Amex offers are one of my favorite features of American Express cards. These offers can be added to your card in your Amex online account and typically refund a certain amount of money at a certain store if you spend over a certain amount. For example spend $50 at X store, get $10 back. This obviously benefits Amex and these stores, because it serves as advertising for them, shop there once with an Amex offer and you may like it so much you continue to shop there! But still, wise consumers can save a lot of money by maximizing Amex offers.

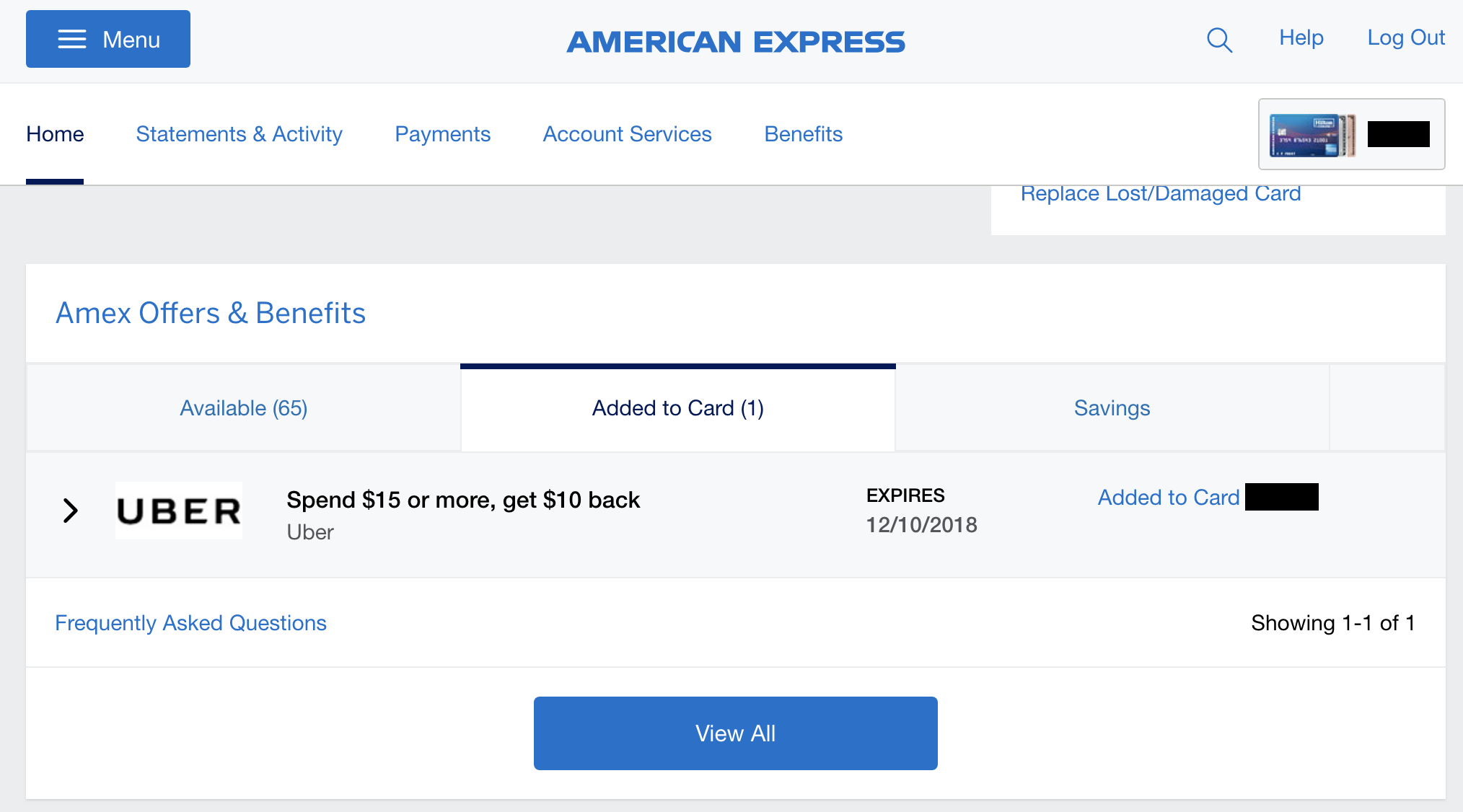

This month there was one offer that particularly caught my eye, get a $10 statement credit when you spend $15 or more with Uber or Uber Eats. That means if you take a ride or order a meal that costs just over $15, you will be saving 66%, that is a phenomenal deal! If you have the Amex Platinum you get a $15 Uber credit every month ($35 in December) anyway, so that would be a saving of $25 ($45 in December).

Here are the terms of this deal:

Get a one-time $10 statement credit by using your enrolled Card to spend a minimum of $15+ in one or more transactions with Uber or Uber Eats by 12/10/2018. See terms for exclusions.

I discovered this offer on my Amex Hilton Ascend card, I was surprised to see that it didn’t appear on my new Gold card, in fact most of the offers in my Gold Card account were uninspiring, hopefully they will add some good ones soon.

If saving money on ride sharing services interests you, there is also a Lyft offer, although the spending requirement is higher: spend $75, get $15 back. The Uber offer is valid until December 10th and the Lyft offer is valid until November 27th. Remember you have to select the offer you want and add it to your card online before you can use it.