The Barclays Arrival Premier card was introduced in April this year and it was Barclays’ first credit card that had a system of transferable points – the the most desirable type of rewards system in the credit card world. With a transferable points system, points can be transferred to airline partners and normally can be redeemed for far greater value than points that have a set value (1c per point in the case of the Barclays Arrival+, which is still available). Transfer partners included Etihad, Eva Air and Qantas, plus several more.

But the card is no longer available on Barclays’ website and View From the Wing reported this morning that it is being closed to new applicants. They talked to Rachana Bhatt, head of Barclays US branded cards who told them: “we didn’t see great demand for the product.” Basically not enough people signed up, so they decided to close the card to new applicants, but are still honoring the cards for current card members.

So what happened? Well, from my point of view the lack of applications was caused by the lack of a sign up bonus on the Arrival Premier card, the card featured an annual spending bonus instead of a sign up bonus. So in addition to earning two points per dollar spent on all purchases, you could earn 25k extra points for spending $25k in one year (which works out at a total of three points per dollar on $25k spent). That bonus was available every year, so the card did have quite good long term prospects, but I think Barclays underestimated what a short term view many consumers have, plus how people really weigh up the pros and cons and will find the caveats hidden in the small print.

One of those caveats was the transfer ratios to airlines, which were not competitive with other cards. Points transferred to most of the airline partners at a ratio of 1.4 to 1, which means the supposed 2x per dollar spent was pretty deceptive, once you transferred to airlines it was really just 1.5x per dollar and there are many cards and combinations of cards that can get you that kind of value or higher, whilst providing a large sign up bonus.

In addition to these factors, the Barclays Arrival Premier card’s annual fee was a little high for the tier. I classify this as a tier three card in my five tier credit card rating system. Tier three cards usually have an annual fee of around $100, with most being $95 and waived for the first year. But the Arrival Premier’s annual fee was $150, a bit higher than the competition. The reason for the higher fee was most probably because the card came with lounge access through lounge key, a smaller lounge network than priority pass, yet the membership still required Arrival Premier cardholders to pay $27 per visit, a deal most credit card savvy people would probably turn their nose up at.

Conclusion

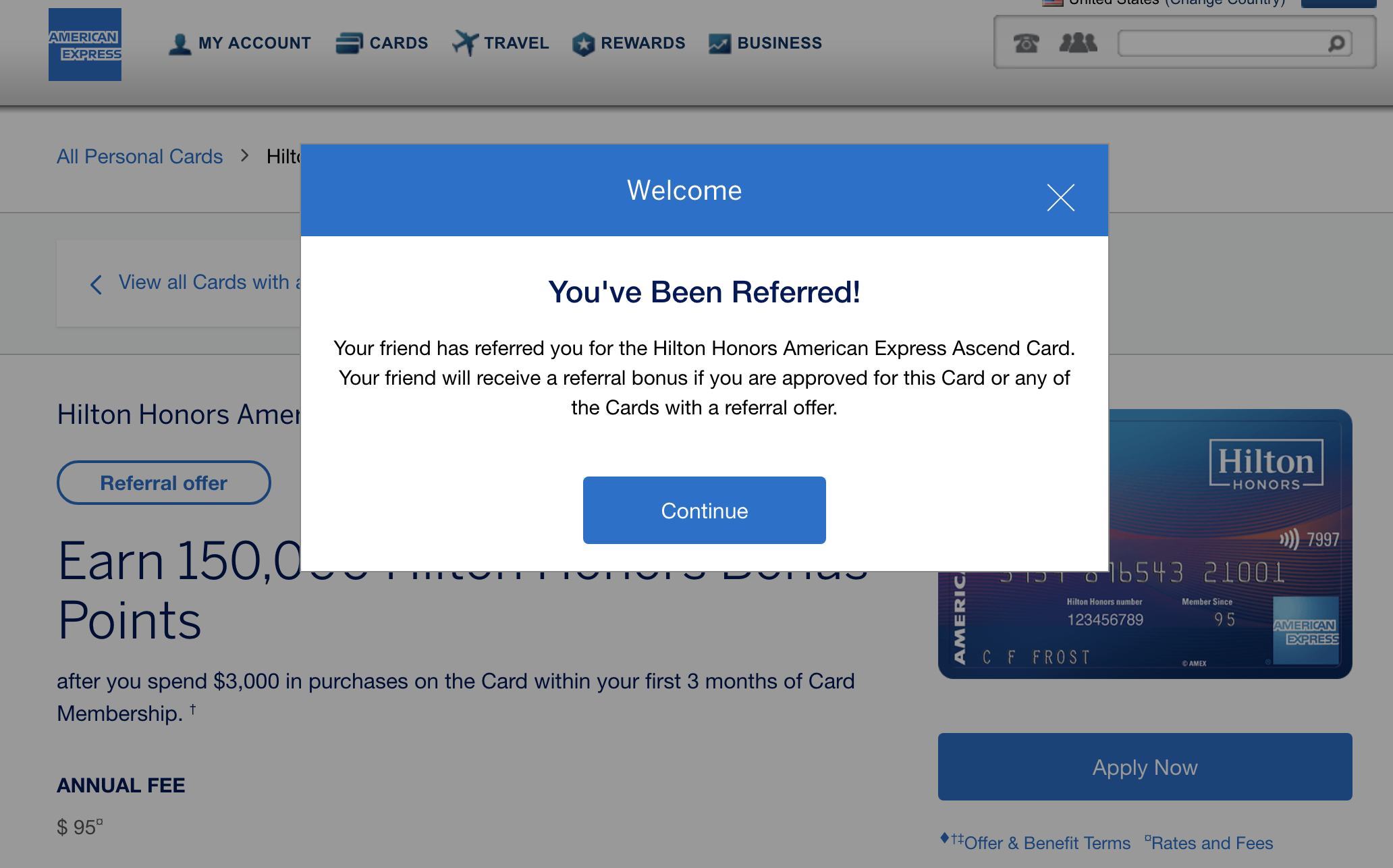

In my opinion the card was trying to straddle tier 3 and 4, giving some of the benefits of a premium card, but not doing it anywhere near as well as an actual tier 4 card. For the lounge access, you can see straight away that it was a bad deal. Tier 4 cards give unlimited access, that is what people are used to, but their annual fee probably wasn’t high enough to allow for that. Tier 3 cards sometimes give limited lounge access, and in my opinion they should have followed the example of the Amex Ascend Hilton credit card (a tier 3 card), offering 10 free lounge passes, rather than unlimited access with a fee for each visit. The lack of a sign up bonus presented an opportunity cost to potential cardholders, get this card with no bonus and have to spend over $2000 on the card every month for a year, just to get 25k bonus points that don’t even transfer to partners at 1:1, when other cards are giving 50k to 60k sign up bonuses after the first three months and the points transfer at 1:1.

Some of the ideas behind this card were interesting, like the concept of a spending bonus you can get every year. But the card should have had a sign up bonus as well, perhaps 25k, then they could of at least said you have the opportunity to get a 50k bonus in the first year. This would have enticed new members and encouraged long term loyalty. The points should have transferred at 1:1, with perhaps a 1.5x earning ratio instead of 2x (it is more clear what consumers are actually getting) and I think you can forget about the lounge access, it isn’t needed, most people wouldn’t want to use it if they have to pay $27 per visit, and probably have a premium card in their wallet that will get them in for free anyway! I wish Barclays would make a few adjustments and re-launch the card, because the set of transfer partners were competitive, but unfortunately Rachana Bhatt told View from the Wing they have “no plans at this point to make any changes to the card.”

Check out our review of the card from earlier in the year.