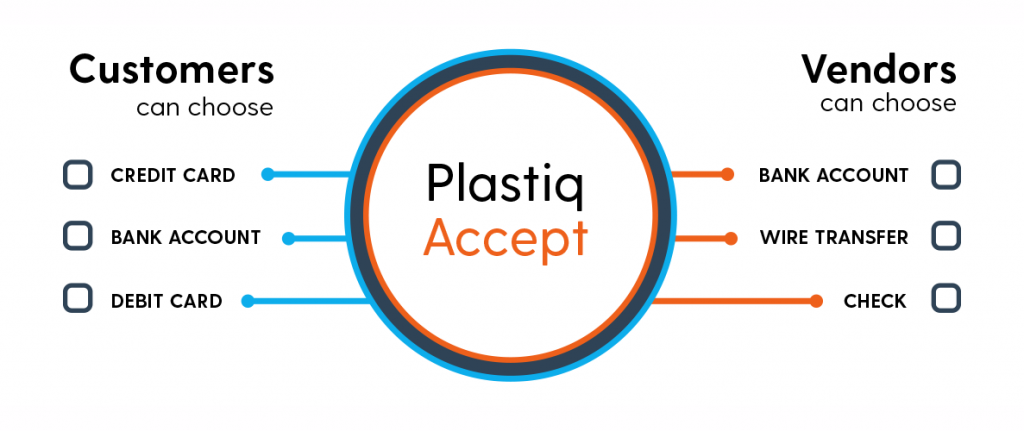

Many vendors in the U.S. still don’t accept credit cards because major card acceptance solutions come with a high cost of card acceptance – fees range between 2.75% and 5% of sales amount. There’s also the time lag between processing a credit card and money being deposited into the vendor’s bank account. For small businesses that only accept cash, checks, or electronic bank transfers because they think they can’t afford accepting credit card payments, Plastiq just introduced the Plastiq Accept.

“We started Plastiq because we saw the need first hand and because we knew there was a better way. We thought that in the age of private rocket launches, there must be a way to make universal credit card acceptance free, fast, easy, and available to any business in a secure, convenient, and affordable way. We made things so flexible and simple, that both you and your customer can now choose how to pay and how to receive payments independently from one another.”

Plastiq Accept at-a-Glance

- All-in-one payment acceptance solution for businesses

- It’s free for vendors to use

- $0 setup fee. Vendors don’t need to pay anything to start accepting credit cards

- Vendor’s customers pay Plastiq a small fee for the convenience of using their credit cards

- No time lag between processing a credit card and money being deposited into the vendor’s bank account. Vendor’s money is typically deposited within 1-2 business days

- Built-in risk-monitoring system

- No cancellation fees or any other fees for vendors

Plastic Accept takes about 5 minutes to set-up and vendors don’t even need to have their own websites to start accepting credit card payments from their customers. Vendors can send a payment link to their customers right away.

Get $100 fee FREE dollars for Plastiq signing up