Referrals has long been a good way to increase the amounts of points you earn, without resorting to more sketchy tactics like manufactured spend. You can simply give a referral links for a card you have to a friend of family member and if they are approved, you can earn $100 in cash back or 10,000 points for example, usually up to an annual limit. In this guide we will look at how to do referrals for Chase cards, although American Express also has a similar system and many of the same principles apply.

The Refer a Friend Program

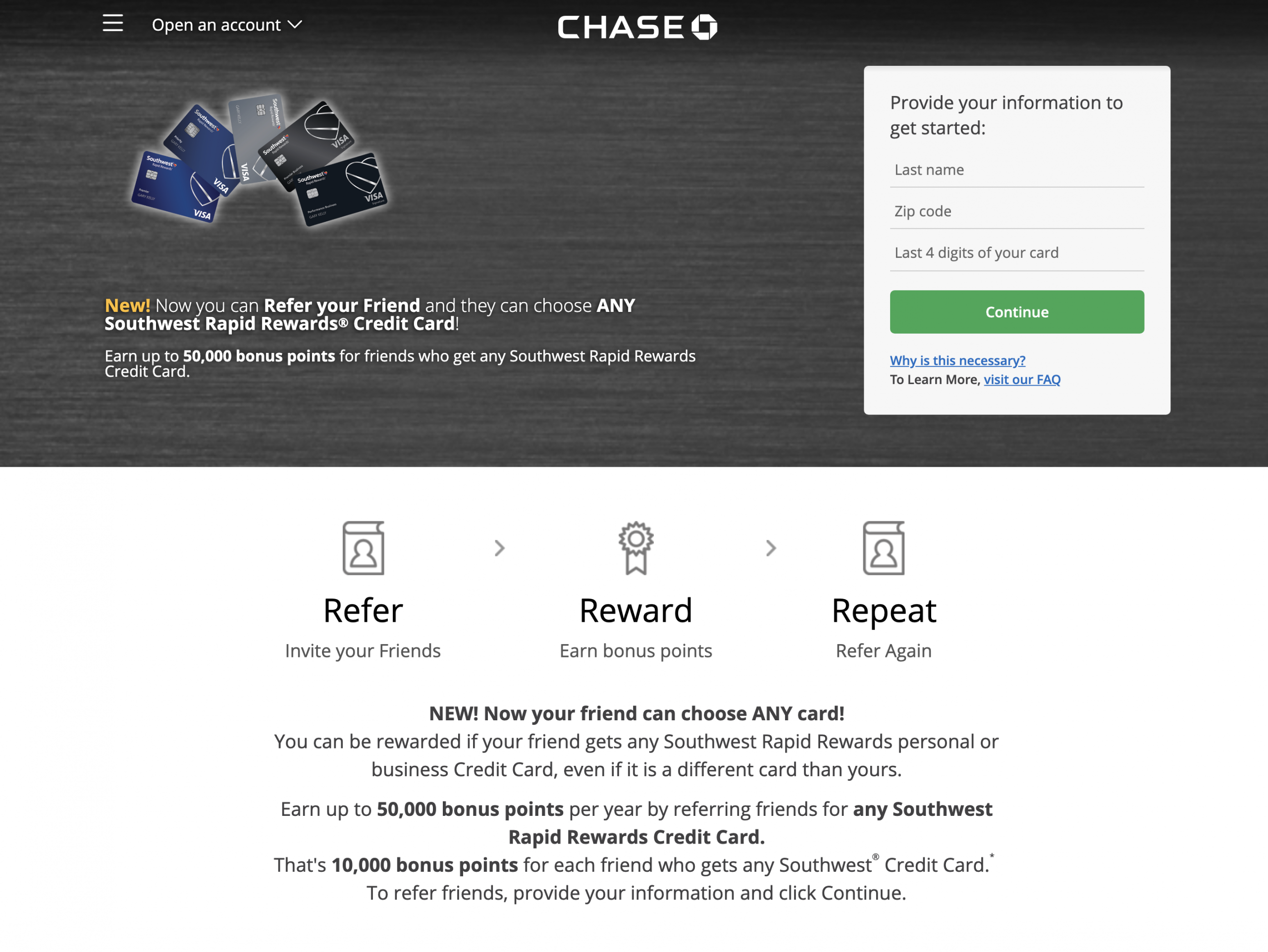

Chase has a special page on their website for their referral program, here is the URL: https://creditcards.chase.com/refer-a-friend

To do a referral for a card you must have that card or one in that series of cards, you then click through and enter your last name, zip code and last four digits of your card number, you don’t actually need to sign in to get a referral link. You also may from time to time receive a referral link through email that you can send out to friends.

There are currently 9 cards, or actually 9 series of cards, that you can refer friends to. We say series of cards, because Chase recently introduced a new feature where Freedom card holders can now refer friends to either the Freedom or the Freedom unlimited, no matter which card they have personally. It works the same way with the Southwest Airlines cards, friends being referred can choose any Southwest co-branded card personal or business.

Referral Bonuses

Here is a list of the bonuses you will earn, as well as the annual maximum for the person who’s referral link is being used:

Freedom/Freedom Unlimited: $100 per referral, up to $500 per year. Friend get’s $200 welcome bonus.

Sapphire Preferred: 15,000 UR points per referral, up to 75,000 points per year. Note: there is no link for Sapphire Reserve.

Ink Business Preferred: 20,000 UR points per referral, up to 100,000 points per year. Friend gets 80,000 points welcome bonus.

Ink Business Unlimited: $150 cash back per referral, up to $750 per year.

Southwest Cards: 10,000 points per referral, up to 50,000 per year.

United Explorer Card: 10,000 points per referral, up to 50,000 per year.

Marriott Bonvoy Boundless: 20,000 points per referral, and up to 100,000 per year.

World of Hyatt Card: 5000 points per referral, up to 25,000 per year.

Chase Disney Premier Visa: 100 Disney points per referral, up to 500 per year.

Tax Issues

While normal credit card rewards and welcome bonuses are not taxable, they are considered a rebate rather than income, it does seem that Chase, Amex and the IRS consider referral bonuses to be income. And if you think about it, you are basically doing marketing work for Chase, if you didn’t do that marketing to your friends or family, Chase would have to spend money on advertising, which would count as income for the company or person they employed.

Chase states the following in their small print:

Your participation in this program may result in miscellaneous income received from Chase and we may be required to send you, and file with the IRS, a Form 1099-MISC (Miscellaneous Income) or Form 1042-S (Foreign Person’s U.S. Source Income Subject to Withholding) for the year in which you participate and are awarded the benefits of the program. You are responsible for any tax liability related to participating in the program. Please consult your tax advisor if you have any questions about your personal tax situation.

So you most likely will receive a 1099 form even if the income you earned from referrals is under the usual $600 threshold. I received forms reporting $550 worth of income for 2018 Amex referrals. Chase value the points at 1 cent per point for tax purposes, so if you earned 100,000 points maxing out your referral link for the Ink Preferred, for example, your reported income would be $1000.

When I report this income on my personal tax return, I claim the card’s annual fee as an expense in my credit card marketing “business.” So for the Ink Preferred, for example, $1000 income minus $95 annual fee, would equal $905 profit that I would then be responsible for paying tax on. This is how I do it, but please remember I am not a CPA and cannot advise you, so you should ask a tax professional whether or not you can claim the annual fee as an expense.

Conclusion

Doing referrals is a great way of increasing credit card rewards, you can promote links to friends and family and every time you apply for a new card, ask around to see if someone has a link, that way they get rewarded and next time they want a new card, they may come to you asking for a referral link. There are also often increased sign up bonuses and extra perks available through referral links.

As for the tax considerations, for me it is a non-issue, if you are due for a refund anyway, it just lowers you refund by $100 to $200, and if you are self-employed and pay your own taxes, it just seems to get lost in the amount you have to pay anyway and doesn’t really matter. Self employed people already have more deductions they can take than employees, so they can usually make it up elsewhere.