Using cashback sites can be a steady source of passive income. At TheCreditShifu.com we like Rakuten. It’s a digital marketplace with built-in Earn Cashback functionality. You can shop for electronics, clothing, food, sporting goods, book your next vacation, and more via this tool and earn cashback for every purchase – on top of points and cashback you earn for using your credit card. Rakuten offers up to 40% cashback this weekend for both on-line and in-store purchases, as well as some extra perks such as free shipping and gifts with purchases. You will also earn $10 for signing up if you don’t have a Rakuten account yet.

To start earning, sign up, and every time you need to buy something – from hotel booking to groceries – go to Rakuten.com or download Rakuten app and search the store or product you’re looking for. Then click on the shop’s or product’s link and shop. You will be paid via PayPal or check quarterly.

This weekend only (7/4 – 7/6), Rakuten will be running an increased cashback at over a hundred stores. Here is a more detailed list of participating online and in-store cashback retailers (shop in-store with linked to your Rakuten account card):

Adidas – was 2% now 6%

Lindt Chocolate – was 4% now 12%

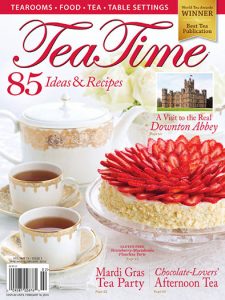

Magazines.com – was 25% now 40%

Example of available deals: Buy a full year of Tea Time magazine for $19.99 and earn $8 back

Casper – was 1% now 3%

e.l.f. Cosmetics – was 3.5% now 10.5%

Elizabeth Arden – was 5% now 15%

Groupon – was 4% now up to 9%

Levi’s – was 2.5% now 7.5%

Michael Kors – was 2% now 6%

Shoes.com – was 4% now 12%

Forever 21 – was 2% now 6%

TOMS – was 4% now 12%

More stores and brands to earn 3x cashback this weekend