“The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.”

Chase is working on keeping its customers loyal and is adding new limited time perks amidst the coronavirus pandemic.The perks, which were today announced, include new options to redeem Ultimate Rewards Points for increased value, the lowering of the Sapphire Reserve credit card annual fee to $450 through the end of the year, and more flexibility with your annual $300 Travel Credit.

Chase New Perks: ‘Pay Yourself Back’ Feature

The new Pay Yourself Back feature within Ultimate Rewards will provide the option to apply points to pay for all or a portion of existing purchases in select categories through a statement credit. Launching first for Sapphire Reserve® and Preferred cardmembers on May 31st. From launch until Sept 30th, points will be worth 50% and 25% more, respectively, when redeemed for every day purchases in the initial categories of: grocery stores, home improvement stores, and dining; including restaurants, takeout and eligible delivery services.

“Now more than ever we know our cardmembers want options to get the most value from their rewards,” said Matt Massaua, Head of Ultimate Rewards and Loyalty Solutions. “We’re continuing to give our customers choices so they have the flexibility to use their points in the most meaningful ways for them.”

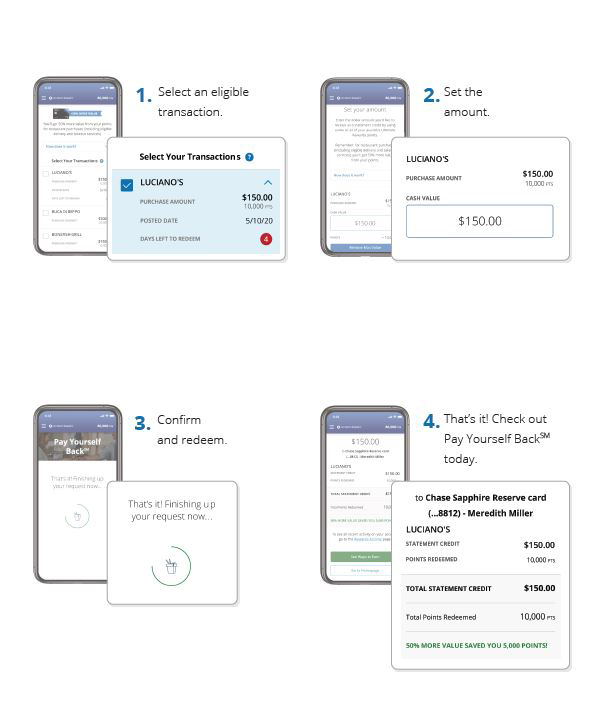

Starting May 31, 2020, Chase Sapphire Preferred and Reserve cardmembers will have access to the new Pay Yourself Back feature. After making a purchase in an eligible category, cardmembers can simply log into Ultimate Rewards on desktop or through the Chase mobile app, select from recent transactions up to 90 days prior, and choose to redeem points for all or a portion of the purchases.

Step-by-Step Guide: How to Use the Chase Pay Yourself Back Feature

This means that Sapphire Reserve cardmembers can apply 10,000 points to pay themselves back on a $150 purchase – which is 5,000 points saved compared to a typical cash back redemption. After applying points to an eligible purchase, cardmembers will automatically receive a statement credit for the amount paid in points within three business days.

Sapphire cardmembers will continue to earn their usual 3x points on restaurant and travel purchases with Sapphire Reserve and 2x points with Preferred, as well as, the bonus earn through the end of June: 5x or 3x total points on purchases at grocery stores for Sapphire Reserve and Preferred respectively.

Chase New Perks Plan for Other Chase Credit Cards

Chase confirmed today that it will introduce other cards that earn Ultimate Rewards points to the Pay Yourself Back feature over time. Sign up for our weekly newsletter to stay in the loop.

More Ways to Earn Your Annual Travel Credit

Now you can enjoy more flexibility with your annual $300 Travel Credit. A statement credit will automatically be applied to your account when your card is used for purchases in the travel category, up to an annual maximum accumulation of $300. Starting June 1, in addition to eligible purchases made in the Travel category, purchases posted by December 31, 2020 in the Gas Stations and Grocery Store categories will also count toward the $300 Annual Travel Credit.

$100 OFF Chase Sapphire Reserve Annual Fee

Back in April, Chase announced that Chase Sapphire Reserve cardholders with an annual fee renewing through July 1 would receive a $100 statement credit toward their annual fees.

Today, Chase added to that new perk: Any Sapphire Reserve renewal between July 1 through Dec 31 2020 will process at $450. If your renewal date is between April 1 and July 1, you will still see a $100 statement credit.

***

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.