Passive income generally refers to income you receive without putting any effort in or doing any work. In practice, purely passive income doesn’t really exist – unless a complete stranger you bumps into you at a grocery store hands you over a stack of money – you would need to put in some effort or invest some funds or both at the outset in order to receive an income later on. There are numerous ways to make extra cash without getting a second job and in this article we’ll lay out a road map for you – all these passive income ideas don’t require a full-time-job-like commitment.

These ten passive income ideas differ by the amount of initial effort and capital you’d need to start earning. Some of these require maintenance to a varying degree. The main point is that as long as you start working on any/all of these ten passive income ideas, you’re bound to earn an extra income.

1. Passive Income Ideas For Monetizing Your Hobby

We’re not talking about starting a business – if you like cars and enjoy fixing them every once in a while, we’re not suggesting you open up a shop. Rather, even if you share your auto-repair and maintenance tips on your blog, but don’t do it regularly and thus your traffic isn’t huge, you can still earn an extra income.

Add a “Buy Me a Coffee” Button to Your Site

If you have a group of loyal readers, no matter how small, add a “Buy Me a Coffee” button to your site. You might be surprised how many people would actually love to buy you a cup of coffee as a token of their appreciation for your valuable advice. Simply go to https://ko-fi.com/ to install. You’ll get paid directly and this platform has 0% fees. Ko-fi has paid $30,000,000 to content creators to date.

Sell Digital Copies of Your Collection

Have a collection of vintage magazines? Scan them and offer these digitally restored copies for sale as instant downloads or send the e-copies of the magazine via email. For works published without a copyright notice between 1925 and 1975 there are no copyright terms and they’re in the public domain. For other years and publishing circumstances, check out this easy-to-read Copyright Term and the Public Domain table in the United States.

Monetizing Your Hobby Case Study

“I’ve been collecting 1930s and 40s Workbasket magazines for a couple of years. This much loved magazine spanned 61 years with the last issue published in 1996. I have about 2 dozen issues now. There are so many groups of Workbasket fans, I offer digitally restored copies of these magazines for only $1.99. Even with 50 magazines sold a week, I’m making $100. To promote, I’ve offered 1-2 projects from the issue for free to bloggers and influencers, they publish it, along with information where their readers could purchase the entire issue.”

–A DIY blogger with about 2,000 website visitors a month.

2. Invest in Bonds and Stocks Passive Income Ideas

These passive income ideas do take start-up cash. Dividend-paying stocks, ETFs, tax-free municipal (muni) bonds, government treasury bonds, corporate bonds, and other investments are designed to preserve capital while generating you interest. Some investments have a lower rate of default and respectively lower yield. For example, muni bonds yield 0.7%-1.52% over 2 – 30 years Meaning you’d need sizable savings invested in order to earn a noticeable amount of cash.

Tip: Residents of states without income taxes can buy muni bonds from any state and remain 100% tax-free.

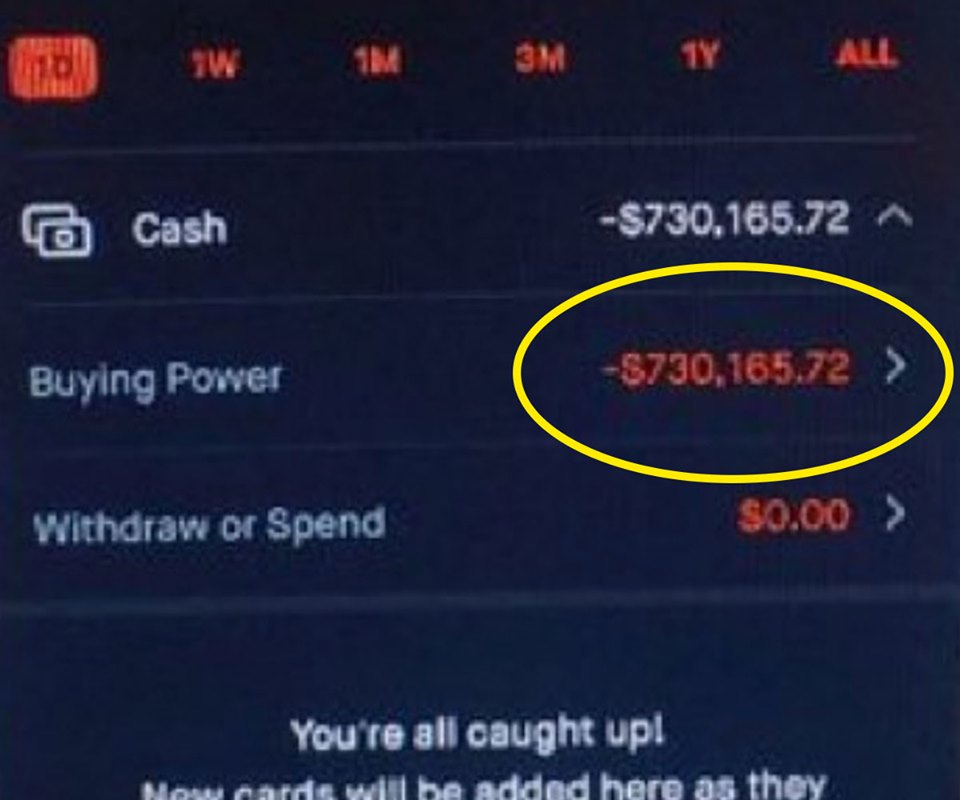

If you have as little as $100, you can start investing today. We have a great deal for you with Webull – a 0% commission stock trading tool – where you get two FREE stocks. You will receive one stock for just opening your account and a second for funding your account with as little as $100. The second stock could be valued up to $1,400.

Webull Review

3. High-Yield CD and Savings Account

This is arguably the most passive of all passive income types out there – just transfer your money from one account to another and start earning. Investing in a high-yield certificate of deposit (CD) and/ or savings account can allow you to generate comparatively small, but tangible income. Online banks normally offer higher interest rate CDs than your local bank, and you’ll still enjoy a guaranteed return of principal up to $250,000, as long as your chosen financial institution is backed by the FDIC.

Some savings accounts also offer a welcome bonus depending on your deposit. For example, The Amex high yield savings account now has a targeted offer of 25,000 bonus points and offers a 1.15% APY.

With a $25,000 initial deposit and a $1,000 recurring monthly deposit you will earn $351 in interest in your very first year (about $30 a month).

The biggest risk is that interest rates tend to fall when the economy weakens, and in this case, you might potentially end up not earning enough to beat inflation.

4. Earn Cashback

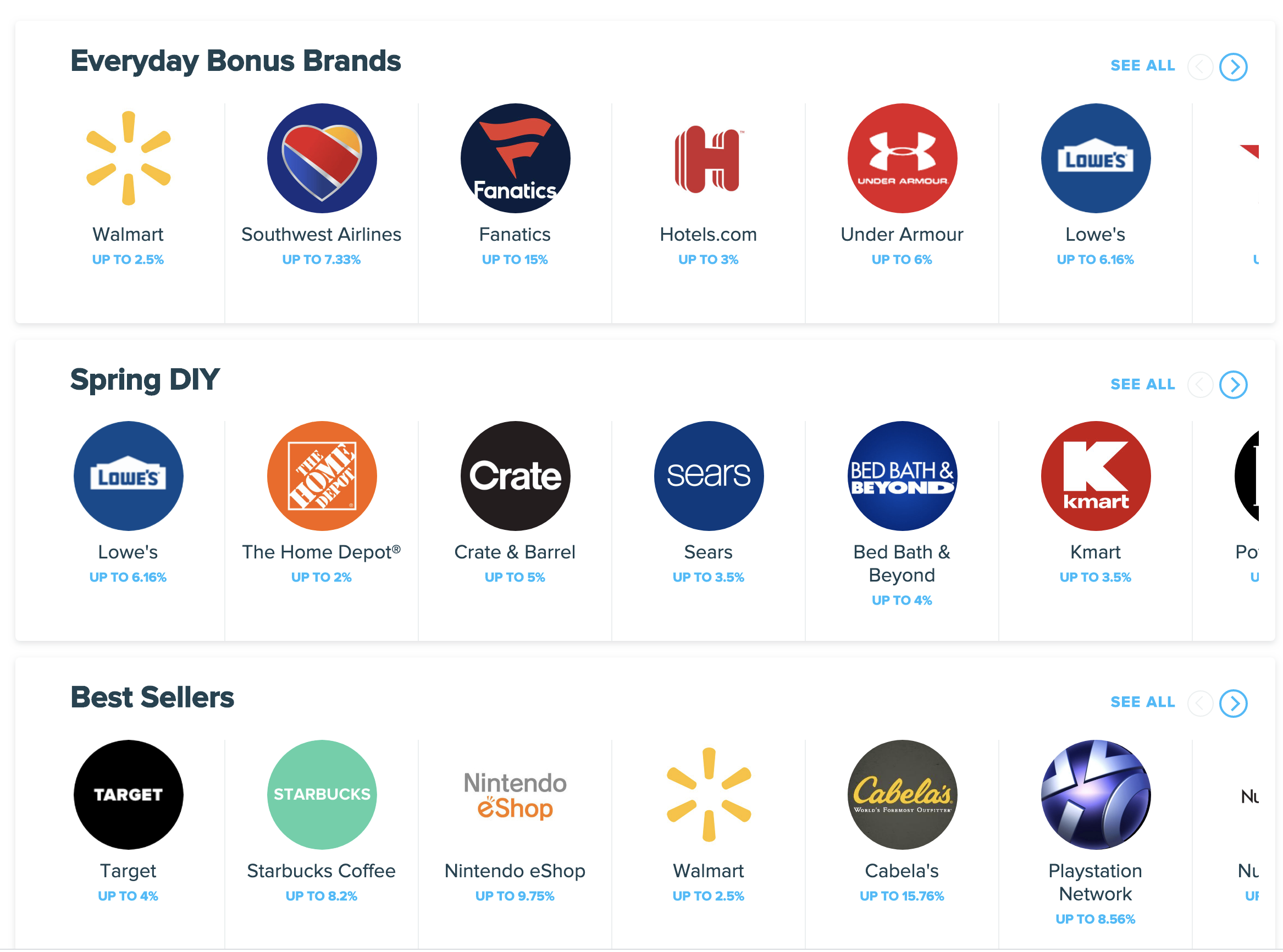

Paying attention to where and how you shop can be a sweet source of passive income. At TheCreditShifu.com we love Rakuten. It offers cashback of up to 12% at various retailers and includes some extra perks such as free shipping and gifts with purchases. Say you’re buying Christmas gifts for ten of your family members with an average of $100 spent on each gift, you can earn $120 back in that week.

You will also earn $10 for signing up, adding a little extra to your total passive earnings.

To start earning, sign up, and every time you need to buy something – from hotel booking to grocery shopping – go to Rakuten and search the store or product you’re looking for. Then click on the shop’s or product’s link and shop and get paid via PayPal or check quarterly.

Learn more:

How to Maximize Your Cashback by Using a Cashback App/Site

5. Referrals and Affiliate Marketing

Affiliate marketing requires you to have a website or social media platform you can use to promote other companies – “affiliates.” When someone uses your affiliate link to purchase a product or services, you get paid. For example, the interest in subscription boxes is mostly generated by innumerable bloggers posting, reposting these essentially sponsored reviews in order to prompt their audience to sign up. For example, a FabFitFan box is $49 a box and pays $8 for each signup. The digital marketing tool suggestions and reviews that you see in abundance online include or are entirely composed of affiliate links.

Amazon is the most well-known affiliate partner, followed by eBay, Awin and ShareASale.

In order for you to see anything interesting cash-wise, your website would have to have sizable traffic. In such a case, it’s almost guaranteed that you’re already very familiar with affiliate marketing and this wouldn’t be a valuable passive income idea for you.

Referrals are similar to affiliate marketing. Referrals almost always include an offer for the person you’re referring to the product or service to, while affiliate marketing links may not include any offers. With referrals, even if you don’t have that many social media followers or your website traffic is not that large, you can still earn some extra cash by referring people to a product or service you’re using and are happy with.

6. Earn FREE Travel

Making your next vacation completely or mostly free is passive income in our book. A tried & true way to do it is to open a travel credit card account and start earning points. With the coronavirus outbreak most travel-centered credit cards made changes to allow credit cardholders earn points on groceries, home improvements, take out, streaming services and more. Most of these cards also come with nice welcome bonuses enabling you to earn your free vacation faster. To learn what card is right for you and what credit score is required for such card check out How to Climb the Credit Card Ladder.

My Top 5 FREE Travel Experiences – Using Credit Card Points

7. Display Ads

Another way many earn passively is by using display ads. This requires a blog and some traffic. Display ads work like billboards, only they’re digital and are on your website instead of a highway. Most display ads are set up by ad networks that work as the middlemen between your website and advertisers. You can always reach out to your local businesses and offer them display ads on your site directly. It doesn’t exactly qualify to be called passive income though.

Google offers DoubleClick for Publishers. It’s never clear how much Google will pay you exactly and at what rate. In general, you’ll earn 10 – 40 cents per 1,000 views of the banner. 35% of Americans use adblock and this in turn will negatively affect your earnings.

Another form of display ads is branded content. If your site is on WordPress, for example, you can simply add such plugins to your site and start earning.

Case study

A Classical poetry website has 70,000-90,000 visitors a month. With the CODEC Sponsored Content plugin (displayed even when adblock is on) their earnings amount to $65-95 a week.

8. Royalties and Tutorial Sales

If you’re really good at something, offer your knowledge in exchange for a fee. There are several ways you can do it. You can invest in recording your course (video, e-book, or a how-to article) and sell it through learning sites or pitch your course to the platforms that will video record and market your course themselves.

While it takes some work to create this course and promote it – at least initially – you will be able to sit back and earn extra cash off the occasional sale. Courses can be distributed and sold through sites such as Udemy, SkillShare and Coursera. Depending on what option you choose you will earn 100% to 20% of proceeds.

There are other types of digital products you can sell in addition to an online course, such as e-books, online instruction guides, and basically anything else you can market and sell online.

Case Study

A Michelin star NYC restaurant chef wrote a Japanese recipe cookbook for weight and blood pressure management. The book was published on July 19, 2014. It has 160+ pages with photos of dishes and took about 6 months to write, test, taste, photograph, design, proofread and publish. The chef invested less than $500 in initial promotion during the first two months of the book’s release.

Six years later she still receives 90% proceeds from 20-49 books sold a month.

9. REITs

A REIT is a real estate investment trust and refers to a company that owns and manages real estate. REITs have a special legal structure so that they pay little or no corporate income tax if they pass along most of their income to shareholders.

Similar to dividend stocks, you’ll have to pick the good REITs, in order to minimize your risk of losing money. Note that REIT dividends are not protected from tough economic times. If the REIT takes the economy’s downward spiral hit, it’s likely to resort to cutting its dividend, which could be down to 0%.

10. Advertise on your car

This passive income idea is obviously not for everyone. Some people won’t like driving their car around town with some “Best Life Insurance” ad on it. If you live in a big city and having an advertising message on your car won’t bother you, google a specialized advertising agency in your area. Once you contact them, they will evaluate your car appearance and your driving routines in order to match you with one of their advertisers.

Just be careful when looking for an agency to avoid being scammed. All ad agencies we’ve seen to this day that work in this space will produce and install/affix the ads on your car for free. There is no “initial installation fee”, “placement deposit”, “vehicle evaluation fee”, etc.