The Chase Sapphire Preferred® Card is one of the most versatile credit cards out there on the US credit card market. It has an affordable annual fee of $95, earns Chase Ultimate Rewards points, which are some of the most valuable points out there, and often gives big welcome bonuses for new card holders. In this review we will go through the pros and cons, (and yes there are a few cons) of this card.

Welcome Bonus

The current welcome bonus is 75,000 points for spending $4000 in the first 3 months of card membership. The points on the Chase Sapphire Preferred® Card are worth 1.25 cents per point when used to book travel, so that is $937.50 worth of free travel you could get from the bonus using the most basic travel portal redemption. That bonus is now listed by Chase as “ending soon”. We don’t know exactly when.

Point Earning

Here are the current bonus categories on the Chase Sapphire Preferred:

Earn 5x total points on travel purchased through Chase Ultimate Rewards.

Earn 2x on other travel purchases.

Earn 3x points on dining, including eligible delivery services, takeout and dining out.

Earn 3x points on online grocery purchases (excluding Target, Walmart and wholesale clubs).

Earn 3x points on select streaming services.

Plus, earn 1 point per dollar spent on all other purchases.

I would say there are some sweet spots here, but also some slight disappointments. For example the 5x on travel through the travel portal is great for flights, this rivals cards like the The Platinum Card® from American Express that earn 5x points on flights booked directly with airlines or through Amex Travel (terms apply). I wouldn’t recommend the Chase travel portal for booking hotels though, since when you book through a 3rd party, you don’t benefit from your hotel status (if you have status with that hotel chain), i.e. no room upgrade etc…

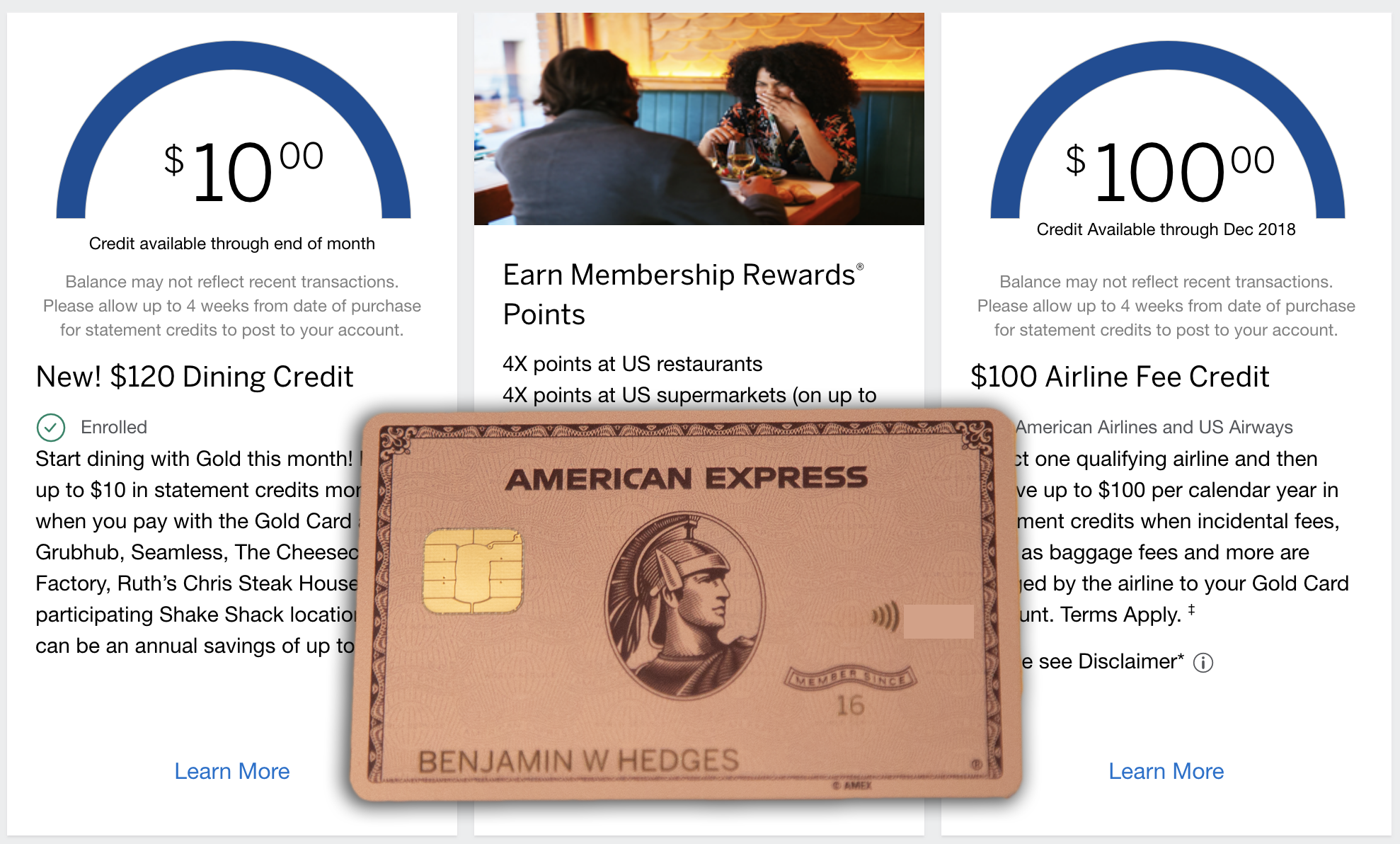

The 3x on dining is competitive, but does not match the American Express® Gold Card, which I consider a competitor with the Sapphire Preferred. Then we have 3x on online grocery spending, that online part is a serious caveat for me. The Amex Gold gives you 4x on U.S. Supermarkets (up to $25,000 in spend per year, the 1x) so it earns more and is more versatile, and although there is a spending limit , it is so high that most people will never hit it (terms apply). Then we have 2x on all travel (outside of the Chase travel portal) and 3x on select streaming services which are definitely good, but are still beaten by other cards.

So the earning categories are a mixed bag, the two best categories, 5x on Chase Travel and 3x on dining, are strangely the same as on the no annual fee Freedom Flex and Freedom Unlimited cards, so the Sapphire Preferred doesn’t really stand out with point earning, but it is not terrible either.

Redeeming Points

The Chase Sapphire Preferred® Card is great for redeeming points. In addition to the points being worth 1.25 cents per point through the travel portal, you can also transfer them to 14 transfer partners, 11 airlines and 3 hotels. Airlines include United, British Airways (great for booking US domestic AA flights) and Emirates. For hotels, Hyatt is a great value partner that you can normally get a lot of value out of.

When redeeming points through transfer partners you should expect to get at least 2 cents in value per point, in my opinion. I was able to get 3 cents in value per point flying to the UK on British Airways business class, and you could get higher values the higher you go in airline classes. If you are interested in checking out how to redeem Chase points for maximum value, check out my video below.

The True Value of the Sapphire Preferred

The Sapphire Preferred is not a card you can take at face value, since on its own it is good, but when you combine it with other Chase cards it becomes great. This system of cards is commonly called the Chase Trifecta, where you combine at least three Chase cards to earn points in different categories and then move the points to your sapphire card to redeem. For example you could have a Chase Freedom Flex℠ which gives you 5x on rotating categories each quarter (up to $1500 in spending), you could then also have a Chase Freedom Unlimited® which gives you 1.5 points per dollar on non-category spend and the Sapphire Preferred to earn 3x on online grocery, 3x on streaming and as your card for redeeming points, since the freedom cards don’t have transfer partners, so you have to move your points to your Sapphire to redeem for maximum value.

Hotel Credit

The Sapphire Preferred features a $50 hotel credit once per year, for any hotel booked through Chase Travel. This effectively halves the annual fee from $95 down to $45.

Future Upgrade to Sapphire Reserve

Another great tip I like to give people is to view the Chase Sapphire Preferred® Card as a first step on the path to getting the Chase Sapphire Reserve®. There are a few reasons why you may do this:

1. Welcome Bonus: The Sapphire Preferred often has a higher bonus than the Sapphire Reserve and thus we normally view that as a good reason to get the Preferred first. Although right now, the two cards both have the same bonus.

2. Easier to Get: The Preferred is a Visa Signature card with a minimum credit limit of $5000. Thus it is easier to get from a credit score and income perspective than the Reserve which is a Visa Infinite with a minimum credit limit of $10,000. You could do the same thing and upgrade after one year.

3. Lower Annual Fee: The Preferred has a considerably lower annual fee than the Reserve at $95 VS $550. Although the Reserve does have an easy to use $300 travel credit, so effectively the annual fee is more like $250. Now if you are just earning points and are not planning to use them for travel just yet, you could get the Preferred. Then after one year or when it comes to the time you want to use points, you can upgrade to Reserve. You will then get 1.5 cents per point in value through the travel portal for all the points you earned on the Preferred and you will get the higher level travel benefits from the Reserve, such as airport lounge access, at a time when you will actually use them.

Conclusion

In total I think the Chase Sapphire Preferred® Card is a great card. Its point earning categories aren’t the most amazing, but are far from bad, but it really comes into its own when you use it as part of a Chase Trifecta or as a first step for upgrading to the Sapphire Reserve in the Future. If you want to take advantage of the current welcome bonus, do remember it is “ending soon”, we don’t know exactly when, but applying sooner rathe than later would be advisable.

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.