The $1200 stimulus checks are all over news headlines since President Donald Trump signed the largest relief package in U.S. history on Friday. In accordance with the “Coronavirus Aid, Relief, and Economic Security Act”, $2 trillion will be injected into our economy, which has been harmed by the COVID-19 virus outbreak. The bill is designed to prop up unemployment insurance and pour money into businesses, health-care providers and state and local governments.

The relief package components include stimulus payments to self-employed individuals, expanded unemployment coverage, student loan changes, and different retirement account rules. Close to 80% of U.S. adults will see stimulus checks of up to $1,200 for individuals and $2,400 for married couples. The federal government will also include $500 for each child or dependent. Let’s take a closer look at a list of factors that determine your eligibility and how much of the $1200 stimulus check you will be able to receive.

What is a stimulus check

A stimulus check is a one-time direct cash payment sent to a taxpayer by the U.S. government, which technically is an advance tax credit that is available for the entire year. In other words, it’s not counted as a part of your income and you won’t have to pay income taxes on the amount you will receive.

How much is your stimulus check

- $1,200 if you’re a single adult with a Social Security number who has an adjusted gross income of $75,000 or below.

- $1,200 if you’re a head of a household and earned $112,500 or less. You will also receive $500 for each child under 17 you claimed on your tax return. Those who file “head of household” are typically single parents

- $2,400 if you’re a married couple (filing jointly) with no children and your earnings are $150,000 or less. Married couples will also receive $500 for each child under 17 they claimed on their tax return.

You can find your adjusted gross income on Line 8b of the 2019 1040 federal tax return. Federal Tax Day is now July 15.

If your income is higher, you will still receive a stimulus check if your adjusted gross income is up to $99,000 for a single person or up to $198,000 for married couples filing jointly. However, the $1,200 amount “phases-out” based on income levels, the check amount reduces by $5 for every $100 you earn over the maximum income limits ($75,000 for single filers and $150,000 for joint filers). Below are some examples

Stimulus Check for a single person with income over $75K

$950 if your adjusted gross income is $80,000

$700 if your adjusted gross income is $85,000

$450 if your adjusted gross income is$90,000

$200 if your adjusted gross income is$95,000

$0 if your adjusted gross income is $99,000 or higher

Stimulus Check for a married couple, filed jointly with income $150K

- $1,900 if your adjusted gross income is $160,000

- $1,400 if your adjusted gross income is $170,000

- $900 if your adjusted gross income is $180,000

- $400 if your adjusted gross income is $190,000

- $0 if your adjusted gross income is $198,000 or higher

Stimulus Check for a head of household with income over $112,500

If you’re a single parent with one child, filing as a head of household; below is your stimulus check table. If you have two or more children claimed, the additional $500 per child will be added to your check.

- $1,450 if your adjusted gross income is $117,500

- $1,200 if your adjusted gross income is $122,500

- $950 if your adjusted gross income is $127,500

- $700 if your adjusted gross income is $132,500

- $200 if your adjusted gross income is $142,500

- $0 if your adjusted gross income is $146,500 and higher

Which Year’s Income is the Check Amount Based on?

If you have filed taxes for 2019 already, then the IRS will use your 2019 income to asses your eligibility. If you have not filed for 2019 yet, the IRS will use your 2018 tax return. You can use this to your advantage, since if you earn’t less in 2018, the you may want to put off filing taxes for 2019 until after you get your check. The IRS will then be forced to use your 2018 income to determine how much you get. Tax day has been extended to July 15th anyway, so you have plenty of time to file. On the other hand if you actually earned less in 2019 than 2018, you may want to go ahead and file now.

Stimulus check and special circumstances

- If you’re receiving Social Security retirement and disability payments each month you qualify to receive a stimulus check.

- If you’re a U.S. citizen living abroad, have a Social Security number and meet the income requirements and you will receive a stimulus check.

- If you’re a veteran, you will receive a stimulus check.

- If you’re eligible unemployed or part unemployed for coronavirus-related reasons, you qualify to receive a stimulus payment.

- If you’re self-employed you qualify to receive a stimulus payment.

- Green Card holders and most foreigners in the US on work visas who have social security numbers and file taxes will be eligible for stimulus checks.

- If you’re a Social Security beneficiary who is not typically required to file tax return, you will not need to file an abbreviated tax return to receive the stimulus payment. The payment will be automatically deposited into your bank account.

Who will not get a stimulus check

Here’s a list of people who most likely won’t receive a stimulus check:

- People without Social Security numbers

- Non-resident aliens (Foreigners here on tourist visas, student visas or illegal aliens)

- Americans who breach set income levels, described above

- College students who are claimed as a dependent on someone else’s tax return. If you’re a student under the age of 24 and your parents pay for at least half of your expenses, in the eyes of the taxing authorities you’re a dependent and don’t qualify for this advance on tax credit.

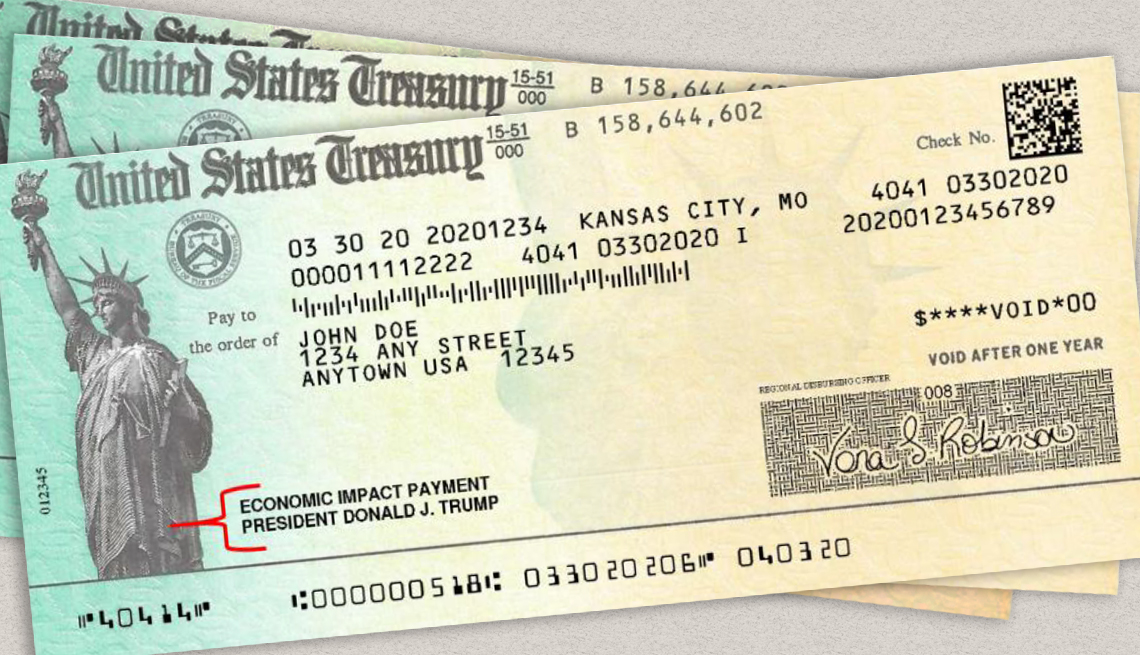

What do you need to do to get a stimulus check

You don’t need to apply or submit any paperwork to receive your stimulus payment, as long as you filed taxes in either 2019 or 2018, you will automatically get a check. If the Internal Revenue Service already has your bank account information, it will transfer the money to you via direct deposit, if not you will receive a paper check via mail.

UPDATE: The U.S. Department of the Treasury and the Internal Revenue Service announced on April 1st that Social Security beneficiaries who are not typically required to file tax returns now will not need to file an abbreviated tax return to receive the stimulus payment. The IRS will use the information on Form SSA-1099 and Form RRB-1099 to generate $1,200 Economic Impact Payments to Social Security recipients who did not file tax returns in 2018 or 2019. Recipients will receive these payments the same way they receive their benefits, such as a direct deposit or by paper check in the mail.

When will you receive your stimulus check

According to Treasury Secretary Steven Mnuchin, most people will get their payments within three weeks from the date the bill was signed (March 27th 2019). You will get a paper notice in the mail no later than a few weeks after your payment has been disbursed for your reference as well.

UPDATE: The IRS stimulus payments distribution plan prioritizes mailing out the checks for the lowest-income Americans first. If your adjusted gross income is $10,000 or less and you don’t file your taxes electronically, your check should be mailed out to you on April 24.

What can impede your receiving the stimulus check

According to the IRS website, if you haven’t filed your 2018 federal taxes, that could affect your stimulus check and the IRS recommends that anyone who hasn’t filed a 2018 tax return to file now. The IRS has also said that people who are behind on child support payments will have their checks either reduced (by the amount they owe) or eliminated completely (if they owe more than $1200). Other situations such as owing back taxes, will not affect your eligibility for a check.

Beware of stimulus check scams

Even though it’s only been three days since the “Coronavirus Aid, Relief, and Economic Security Act” was signed, scammers didn’t waste their time and are have already come up with new fraud schemes.

According to The Federal Communications Commission (FCC), no one will call or text you to verify your personal information or bank account details in order to “release” the funds. The Treasury Department expects most people to receive their payments within three weeks, via direct-deposit information the department has on file from prior tax filings. The IRS will not call and ask you to verify your payment details and you should not give out your bank account or PayPal account information to receive your stimulus check.

In summary, if you have a social security number, your income is below $99K (single) or $198K (married, filed jointly), you will receive a stimulus check. You don’t need to spend any money to receive your check, nor do you need to apply for it. The Internal Revenue Service (IRS) will deposit your check into the direct deposit account you previously provided on your tax return or send you a paper check. The only thing left for you to do is decide how to spend it, here are some ideas…