As the coronavirus forces would-be travelers to stay indoors, airlines in every country of the world are taking nearly extinction-level hits. United Airlines Holdings and Delta Air Lines and their respective credit-card partners, JPMorgan Chase and American Express, are in talks about selling their miles ahead of schedule and at a lower price in order to raise cash amidst the critical economic situation caused by the coronavirus pandemic, according to Wall Street Journal.

It is not clear at the moment whether or not the talks will result in any deals, but the fact that airlines are ready to resort to such drastic measures by cutting down future revenue, is quite telling of the airlines’ desperation. U.S. airlines have cut about 70% of flying in April and the reductions have not yet reached the bottom, more cuts are probably still ahead of us. As a result of the coronavirus measures, United Airlines shares were down 8.4% at $28.87. Delta shares were off 5% at $23.16.

U.S. airlines have a number of assets to secure billions of dollars of loans. United Airlines Holdings Inc total assets for the quarter ending December 31, 2019 were $52.611B, a 7.32% increase year-over-year. Delta held assets to the value of around 64.5 billion U.S. dollars in the fiscal year of 2019. These assets, however, might not be enough to keep the airlines afloat, especially since it’s nearly impossible to predict how much longer the travel ban is going to last. It’s also clear that not every American family will rush to spend on travel once the restrictions are lifted.

It’s a standard procedure for banks to buy miles from airlines to reward consumers for spending on their credit cards. Buying the miles all at once and at a sizable discount, instead of buying them later as cardholders accrue points, is a very uncommon practice. Similar deals were only on the market after 9/11 and after the 2008 market crash.

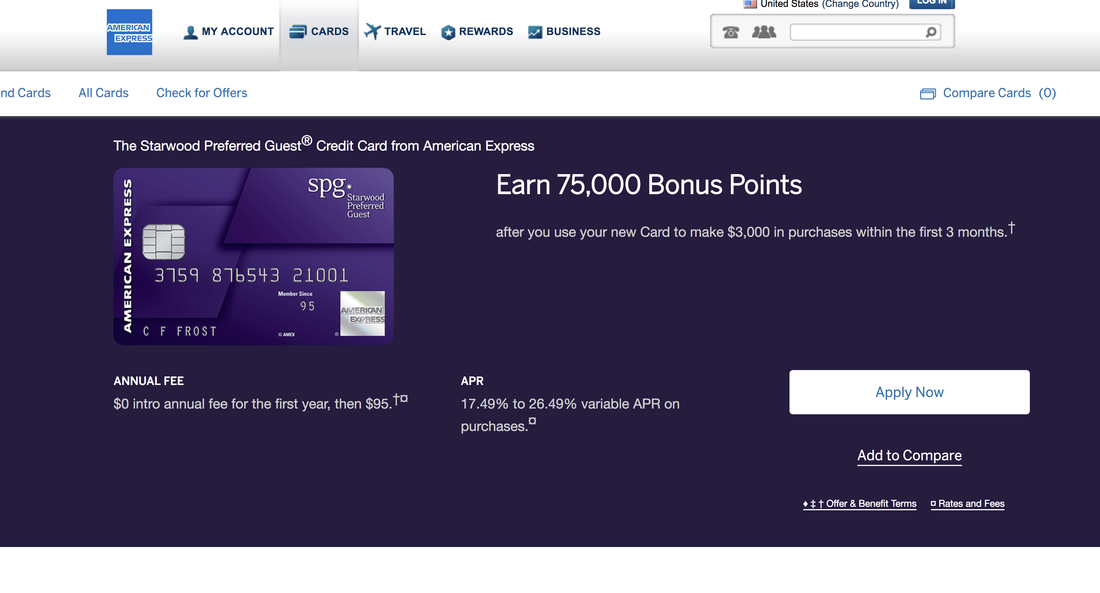

By making this move, United and Delta airlines would sacrifice their future revenue and lose the upper hand in future negotiations with JPMorgan Chase and American Express. To get a sense of how lucrative these loyalty programs are for airlines Delta and American Express recently renewed their agreement through 2029, with Delta hoping (before the COVID-19 pandemic) it would be worth $7 billion by 2023.

The $2 trillion stimulus package that Congress passed at the end of March set aside $50 billion in grants and loans for U.S. airlines, 30% of which will need to be repaid and the U.S. Treasury will require stock warrants from airlines.

As of Tuesday, April 14th, no deal between JPMorgan and American Express and their respective partners Delta and United Airlines, is finalized or even approaching that stage. While this is an easy way to get liquidity for the airlines short term, in a nutshell they would be taking a significant cut on future revenue in exchange for staying in business and securing jobs for Americans working in the travel industry.