As part of a $2 trillion financial stimulus package plan, by now 88 million Americans should have received their paychecks. The new wave of checks is scheduled to hit our bank accounts by tomorrow, April 29th. If you want to know your stimulus payment updates today, you can go to the IRS website and check your stimulus check status by using the Get My Payment tool.

There is yet another new proposal on the stimulus payment horizon. It’s called the Automatic Boost to Communities (ABC) Act proposal. Under the proposed act, the federal government would provide a $2,000 payment using BOOST debit cards to every person in America as critical relief during the COVID-19 crisis. This stimulus payment would be followed by $1,000 recurring monthly payments that wouldn’t end until one year after the end of the crisis.

“The COVID-19 pandemic has devastated working people and small businesses for more than two months and will continue to do so for several more,” said Congresswoman Jayapal, who co-introduced the Act. “The ABC Act provides immediate relief to those in need – regardless of their immigration status – and ensures that relief lasts the duration of the pandemic.”

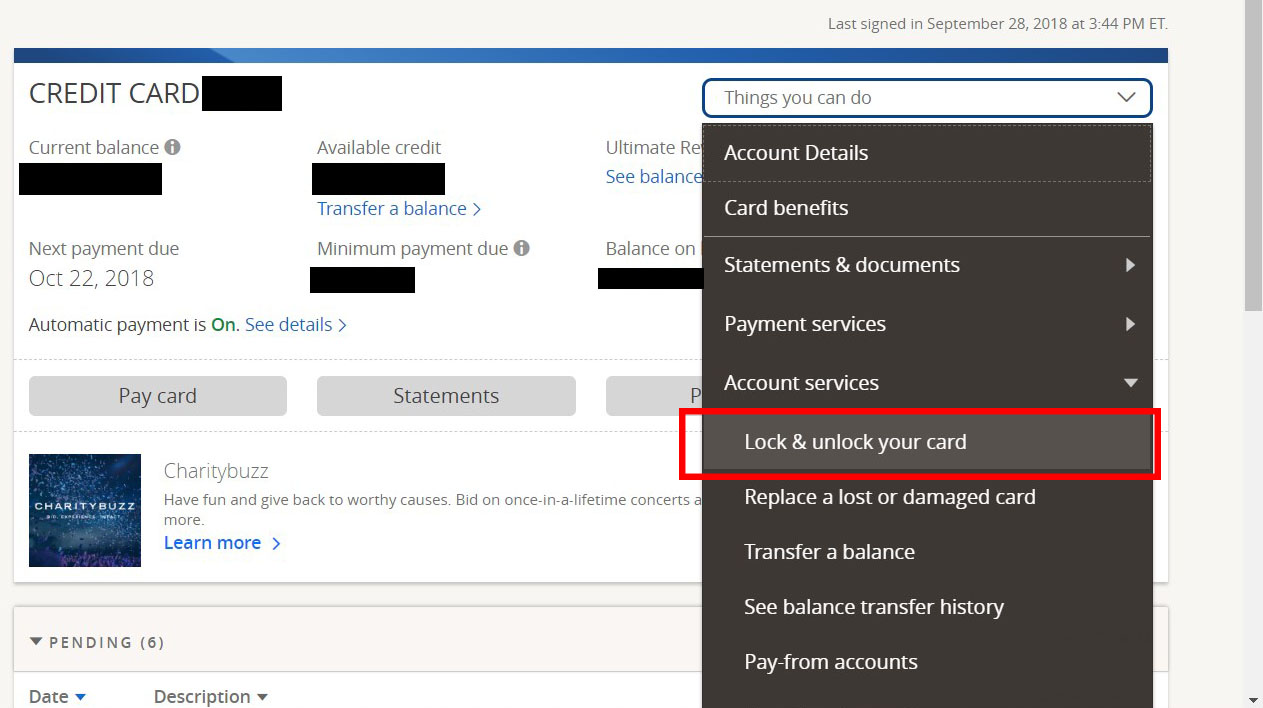

The ABC Act would be funded directly from the Treasury with no additional debt issued by “minting two $1 trillion coins, and additional coins as necessary.” The Act proposes the payments to be distributed via pre-paid U.S. debit cards managed directly by the U.S. Treasury. These debit cards could be used in the exact same way as you would use any other debit card: from regular grocery shopping and making online purchases to withdrawing cash from ATMs.

How the ABC Act Would Work

The ABC act calls for every person in America to receive the $2000 stimulus payments, including those who are claimed as dependents, college students, and people who don’t have a social security number. If the ABC act is voted in, the government will deposit cash into each of these debit cards.

After the initial $2,000 payment, a $1,000 payment would be then deposited into each of the debit cards. The $1000 payment would be recurring every month for a total of 12 months after the pandemic is over.

How ABC Act Would be Funded

The ABC Act is proposed to be funded by having the U.S. Mint create two platinum bullion coins, each worth $1 trillion, which the Treasury would deposit in its account with the Federal Reserve. The Treasury obtained this authority under the 1996 Coinage Act that grants the Treasury Secretary permission “to mint and issue platinum bullion coins and proof coins.”

The concept of a trillion-dollar coin first appeared in 1992, when presidential candidate Bo Gritz suggested that the national debt could be paid off if the Treasury minted a coin equal in value to the national debt and sent it to the Federal Reserve.

Back in 2013 however, the Treasury stated that “neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit.”

What Does Minting a Trillion dollar Coin Mean Exactly

When the U.S. Mint ships any coin, including the platinum bullion coin, from its vaults to the vaults of the Federal reserve, an amount equal to the difference between the coin’s face value and its cost of production is booked as profit.

“This amount is subsequently transferred to the general fund of the treasury where it is available to finance government operations in the same way that tax revenue does. When the Fed returns the coin to the Mint due to damage or wear, the accounting treatment is reversed and the coin is melted. Thus, seigniorage [profit] “earned” from the coin is like an interest-free loan over the life of the coin,” explained Philip Diehl, the former U.S. Mint director. In other words, minting the platinum bullion coins is a “way of delaying the date at which that [debt] limit is reached, in the same way a sudden surge of tax revenue flowing into the treasury would do.”

The U.S. economy has been seriously damaged by the COVID-19 pandemic, millions of Americans are out of work and the additional stimulus payment would provide an instant relief. Sending out millions of U.S. debit cards however, would require the U.S. Treasury to restructure and invest in the technology needed to execute the distribution of the debit cards. This isn’t something that could be achieved overnight. Also, by expanding the money supply, minting $1 trillion coins would drive the U.S. economy toward hyperinflation.

The ABC Act is one of the several proposals currently under review by the Congress. Learn more about what is most likely to be included in the next stimulus act:

1 comment

How do I find out if I will receive a card for additional stimulus payments. My current phone number is 954 913 7177. Or if you prefer you can mail me a stimulus payment card, to my Home address at Edward B Kramer 8842 s.w 3rd Street Apt 101

Pembroke Pines, Florida 33025. I look forward to you’re response as soon as possible. Thank you for you’re time and consideration in advance.