The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Following credit line increases, heightened fraud security, extended payment deadlines, and waived late payment fees, credit card issuers continue adjusting their policies amidst the coronavirus outbreak. Just recently Chase announced its decision to give select Chase Sapphire Reserve cardholders a $100 annual fee credit to offset the card’s $550 annual fee (accounts with renewal dates between April 1 and July 1, 2020). Now Chase is extending the sign-up bonus spending period deadlines for three months for select cardholders (for accounts opened from Jan. 1, 2020, through Mar. 31, 2020).

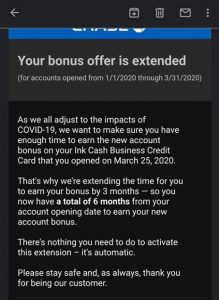

“As we all adjust to the impact of COVID-19, we want to make sure you have enough time to earn the new account bonus,” reads the letter from Chase Card Services communication. “We’re extending the time for you to earn your bonus by 3 months – so you now have a total of 6 months from your account opening date to earn your new account bonus.”

Chase cards that qualify for the bonus spend period extension

Every U.S. consumer, with Chase personal or business credit card account that is “points based” i.e. not earning cash back, opened this year before March 31st, is eligible for the bonus spend period extension, including:

Chase Sapphire Preferred Card – 100,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That’s $1250 toward travel when you redeem through Chase Ultimate Rewards. Earn 2X points on travel and dining at restaurants worldwide and 1X on all other purchases.

Chase Sapphire Reserve – 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. Earn 3X points on travel immediately after earning your $300 travel credit and 1 point per $1 spent on all other purchases.

United Club Infinite Card – 100,000 bonus miles after you spend $5,000 in purchases in the first three months from account opening. Earn 2 miles per $1 spent on dining and 1 mile per $1 spent on other purchases.

IHG Rewards Club Premier Credit Card – 140,000 bonus points after spending $3,000 on purchases within the first three months of account opening. Earn 2 points per $1 spent on purchases at gas stations, grocery stores, and restaurants and 1 point per $1 spent on all other purchases.

Southwest Rapid Rewards Priority Credit Card – 40,000 points after you spend $1,000 on purchases in the first three months your account is open. Earn 2 points per $1 spent on Southwest purchases and Rapid Rewards hotel and car rental partner purchases. Earn 1 point per $1 spent on all other purchases.

Ink Business Preferred Credit Card – $500 bonus cash back after you spend $3,000 on purchases in the first 3 months after account opening. Unlimited 1.5% cash back rewards on every purchase made for your business – with this no annual fee credit card.

How to apply for the extension

If you opened your Chase account earlier this year, through March 31st, there is nothing you need to do to get the extension – it’s automatic. Some of our readers shared today that they already received emails notifying them of their extensions.

Currently, Chase’s extending bonus spending period policy won’t apply to those cardholders who opened their accounts in April. Certainly, this could change in the coming weeks as the situation with COVID-19 continues to evolve. Chase’s policy may extend to include newer cardholders, or have new benefits; for the most recent updates, follow The Credit Shifu on social media.

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.