The new U.S. Bank Altitude® Go Visa Signature® Card is credit card issuers’ latest response to our changing – due to the virus outbreak – lifestyles. With travel restrictions still in place, the new credit card’s main appeal is higher-than-average earnings on food spending. The card also has no annual fee which is especially valuable during the times of economic uncertainty.

The new Altitude Go Visa Signature Card rewards customers for restaurant spending (including takeout), food delivery, groceries and streaming service purchases. U.S. Bank’s Altitude Go card can also be used at contactless readers, speeding up the checkout process.

The only other card currently on the market that earns 4 points per dollar spent on dining, including delivery and take-out is the American Express® Gold Card. However, the Amex Gold card has an annual fee of $250. In other words, the new Altitude Go card is a more affordable option.

Altitude Go Visa Signature Card Highlights

- Earn 20,000 bonus points after spending $1,000 in the first 3 months

Points are worth 1 cent each and can be redeemed for cash back as a statement credit, or a deposit into a qualifying U.S. bank account starting a minimum of 2,500 points.

The rewards earned by using the U.S. Bank Altitude Go cannot be combined with the Altitude Reserve Visa Infinite Card rewards ($400 annual fee).

- Earn 4x points on takeout, food delivery and dining

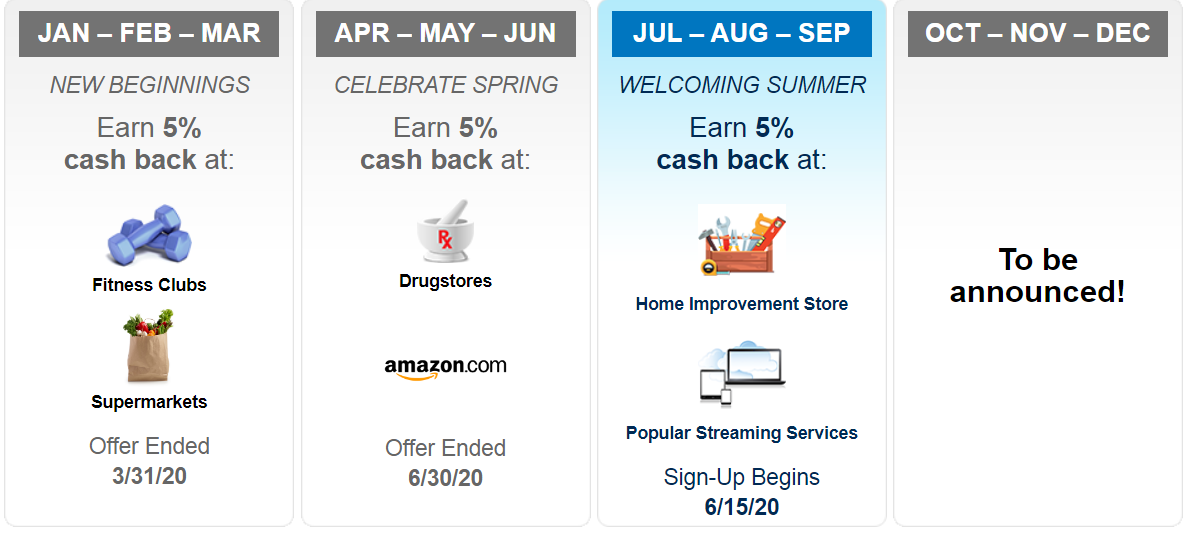

- Earn 2x points at grocery stores, grocery delivery, streaming services and gas stations

- Earn 1x point on all other purchases

- Receive a statement credit of $15 annually for streaming services

The statement credit will be applied within two statement billing cycles following eleven consecutive calendar months of eligible streaming service purchases.

- No foreign transaction fee

- No Annual Fee

To sum up, the main highlight of the new U.S. Bank Altitude Go is 4% cash back on dining with no annual fee. The $15 annual streaming credit is a nice bonus if you are already paying for some streaming service. The possible downside however, is that generally the credit cards from US Bank are more difficult to get approved for. If your credit score is on a lower end, you are very likely to be declined. So we would recommend this card only for people with a year of credit history or more and a score of around 700,

Learn more about What Can Affect Your Credit Score? (And How To Deal With It!)