This morning we reported on a rumor that Citi was bringing in a set of new benefits to the Prestige card, however the details were somewhat vague. But, now we have confirmation that most of these are true. The card will be opened up to new applicants again sometime in January 2019 and will feature the following benefits.

Improvements

5x points on air travel and dining

3x on cruise lines

$250 air travel credit will become a universal travel credit

Cell phone insurance (coming May 2019)

Downgrades

4th night free hotel benefit will be limited to twice per year

Points won’t have a 25% bonus when redeeming for travel through Citi anymore (new value 1c)

Annual fee will increase to $495

2x on entertainment category gone

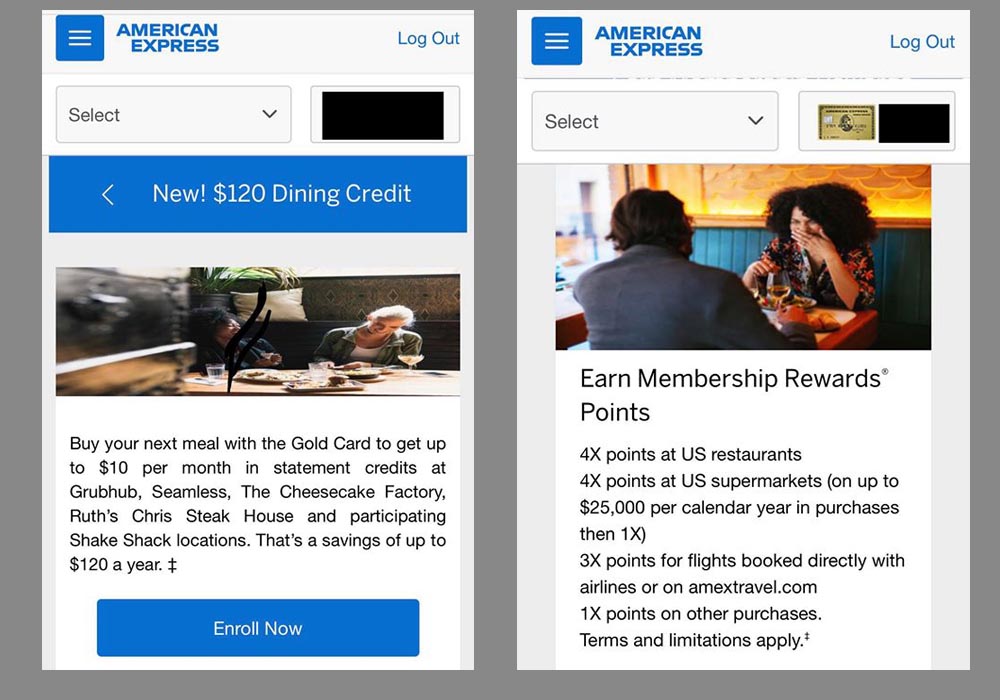

5x on dining and air travel directly competes with the Amex Platinum and recently revamped Gold Card, while the changes to the travel credit make it easier to offset the annual fee since you will be able to get a statement credit for all travel, not just air travel. This will effectively halve the annual fee.

However the new restrictions on the 4th night free benefit will upset some power users of this card who were able to get amazing value out of the perk. Citi told The Points Guy that most card holders use the perk once per year, so it seems it shouldn’t impact most people, except those really serious travel hackers. In my opinion swapping 2x on entertainment for 3x on cruise lines is a downgrade, since entertainment is a far broader category and some people simply don’t like cruises and never go on them, I have never been on one, for example.

Conclusion

These updates bring the card back into the general direction the premium card space is heading in. Following Amex’s lead they have raised the annual fee, the card is called “prestige” so you would expect it to be expensive! Yet they have still preserved and even increased the value the average user will get out of the card, except for 4th night free power users. Now if only they could bring back Admiral’s Club access….