Hey Credit Warriors! I did do the Best Credit Card Bonuses for October 2023 video but there are some more good ones. So let’s take another look at some of the best credit card bonuses out there that I haven’t talked about in the Part 1 video.

Best Credit Card BONUSES October 2023 Part 1

If you don’t know, a credit card welcome bonus is when a certain credit card gives you a certain amount of points or cash back for spending a certain amount of money in a set amount of time from when you open the card. For example, spend $1,000 in your first 3 months and get $200 cash back.

Top High-Tier Travel Credit Card

The first card I want to talk about is the CapitalOne Venture X which is one of the top high-tier travel credit cards on the market right now.

The card earns:

- 2X Miles per dollar on all purchases that can be transferred to a load of great Transfer Partners.

- It has a $300 travel credit that gets you access to the CapitalOne lounge and Priority Pass lounges. It’s the cheapest way to get meaningful lounge access from a credit card these days.

The annual fee is $395. But that’s offset by the $300 travel credit and the $100 Global Entry Credit in the 1st year. And then you get 10,000 points every anniversary which are worth at least $100.

Put simply, this card costs you pretty much $0 per year as long as you use all of the benefits and credits effectively.

The public Welcome Bonus on the Venture X is 75,000 points. But there is currently a way that you can get 90,000 points for spending $4,000 in your first 3 months and that is through a direct link. Banks sometimes have direct links to higher offers. Maybe it’s originally something that they created for their Bankers in Branch to give to clients who they wanted to give a higher offer to and then they can get leaked out. No matter how they you know come about there are these links out there that give you higher offers.

Limited-Time Welcome Bonus Business Cards

Let’s now move on to another bonus. Chase currently has limited-time offers running on their two United Airlines co-branded business cards. These are tier three United business card and tier four United Club business card. On both of these cards they are offering 75,000 United miles for spending $5,000 in your first 3 months of card membership.

United did conduct a pretty devastating devaluation a few months ago of their points.

One used to be able to book Polaris business class from Europe to the US East Coast for 60,000 points that’s a $4,000 flight right there. Now that same flight with fully flat beds and private seats will cost you 80,000 points. If you do the $5,000 in spending for your bonus on either of these cards you’ll have at least 5,000 points for doing the spending plus 75,000 points when you trigger the bonus for a total of 80,000 points which is enough for that flight and thus you would have enough for a one-way business class ticket to Europe from New York for example.

Apart from the bonus these cards don’t really earn you that many points. Arguably, you might be better off with one of the other Chase cards that earn Ultimate Rewards and then you could transfer those points to United because United is a Chase Transfer Partner.

These cards do have useful benefits if you fly United often:

- A free check bags

- Priority boarding

- The mid-tier card gives you two United Club Lounge passes per year

- The higher tier card gives you unlimited access to the United Club

How to Never Miss Offers and Bonuses

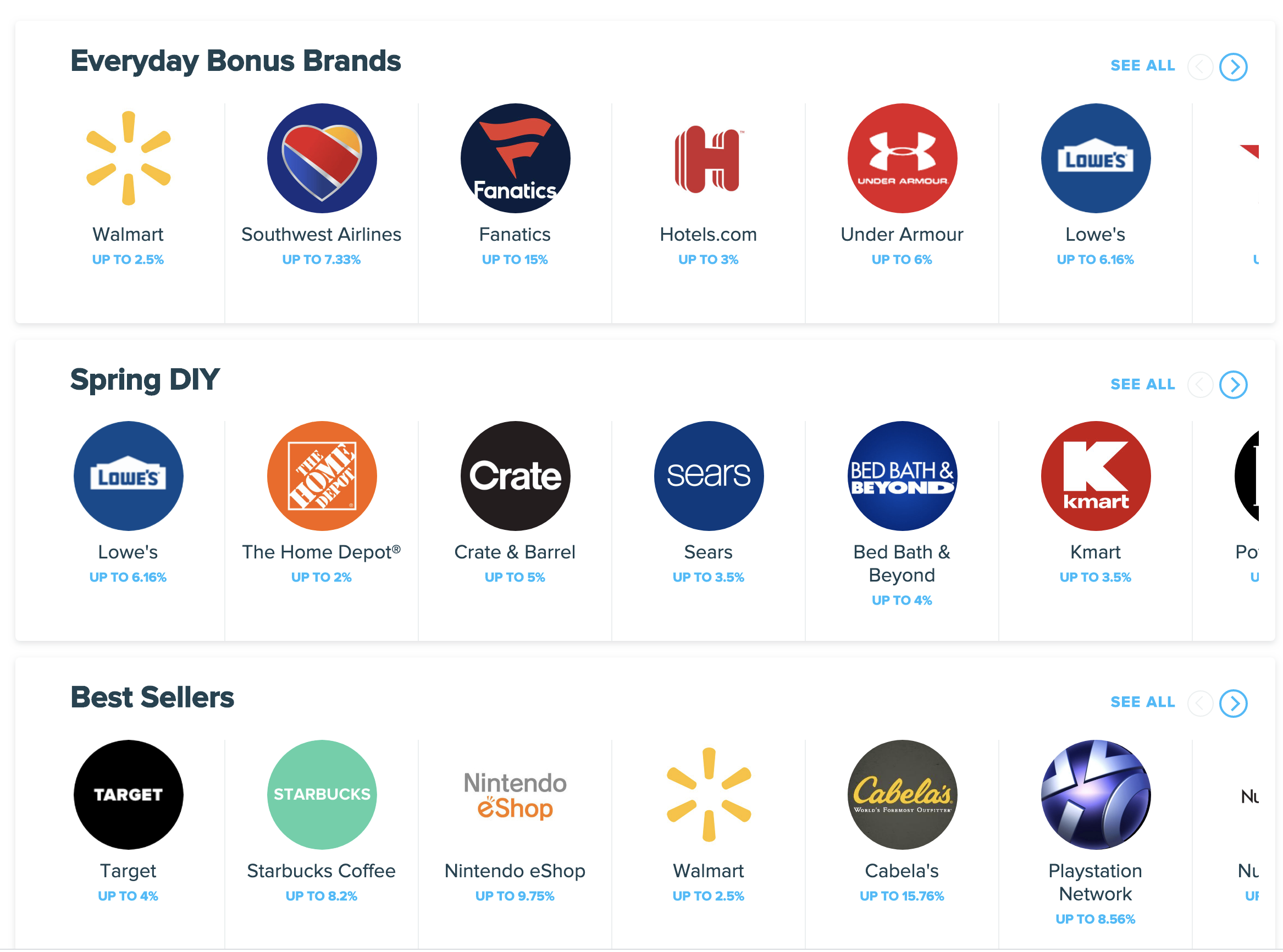

If you have American Express cards or any other credit card for that matter but especially American Express cards check out MaxRewards. It’s a smartphone app that does a soft link with your bank and displays ALL of your credit card balances, transactions, points, and rewards balances in one place. That’s regardless of which bank issues your card. There’s a welcome bonus tracker and the app also tracks spending categories even the ones that change each quarter and always recommends the best card for every purchase.

The pro version of Max rewards MaxRewards Gold is especially useful since it activates all of your American Express offers, adding them to your cards so that you never miss a deal. You might use an American Express offer without realizing it and coming home to an email telling you that you save money. That’s happened to me a couple of times and when you activate all your offers, new offers that you never knew even existed appear in your account and MaxRewards activates them too.

Get a free month of the Gold version of MaxRewards with a code SHIFU or you can just use my link to download the free version and check out the free features.

$500 in Cash Welcome Bonus

The U.S. Bank Altitude Connect card is currently offering 50,000 points which is also redeemable for $500 in cash back as a welcome bonus.

the important thing is though the spending requirement is lower than it used to be. Which is what makes this news. It’s gone down from $3,000 down to 2,000 and that’s pretty generous for a $500 value welcome bonus. This isn’t actually that new, it’s quite a few months since this bonus spend requirement was lowered but we haven’t talked about it on my channel and someone commented the other day that I should talk about it since it’s a pretty good deal, so I am. Spending requirement is only $2,000 and you get $500 in value.

The annual fee of $95 is waved for the first year so that’s even better.

With this card you earn 4X per dollar on travel and gas. It makes it one of the best gas cards out there.

Transfer Bonuses

Chase has a couple of transfer bonuses going on. If you don’t know, a transfer bonus is when you transfer say 1,000 points to some airline and you get 1,200 in your airline loyalty account. That would be a 20% bonus.

The first of these bonuses is with Virgin Atlantic and this bonus is for 30% and it runs from October 1st to November 15th. So 6 weeks it’s already active now and you’ll be able to find it in your account. I found it in my account without too much trouble but there is another bonus that people have been seeing and that is for 25% to JetBlue. This would be the first time Chase has ever done a bonus to JetBlue. The bonus supposedly runs until January 10th 2024. Personally, I really like JetBlue. I took their Mint Studio business class to London a few months ago and I really loved it: The food was great, they gave you pajamas, there was a huge TV, loads of amenities. It was really cool I made a video on it.

The thing about this JetBlue bonus is that although it’s showing up for some people in the Chase app I was not able to find it. After digging on Reddit and I found a conclusion about it from one Reddit user:

I feel January 10th 20124 is very far away and it’s likely that it’s not a live bonus yet. I think it just glitched and it’s showing early for some Chase Inc preferred users somehow.

Personally, I agree with that guy, probably it isn’t live for most people yet. If you do see it, let me know in the comments! Otherwise look out for it in your account in the coming months. Most bonuses run for about 6 weeks to 2 months. So maybe in late November you might notice it appearing in your account.