Forbearance programs are designed to provide financial relief during times of hardship. Discover Card has a variety of credit card hardship programs – payment deferrals, forbearance, payment plans – that saw an overwhelming rise in demand due to the coronavirus outbreak. The company had about $3.3 billion of card loans in the forbearance program at the end of May. Now the situation seems to be improving.

“A lot of people took one month [of payment deferral] and are not renewing for a second month,” said Roger Hochschild, chief executive officer and president of Discover at the Morgan Stanley Financials Virtual Conference on Tuesday, June 9, 2020. “The re-enrollment rate is relatively low.”

Discover’s network volume reached $403Bn total in 2019. As the coronavirus pandemic crippled economic activities, the credit card issuer was battered leaving spending on the company’s cards down about 30% at the depth of the crisis.

Spending has begun to improve, dropping 12% to 13% at the end of May from a year earlier, Hochschild said. Borrowers may have been helped by the record government stimulus injected into the economy in April and May, according to Discover.

Customers coming off the deferral plans is certainly a sign of their financial health improvement. It’s also good news for the credit card companies since credit card issuers don’t have to set aside as much cash in this scenario.

Other Discover Updates

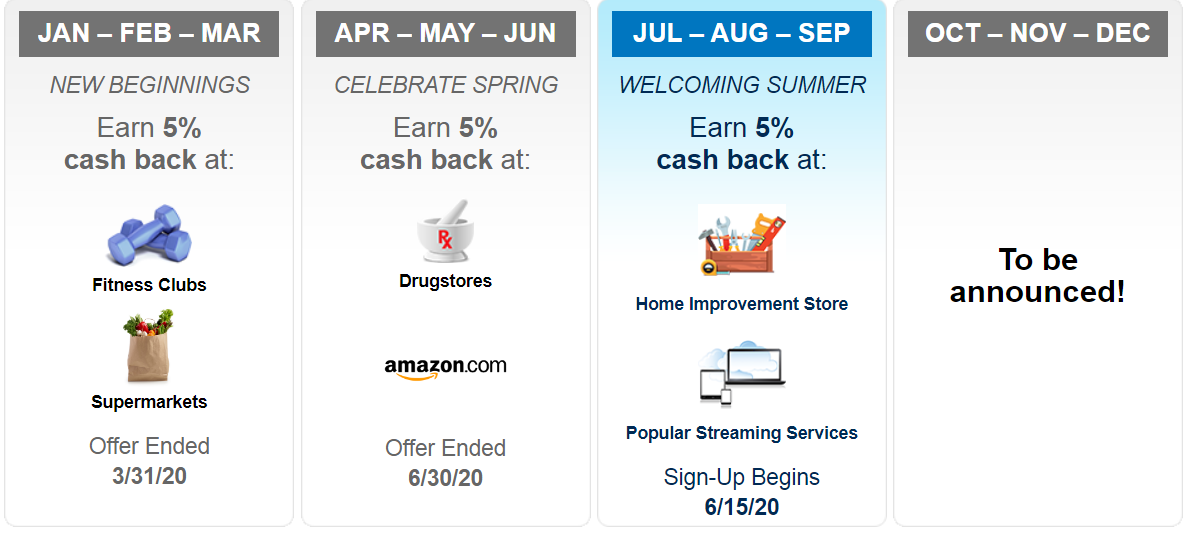

Discover just added Home Depot as an additional option to earn 5% in the Q2 2020 rotating categories (through end of June). In order to take advantage of this offer you must enroll before making these purchases and the 5% back is valid on the first $1,500 in purchases each quarter (up to $75 per quarter), and then 1%.

To learn more about Discover It credit card check out this side-by-side comparison video.

***

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.