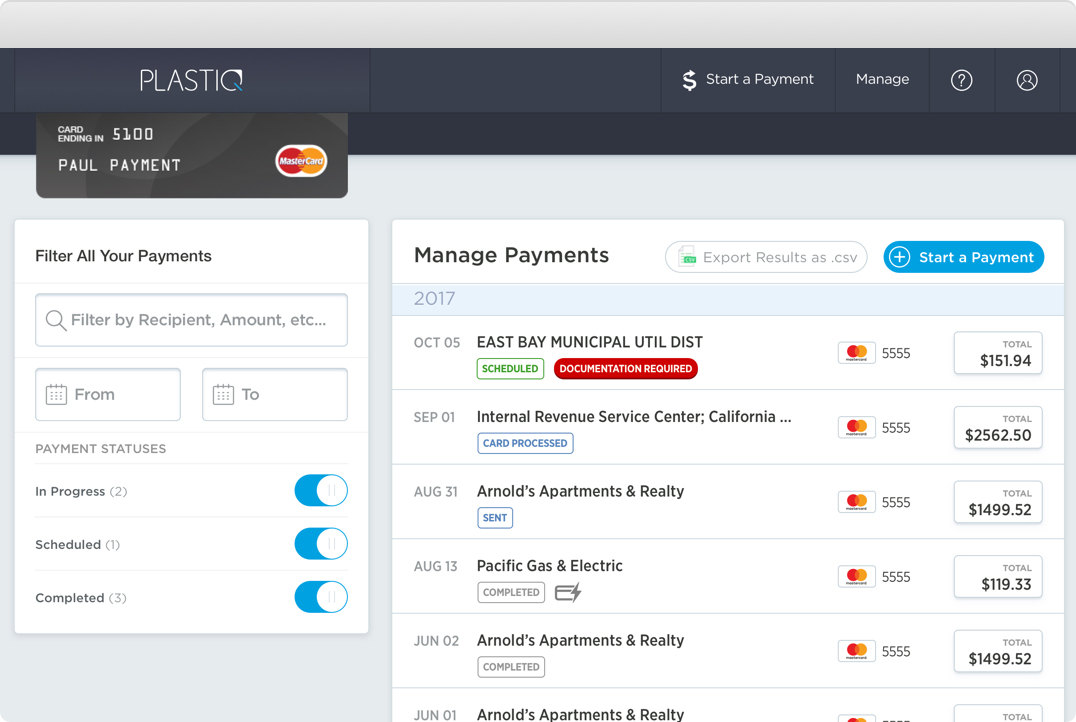

Plastiq is an excellent way to maximize your credit card points and your cash on hand by putting virtually any expense on your credit card: rent, taxes, business supplies, and more. Earlier this week Plastiq announced that they will be changing their fee structure and the new processing fee will see a 0.35% fee increase – from 2.5% to 2.85%. The fee increase is effective July 1.

The fee increase is said to be the result of an upcoming increase of the cost of processing a credit card from several major credit card companies.

“Recently, several major credit card companies announced an upcoming interchange price increase (the cost of processing a credit card), which directly impacts our costs at Plastiq,” explained Eliot Buchanan, Plastiq CEO. “Plastiq has historically absorbed the cost of all interchange increases, and we have kept our fees flat. However, at this time, an increase is necessary. We’re still priced lower than our competitors.”

Earlier this year Plastiq stopped allowing most prepaid gift cards from working on the platform. However, even with this fee increase Plastiq is still able to provide [slightly] better terms than Paypal (2.9% + 30 cents) for various transactions, including sending money to a friend with your credit card. You can also still earn valuable points by using Plastiq to pay your various bills and even taxes – Tax Day is July 15 this year.

How to Make Profit by Paying Taxes With a Credit Card

The fee change will take place across all cards and all payees after July 1st, but all payments scheduled now for post-July 1st will still be processed with the 2.5% fee. This is to say you still have six days to lock in the 2.5% fee and schedule out payments during these six days for any number of months ahead.