Last week the IRS sent out stimulus payments to 80 million Americans who the IRS had direct deposit information for and only 1% of those payments failed. It sounds like a very small percentage, of course, but given that it means 800,000 people didn’t receive their payments due to some error, it’s still a sizable number. Now, this leaves another 70 million Americans waiting for payments since the IRS didn’t have their direct deposit information. Today we’re looking into why your money hasn’t arrived yet, common problems and what you can do to fix it.

Problem #1: You might not be eligible

There is a list of people who are not eligible to receive the $1200 stimulus payment and thus the first step is to figure out if you are eligible. People who fall into any one of the following categories are not eligible to receive the stimulus check at this time:

- People without Social Security numbers

- Non-resident aliens (Foreigners here on tourist visas, student visas or illegal aliens)

- Americans who breach set income levels

- College students who are claimed as a dependent on someone else’s tax return. If you’re a student under the age of 24 and your parents pay for at least half of your expenses, in the eyes of the taxing authorities you’re a dependent and don’t qualify for this advance on tax credit.

If you’re claimed as a dependent on someone else’s tax return in 2018 and haven’t filed for 2019 yet, you could resolve this ineligibility issue by just filing taxes on your own. If you have been claimed as a dependent in 2019 already, then unfortunately, there is no resolution for that and you’re not going to get your own stimulus check.

In a nutshell, you’re eligible to receive the $1200 stimulus check if you meet all these requirements:

- Have a valid Social Security number,

- Could not be claimed as a dependent by another taxpayer, and

- Have adjusted gross income within these limits set by the Congress

This is to say, if your spouse doesn’t have a social security number and you file taxes jointly, both of you won’t receive the stimulus checks. The exception to the rule is when one of you is a member of the military, the rule doesn’t apply then and only one spouse needs to have a valid SSN.

Problem #2: The IRS doesn’t have your direct deposit information

What can you do to remedy that? There is actually a portal – a convenient website – where you can enter your direct deposit information for the IRS to send you your check. The portal opened last week.

“If we don’t have your direct deposit information from your 2018 or 2019 return — and we haven’t yet sent your payment — use the Get My Payment application to let us know where to send your direct deposit,” reads the IRS statement posted on its website.

This video covers in-depth exactly how to use this portal so if this is your situation you can go ahead and enter your information.

Problem #3: You use tax filing software

If you file taxes through a company like H&R Block, or Turbotax, etc. there are some systems where you pay the system and the tax filing system pays the IRS on your behalf. If this is your situation, your money might have ended up in the tax filing system’s account.

If you suspect this could be your case, The Credit Shifu advises to contact your Certified Public Accountant (CPA) or Enrolled Agent (EA) who does your taxes and ask if you’ve received the stimulus payment. Supposedly they should know and should be able to pay you the money.

There is also the case of those who received a Refund Anticipation Loan from their tax provider. In that case the tax provider’s temporary account will have been provided to the IRS and the money will go to their account, but since the account is already closed, bounce back to the IRS. The IRS will then mail you out a paper check, unless you add direct deposit details through the portal.

Problem #4: Wrong amount, lacking dependents

Another reason you may be missing out on money is that you did actually receive a payment but it was either for a wrong amount or it was lacking the payments for dependents. The Federal government gives $500 for each child 16 years old or under. There are no limits on the number of children that qualify. If your child is over 16 years old, you won’t receive the $500 stimulus payment for this child even if you claim the child as a dependent.

There were reports of people who’ve are missing the dependent payment for children 16 years old and under. One of the possible reasons for that is that your children don’t have their own social security number.

The IRS has said that they’re going to send out letters within 15 days to recipients of the direct deposits where they’re going to detail a way that you can dispute the amount and see if you can recoup that $500 for each dependent.

Problem #5: Your money was intercepted by debt collectors

If you had a payday loan – a type of loan where the payday loan company can actually take the money from your account as soon as money is deposited – when that stimulus check hits your account, that may count as a payday and the loan company can take that to pay off your loan.

If you owe a bank money or if your bank account is overdrawn, below $0, the stimulus check may have just taken you above zero and it might look to you as if you’ve only received a partial stimulus payment. Also if you owe money to that bank on a separate loan product, the bank can garnish that money from your account if you’ve passed due on payments from that loan and use it to pay off that loan. Some banks, however, said that they won’t do that, notably Chase and few others as a part of their efforts to provide financial aid to Americans amidst the coronavirus outbreak.

Essentially, there is nothing in the CARES Act that could protect you from this. However, some states have signed state executive orders to prevent debt collectors from seizing stimulus checks.

“These recovery checks were meant to provide relief, not reward debt collection agencies for preying on Oregonians who have lost their livelihoods due to the COVID-19 pandemic,” Oregon governor Kate Brown explained in her statement last week.

What can you do to guard against your money being seized by the debts collectors? You can set up a new bank account to have the stimulus check paid into. If the IRS doesn’t already have your direct deposit information, if you’re in this situation and you think it’s possible that someone can take it out of your account because they have the information and you do owe that company, you could try to set up a new bank account – you can do it quite easily online – and use that new bank information to enter into the portal.

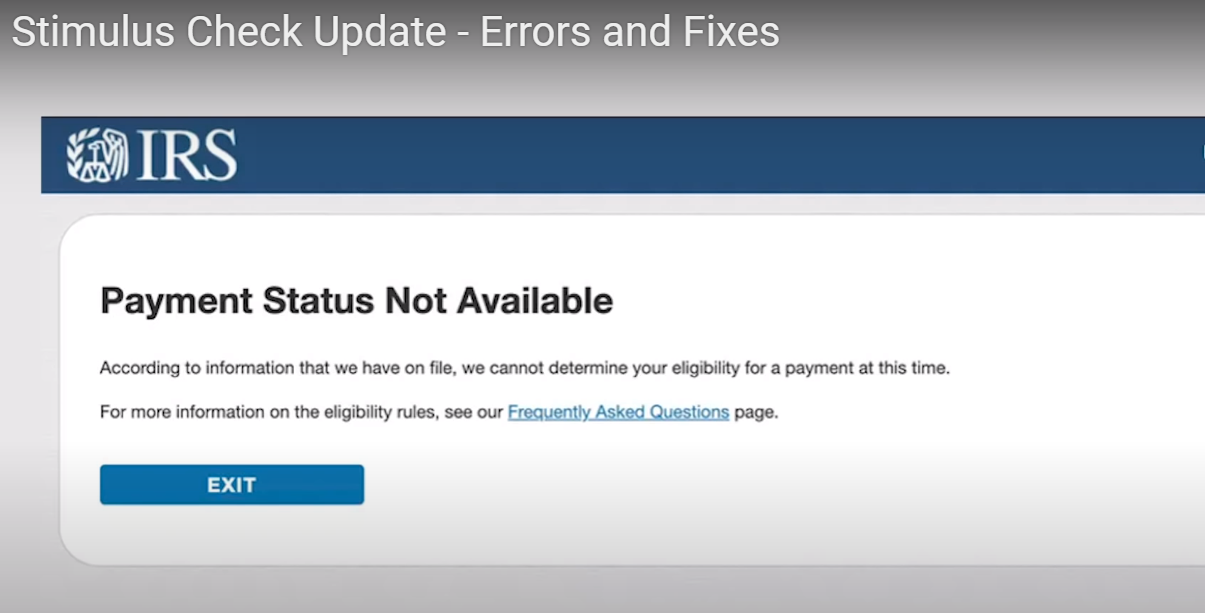

Problem #6: You used the portal but you only got an error message

The standard error message that people seem to be getting is Payment Status Not Available. There are four main scenarios when you’re likely to get this message:

- If you haven’t filed your taxes in 2018 and/or 2019, you most likely will get this message because the IRS is going with the information they have for only those two years. To remedy that, file your taxes.

- If you only just filed your 2018 return, a year late, it’s likely your tax return hasn’t been processed yet and you would have to be patient.

- If you only just filed your 2019 return and you were not eligible in 2018.

- If you’re a recipient of social security or any other kind of benefits you may get this message because your information hasn’t been added to the system. The IRS uses some antiquated computer system – the master file for their platform was coded in 1962 (!) using an old computer language called COBOL – the good news here is that no one probably remembers the language to hack it and make some malicious alterations to it. The IRS also has 16 other databases, including social security databases, taxpayers, and all sorts of different scenarios that don’t easily communicate with each other.

The IRS is trying to integrate the data, and the agency says they include more and more updates each day. Check portal once a day, hopefully once your tax return has been processed, your information will be in the portal. Checking back more than once a day won’t help because the system only updates once a day and it may actually lock you out for a period of time. This is a security feature that is built-in.

Some people also got a Not Able to Verify Your Identity error message. When you enter your information, you have to enter your social security number, your date of birth, and your address. Now, you need to make sure all that information is the same as you enter on your tax return. If you only just filed your tax return for this year it may not be processed yet and if there have been changes between your 2018 and 2019 tax returns you may want to try your 2018 information just in case there has been a delay in processing it. For example, if you only filled your 2019 tax return a few days ago, it may not have been processed yet and the system may still be going by your 2018 information. This is to say, double check your street address and make sure it’s exactly the same as on your tax return.

Despite these possible errors, many people have had a positive experience using the system. The IRS says 6.2 million people were able to log onto the system on the very first day of the launch (last Wed) and smoothly track their payments, etc. Over 1 million people were able to successfully add their direct deposit information on that same day.

The fact that around 80 million people have already gotten their payments and 1.1 million have already given the IRS their direct deposit information and will probably be getting their stimulus checks in a week or so, is actually really good compared to when it was done last time in 2008, when it took 75 (!) days from when the bill was passed to when people got payments. That’s 2.5 month. Right now, we’re only at the 3 week mark, so it’s much more efficient now.

Something to be extremely cautious about

According to Google’s recent report, in just one week from April sixth to April 13th , it saw more than 18 million daily malware and phishing emails related to COVID-19 scams in addition to the 240 million daily spam messages it sees related to coronavirus.

The IRS, which issued a formal warning about various scams, has an official economic impact payments site and has been advising taxpayers on how to avoid getting caught by hackers and scammers that would send them somewhere else. The IRS has stated that it won’t contact individuals by email regarding tax filings. The IRS also won’t contact you via email or phone regarding your stimulus check.

This month’s research from IBM Security revealed that 35% of those asked would expect to hear from the IRS by email and more than half of respondents said they would click on links or open attachments that referenced their entitlement to a stimulus check payment.

Assistant Attorney General Brian A. Benczkowski of the Justice Department’s Criminal Division said that “the department will continue to collaborate with our law enforcement and private sector partners to combat online COVID-19 related crime.”

What’s next?

There is another massive stimulus bill coming, and Chuck Schumer said this week that it should be similar in size to the CARES act, which cost our nation over $2 trillion! Many Americans who were not eligible to receive the stimulus payment in the first round are likely to be eligible this time. Check out what’s likely to be in the new bill.