With the second round of the stimulus bill expected to be approved in May, many Americans are still waiting for their first $1,200 check and are eager to learn about the stimulus payment update. On Friday, the Treasury Department and the IRS reported that 88.1 million stimulus payments worth nearly $158 billion had been issued and the program is only in its third week.

The historically high amount of financial aid and the anxiety with which some Americans affected by the coronavirus economic fallout wait for their much needed checks breeds an unprecedented number of scams. In just one week from April 6th to April 13th more than 18 million daily malware and phishing emails related to Covid-19 scams have been recorded, and that’s in addition to the 240 million daily spam messages related to coronavirus, according to Google’s recent report.

The IRS urges taxpayers to be on the lookout for a surge of calls, text messages, websites, social media, and email phishing attempts about the Coronavirus, or COVID-19 as these contacts can lead to tax-related fraud and identity theft.

“We urge people to take extra care during this period. The IRS isn’t going to call you asking to verify or provide your financial information so you can get an economic impact payment or your refund faster,” said IRS Commissioner Chuck Rettig. “That also applies to surprise emails that appear to be coming from the IRS. Remember, don’t open them or click on attachments or links. Go to IRS.gov for the most up-to-date information.”

Scams Disguised as Your Stimulus Payment Update

Regardless of what mediums (email, phone call, Facebook messenger, etc) scammers use, there are several signs the message is a 100% scam.

According to the IRS, scammers may:

- Emphasize the words “Stimulus Check” or “Stimulus Payment.” You should know that the official term used by the IRS is “economic impact payment.”

- Ask the taxpayer to sign over their economic impact payment check to them under various pretenses. The IRS has issued the stimulus payment to you and there is no scenario under which it would ask for the check back.

- Ask for verification of personal and/or banking information saying that the information is needed to receive, verify or speed up processing your economic impact payment.

- Suggest that they can get a tax refund or economic impact payment faster by working on your behalf. This scam could be conducted by social media or even in person.

- Mail you a bogus check, perhaps in an odd amount, then tell the taxpayer to call a number or verify information online in order to cash it. The IRS issued checks don’t require any additional verification step in order for you to put the money in your wallet. If you received an economic impact payment as a paper check via mail, you can just deposit it to your bank account. Depositing via your bank’s app is the fastest way to cash your check.

Deter Stimulus Paper Check Fraud

The Secret Service and the Treasury Department are working together to help Americans protect themselves from counterfeit stimulus checks, as the Trump administration plans to mail millions of coronavirus relief paper checks later this month.

“With the implementation of the CARES Act, comes opportunities for criminal activity, like check fraud,” the agencies said in a statement last week. “The Secret Service and the U.S. Department of the Treasury want to inform citizens and consumers nationwide on ways to protect themselves during these times.”

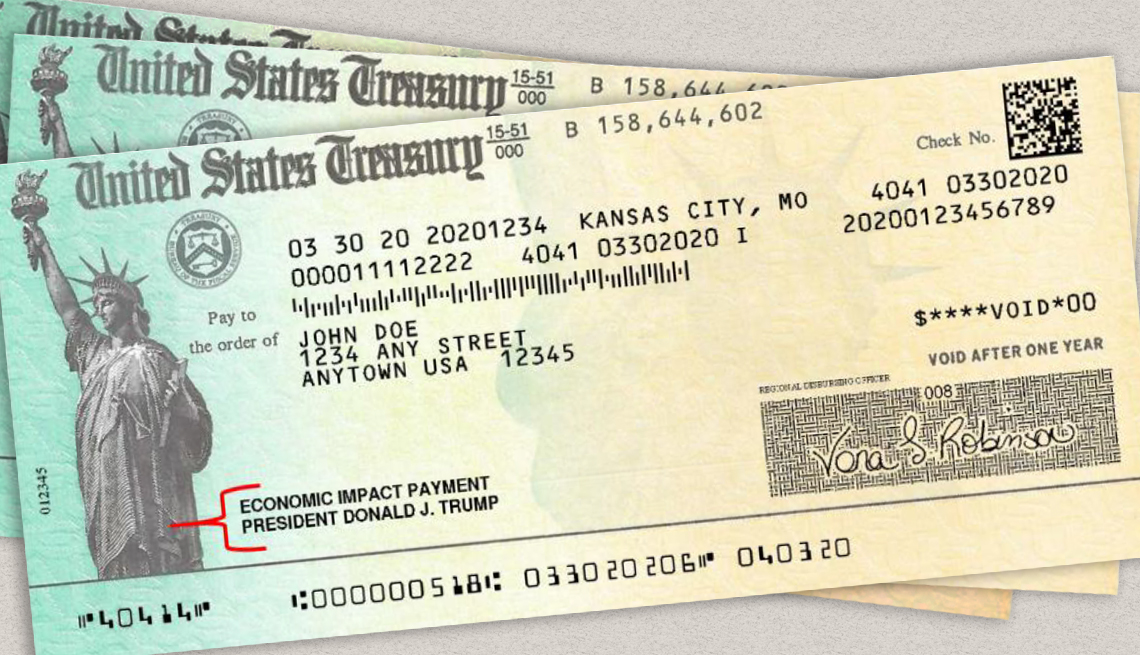

The Secret Service has released a sample of the paper check and a set of “quick tips” and “genuine security features” for those reviewing the legitimacy of checks mailed to them:

- Treasury seal

The checks will include a “Treasury Seal” placed to the right of the Statue of Liberty on the check. It will say “Bureau of the Fiscal Service,” replacing an old seal, which would have read “Financial Management Service.”

- Bleeding ink

The treasure seal will show bleeding ink when moisture is applied, causing the black ink to “run” and turn red.

- Watermark

The stimulus checks are printed on watermark paper, which will read “U.S. TREASURY” and can be seen from both the front and the back of the check when you hold it up to a light. The check will also have a protective ultraviolet pattern, which is invisible to the naked eye, but if put up to ultraviolet light, one could see the U.S. Seal of an eagle, or “FISCALSERVICE.”

- Microprinting

Microprinted words are so small they appear as just a line to the naked eye and the words become visible only when magnified. Legitimate stimulus payment checks will have microprinting on the back of the check with the words “USAUSAUSA.”

- President’s name

Lastly, the lower right side of the Statue of Liberty imprinted on left side of the stimulus check will read: “Economic Impact Payment, President Donald J. Trump.”

How Stimulus Paper Check Scams May Work

Scenario #1. Scammers send you a check for a larger amount than you are owed and then ask you to repay some of it. Later, when you cash the check, it bounces, but you are still out of money.

Scenario #2. Scammers send you a check but include a letter that says you need to call up some number to confirm your identity before cashing it or saying you need to call or go online to activate/verify it before you can cash the check. Scammers will then ask for your social security number or bank details etc.

Stimulus Payment Scams via Phone Calls

IRS impersonators might call you on the phone under various stimulus payment update pretenses. For example, scammers might tell you that in order to speed up your stimulus check processing they need to verify your information, or they might tell you other people tried to access the system with your details and that your account is now blocked to unblock it you need to provide them with your personal information.

If you don’t wish your bank accounts to be drained, never, ever give out your personal information.

The IRS has advised taxpayers to ignore any strange phone calls, voicemails, and text messages claiming to be from the IRS or any other government agency regarding your stimulus check. The Federal Communications Commission even has some audio samples of these types of voicemails.

If you want to track your payment, simply use the official Get My Payment IRS tool.

Stimulus Payment Scams via Email

Recent research from IBM Security revealed that 35% of respondents would expect to hear from the IRS by email and more than half of respondents said they would click on links or open attachments that referenced their entitlement to a stimulus check payment.

The IRS has stated numerous times that it won’t contact individuals by email regarding tax filings.

“As long as you filed taxes for 2018 and/or 2019, the federal government likely has the information it needs to send you your money,” said the Federal Trade Commission in a recent report. In other words, you won’t need to sign up for anything or give anyone your personal information.

In order to avoid being scammed and have your identity stolen, never click on a link, only go directly to the Get My Payment tool on the IRS website to check your stimulus payment update. Over the weekend, the Treasury Department announced it had made significant enhancements to the Get My Payment tool to fix several glitches, including payment status for closed bank accounts, greater access for taxpayers who filed in 2018 but did not use direct deposit for a refund and the ability to submit a zero for the question about the refund amount or amount owed.

How to Report Suspected Scams

If you’ve received unsolicited emails, text messages or social media attempts to gather information that appear to be from either the IRS or an organization closely linked to the IRS, such as the Electronic Federal Tax Payment System (EFTPS), should forward it to [email protected].

The IRS encourages Americans not to engage potential scammers online or on the phone. Learn more about reporting suspected scams by going to the Report Phishing and Online Scams.