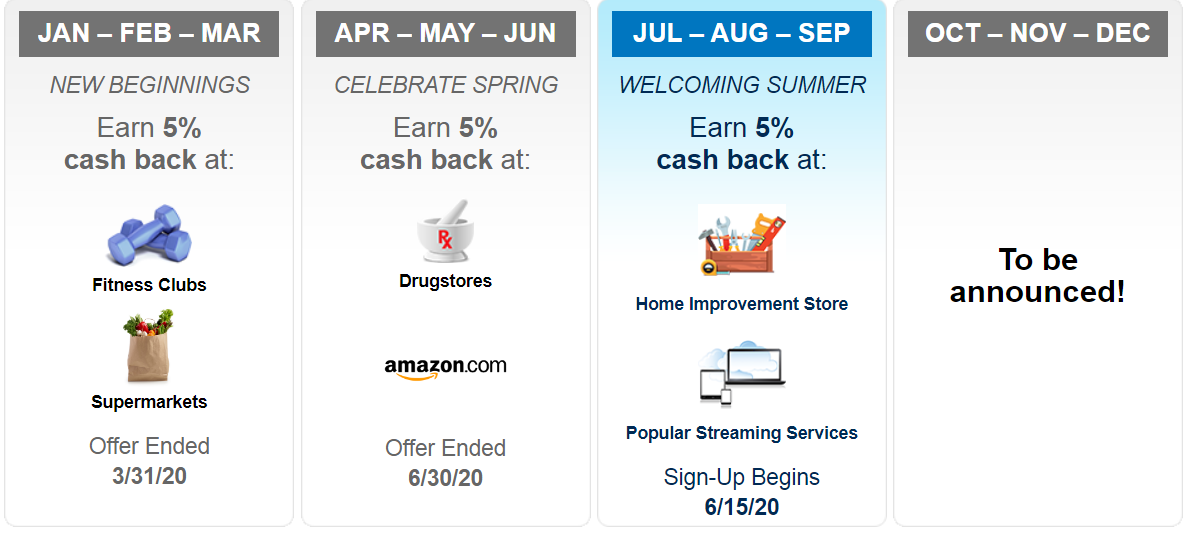

The Citi Dividend Card is a cashback credit card that offers rotating quarterly bonus categories that earn 5% cashback. Citi Dividend doesn’t have the $1,500 limit, but the max total rewards you can earn annually is $300. Citi has just released the 5% categories on Citi Dividend cards for the third quarter of 2020 (July through September).

The new bonus categories are home improvement stores and select streaming services.

-

Home Improvement Stores

Your home is your castle as they say, and you should feel safe and comfortable there. Whether you’re planning to replace windows and siding to protect your home from intruders and weather-related damage or planting a few annuals to uplift the appearance of your home (and boost its value), you can now earn some extra cashback on your home improvement related purchases.

Home Improvement 5% cashback stores include:

- home supply warehouse stores

- lumber and building materials stores

- paint and wallpaper stores

- wallpaper stores

- hardware stores

- nurseries – lawn and garden supply stores

- glass stores

- paints, varnishes, and supplies stores.

Not included in the 5% cashback home improvement category:

- florists’ supply stores

- nursery stock

- flower stores.

2. Select Streaming Services

Including:

- Cable

- Satellite

- The following streaming providers: Amazon Prime Video, CBS All Access, fuboTV, Netflix, Pandora ,Showtime, Sling TV, Spotify, Starz, Vudu, YouTube Premium, YouTube TV.

Several credit card issuers have added bonuses for streaming and home improvements in Q2 2020. This is one of the many changes brought about as a result of the coronavirus outbreak and how it modified our lifestyles. If you find yourself relying on credit cards to pay your bills, check out

3 Things you MUST DO To Get Out of Financial Hardship