertainment deduction, for example taking your business clients to a golf course, or taking your employees on a team building trip.

The President’s argument is that having these incentives would encourage American companies to spend more on in restaurants, entertainment and sports sectors and thus help the US economy recover quicker.

Payroll Tax Cut

President Trump has suggested suspending the entire payroll tax for the duration of the year. According to research by Tax Foundation, this would cost about $950 billion (if the tax is suspended between April 1 and December 31), but a payroll tax cut or suspension may support firms facing liquidity problems and considering layoffs, easing the impact of an economic slowdown.

Right now there is a 15.3% tax in wages, with 7.65% paid by the employee and 7.65% paid by the employer. A reduction in or suspension of the payroll tax would accrue to workers in the form of higher wages. An employer-side payroll tax reduction or suspension would ensure greater liquidity for businesses that may otherwise become insolvent in the face of falling demand. While the burden of the payroll tax is borne by employees in the long run, removing it in the short run may give firms room to prevent layoffs or a reduction in investment they would otherwise be forced to make.

To put this into numbers, for a 50k salary, it would mean a $318 extra per month (full cut).

This has been done before. For example, in 2010, the employee-side payroll tax was reduced from 6.2 percent to 4.2 percent for 2011 and 2012 to stimulate the economy. General revenue was used to replace the revenue loss for the Social Security trust fund over those two years.

The proposal met with criticism though. While the proposed payroll tax cut would help people from the middle and low income brackets, it wouldn’t help retirees since they don’t pay these taxes.

***

The final package is expected to be signed within the next few weeks and many of the proposals certainly won’t make the cut. The cost of the next coronavirus package could easily surpass $1 trillion. The good news is that Congressional leaders and the White House agree on the need for another economic recovery bill after the $2.2 trillion package President Donald Trump signed into law in March. Americans are also not giving up on their countrymen — nurses and physicians working long into the night; delivery workers bringing essential goods to their neighbors’ doors; church groups assembling care packages for the ill. While the coronavirus brought heart wrenching damage, Americans are nevertheless ready for a comeback.