We’re officially in the middle of that time of the year when most of us are preparing financial statements and reports about our gross incomes for the previous year, a.k.a. tax season. That gross income means all income, regardless of the (legal, we hope) source it might have been obtained from. In general, any income a taxpayer receives is subject to tax by the government. Should your credit card rewards be included in that gross income?

Credit Card Rewards: Rebate or Income?

Technically speaking, credit card rewards are an adjustment in the purchase price, not an accession to wealth, and thus are not viewed as a part of your gross income. In other words, rewards gained through spending your money are considered a rebate and the IRS treats them as discounts rather than income. Since a discount isn’t taxable, there’s no need to keep track of all your cash back rewards when you prepare your tax return. Travel miles, points accumulated toward future purchases, regardless of what type or how many transfer partners you choose, sign up bonuses that are issued to you once you reach a certain spending amount, and reward discounts automatically applied as balance credits, are the most common credit card rewards, and all of these are viewed as non-taxable rebates.

However, if the sign-up bonuses are issued to you directly in cash, with no strings attached–no stipulation as to how much you need to spend in your credit card purchases–then these sign up bonuses can be taxable. Because there is no favor granted or expected in return for something, a reward received as a result is not treated as a discount and you are required to report it on your income tax return.

If you’re a business credit card holder, redeeming points can lower your tax deductions, since you used points to pay for certain things so it lowered the amount your business spent. This isn’t generally a problem for very small businesses, but larger companies who actually use points or cash back to pay some business expenses should certainly account for this.

Points from Referrals Are Taxable

Points you earn through referring others to credit cards are not a form of discount or a rebate however, these are considered a part of your gross income. Credit card companies will issue you an IRS Form 1099 INT or 1099 MISC, which you then must include as taxable income on your tax return.

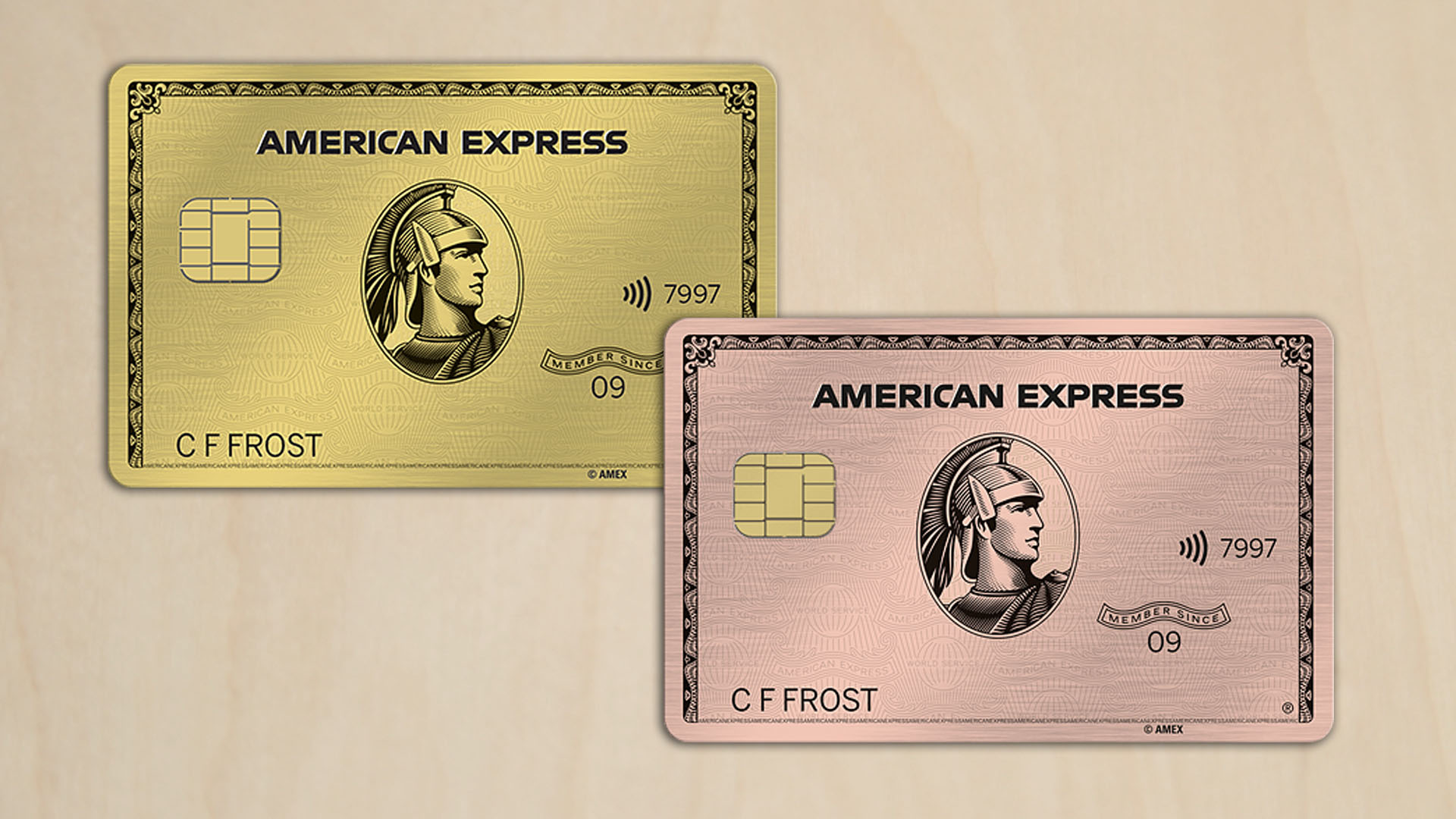

For example, Amex Gold offers 10K points per every qualified referral, with 55K points maximum per year. Chase Ink Preferred offers 20K per referral, with 100K annual maximum.

To give you an idea what these numbers look in regular currency, Chase and Amex value the points at 1c per point (actual value could be higher if you redeem the points for travel).

Credit Shifu claims the card annual fees as a deduction on the schedule C where he reports income from this “business”, since if you have the card in order to do referrals, you have to pay the annual fee. The IRS has never complained to CreditShifu about this, but don’t take this as financial advice, talk to your CPA before doing it.

Referrals are a great way to earn extra credit cards points, cash back, and rewards. Check out this video, where Credit Shifu looks into Chase’s refer-a-friend program.

Earn Extra Rewards While Paying Your Taxes

If you owe tax, a great way to earn some extra rewards is to use a credit card to pay. Plastiq is a bill pay service that allows you to use your credit card for virtually any expense, including paying your taxes, and makes it possible to earn credit card rewards. Plastiq charges a small fee, but can be a great way of hitting minimum spend for a sign up. bonus. You can also use our referral link to get a $500 payment fee free!