Credit Card networks Visa and Mastercard have settled a lawsuit that alleges the two companies violated antitrust laws by fixing prices, specifically the fee a merchant pays when a credit card is swiped. This alleged price fixing benefitted the banks that issue credit cards in partnership with Visa and Mastercard at the expense of merchants.

The lawsuit had been going on for 13-years, dating back to 2005 when both Visa and Mastercard were owned by banks. The two companies have now been ordered to pay upto $6.2 billion to 12 million US merchants who accept Visa and Mastercard payments.

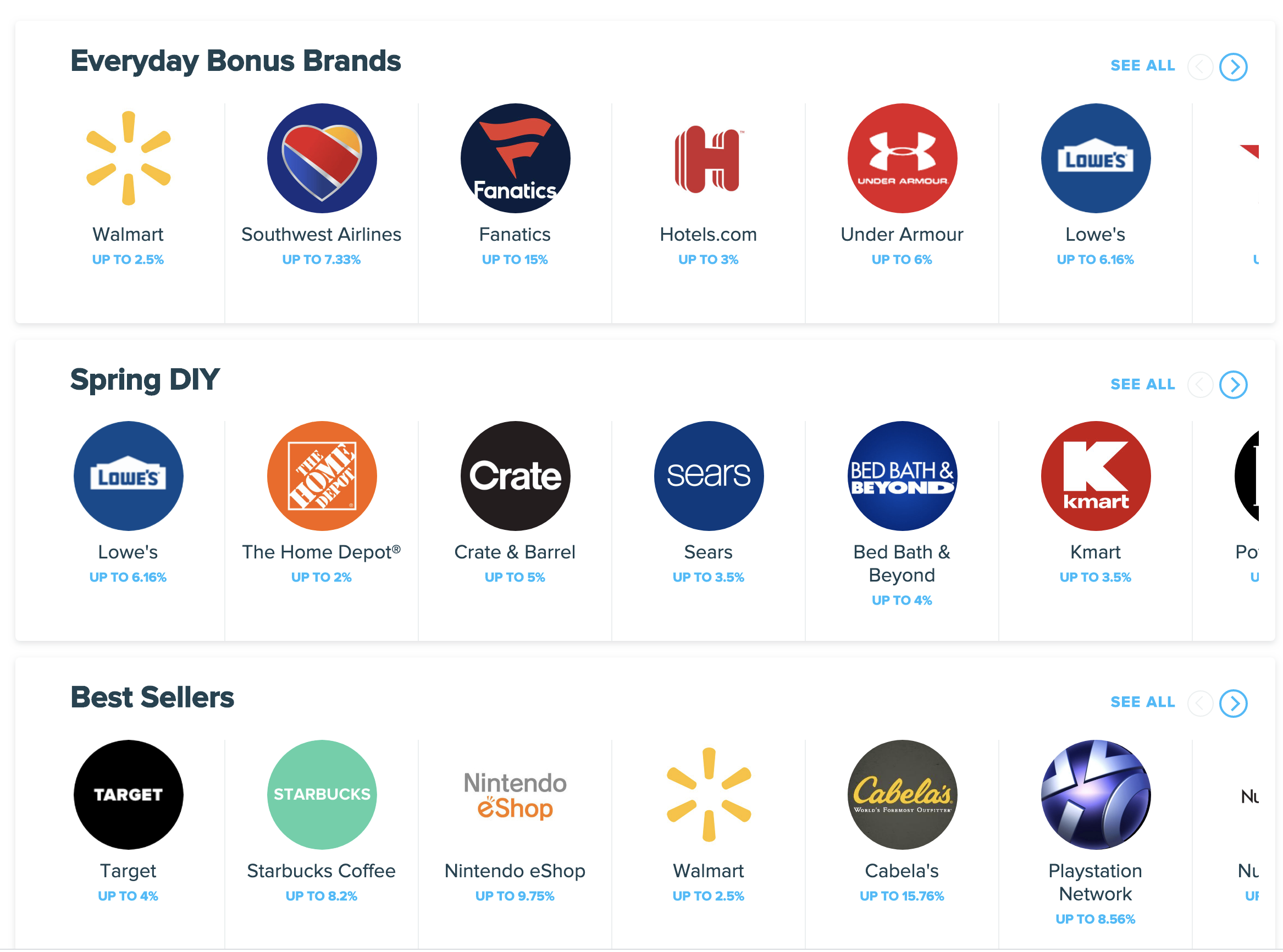

However the end payment may be lower, since several big retailers, for example Walmart, have already opted out of the settlement. Lawyer on the case, Patrick Coughlin explained why to CNN: “The top 1% of the merchants make up 25% of the nation’s commerce,” he said. “They were never going to be part of the deal. But this is important for the other 99% who handle the other 75% of purchases.”

Both Visa and Mastercard’s stock prices rose over 1% on Tuesday after the settlement was announced. The settlement is the largest ever US antitrust case, but may only be the first step, another class of merchants are pressing ahead to fight for changes in Visa and Mastercard’s business practices.