Some Americans who haven’t received their stimulus checks yet, may be received the payment in the form of a debit card. This article contains all you need to know to set up and use your card effectively. The Economic Impact Payment (EIP) Card is a prepaid debit card that contains the money you are receiving as a result of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The EIP card is sponsored by the Treasury Department’s Bureau of the Fiscal Service, managed by Money Network Financial, LLC and issued by Treasury’s financial agent, MetaBank®, N.A.

Your EIP card will arrive in a plain envelope from “Money Network Cardholder Services”. The Visa® name will appear on the front of the card; the back of the card has the name of the issuing bank, MetaBank®, N.A. EIP Card is not a credit card and doesn’t come with the kind of liability protection credit cards do. You should thus treat your EIP card with the same care as you would treat cash.

There are some limits to your EIP card, such as an ATM withdrawal limit of $1,000 per transaction and per day (bank limits may be less), Point-of-Sale (POS) transactions limit of $2,500 per transaction and per day, and bank/teller over-the-counter withdrawal limit of $2,500 (bank limits may be less).

Here is an outline of everything you need to know about your EIP card.

How to Activate and Set Pin

You need to activate your card prior to use by calling customer service on 1.800.240.8100 . For cards that carry more than one name, only the primary cardholder may activate the card. You can also set or change the 4-digit PIN by calling the same number.

During activation, you will be asked to validate your identity by providing your name, address, and social security number. You will also be asked to create a 4-digit PIN required for ATM transactions and automated assistance and to hear your balance. For your account security, it’s always a great idea not to use personal information such as birth year etc… as your PIN.

Don’t forget to sign the back of your EIP card. Keep your EIP card number in a safe place, like we said earlier, treat the card with the same care as you would cash.

To set up a User ID and Password for online access, click on the Login button and click “Register Now”. Follow the steps to create your User ID and Password. Be sure to have your EIP card handy. You can use the same User ID and Password created for online access to access the Money Network® Mobile App.

Keep Track of the Amount of Value Loaded on the Card

You can keep track of the amount of value loaded on the cards issued to you. To obtain information about the amount of money you have remaining in your card account, call customer service. This information, along with a 12-month history of account transactions, is also available online at EIPCard.com. You also have the right to obtain at least 24 months of written history of account transactions by calling customer service.

What Can Be Done with the Card for Free

NO FEE services on your stimulus debit card include:

- Card account opening, checks and initial card

- Monthly maintenance

- Signature debit transactions (select “Credit” or sign at POS)

- PIN debit transactions (select “Debit” and enter PIN at POS; cash-back option at participating merchants)

- Money Network® Check

To request checks, call customer service. Participating check-cashing locations do not charge fees to cash Money Network Checks. To find these locations, use the locator on the Money Network Mobile App or at EIPCard.com, or call customer service. Non-participating check-cashing locations may charge fees and may also limit the dollar amount of checks they will cash.

There is no fee for cashing Money Network Checks at designated locations. Certain of those locations will cash Money Network Checks up to $5,000.00 per check. Other check-cashing locations may impose higher or lower limits, but one individual Money Network Check at any check cashing location, and multiple Money Network Checks in one day, may not be made payable for more than $9,999.99.

- In-network ATM withdrawal

To find in-network ATMs, use the locator on the Money Network Mobile App or at EIPCard.com, or call customer service at 1.800.240.8100 (TTY 1.800.241.9100).

- ATM decline in the U.S. (in-network or out-of-network)

- ATM decline internationally (non-U.S.) but you may be charged a fee by the ATM operator, even if you do not complete a transaction.

- First bank teller over-the-counter cash withdrawal on your card

- Transfer of funds to a personal bank account (ACH transfer)

- Monthly paper statement

- Account balance when inquired through 24/7 toll-free card account access

- Inactivity on your card

Purchase Gas Using Your EIP Card

To purchase gas using your EIP card, give your card to the attendant to pre-pay for gas in order to avoid a pre-authorization. As with most debit cards, if you pay at the pump, merchants will pre-authorize your purchase, which temporarily puts a hold on your card balance that could be greater than the transaction amount. Once processed, the money will be released, and your balance will be adjusted. Pre-authorized funds may take up to 7 business days to be released back to your card account balance.

Use Your Card to Pay Rent or Mortgage

You can use your card to pay your rent or mortgage if your landlord or mortgage company accepts Visa debit card payments. You will need to enter your card information as directed by your landlord or mortgage company to complete your transaction. You can also use a free Money Network Check to make these payments with the funds in your card Account.

You can use your card for any recurring bill payments. Just make sure you have sufficient funds to cover the entire bill. If you have insufficient funds, then your payment may be declined or partially authorized.

What Can be Done for a Fee

- $2+ Out-of-Network ATM withdrawal

$2.00 is MetaBank fee. They waive this fee for your first out of network ATM Withdrawal. You may also be charged a fee by the ATM operator, even if you do not complete a transaction

- $5+ Bank Teller Over-the-Counter cash withdrawal (waived first time)

$5.00 is MetaBank fee. You can withdraw funds at banks displaying the Visa® logo in the U.S. and outside the U.S. You may also be charged a fee by the bank.

- $0.25 ATM balance inquiry fee (in network or out-of-network or in ATMs outside of the U.S.)

To find in-network ATMs, use the locator on the Money Network Mobile App or at EIPCard.com, or call customer service. You may also be charged a fee by an Out-of-Network ATM operator, even if you do not complete a transaction

- $3.00 non-U.S ATM Withdrawal fee

This is MetaBan fee. You may also be charged a fee by the ATM operator, even if you do not complete a transaction.

- $7.50 Reissued lost/stolen card shipped via U.S. mail 7-10 business days after order placed

- $17.00 Priority shipping fee. There is an additional fee to ship replacement card 4-7 business days after order placed. Reissuance of card fee also applies.

Why Your Balance Might Be Lower Than You Think It Should Be?

You can’t stop payment on any purchase transaction originated by use of your card. With certain types of purchases (such as those made at restaurants, hotels, or similar purchases), your card may be “pre-authorized” for an amount greater than the transaction amount to cover gratuity or incidental expenses. Any pre-authorization amount will place a “hold” on your available funds until the merchant sends us the final payment amount of your purchase. During this time, you will not have access to pre-authorized amounts. Once the final payment amount is received, the pre-authorization amount on hold will be removed.

EIP Card Returns and Refunds

If you are entitled to a refund for any reason for goods or services obtained with your card, the return and refund will be handled by the merchant. You may wish to retain receipts as a record of transactions. Receipts will be required if you need to verify a transaction.

Protecting Yourself against Fraud

If you believe your card or PIN has been lost or stolen, or if you believe that an electronic fund transfer has been made without your permission, you should immediately call MetaBank customer service to keep your possible losses down.

If you tell MetaBank within 2 business days after you learn of the loss or theft of your card or PIN, you can lose no more than $50 if someone used your card or PIN without your permission.

However, if you do not tell MetaBank within 2 business days, and MetaBank can prove they could have stopped someone from using your EIP card or PIN without your permission if you had told the bank within those 2 business days, you could lose as much as $500 (!)

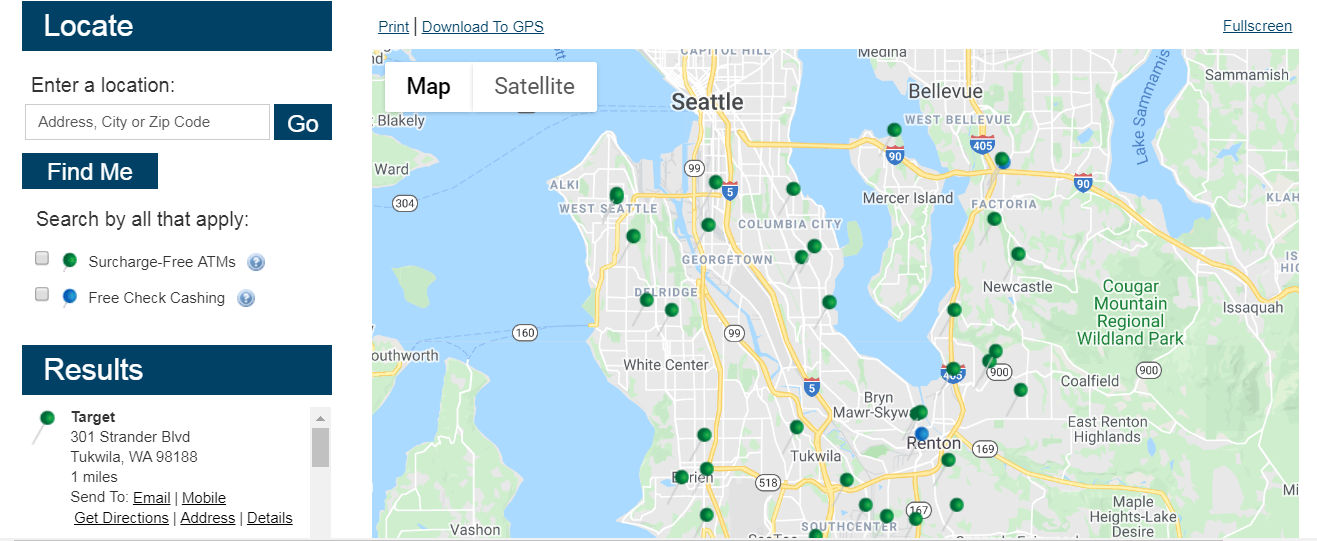

How to Find In-Network ATMs

The cards use the All Point network of ATMs. To find in-network ATM near you use this map or type in your zip code.

***

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.