Chase and Marriott have been welcoming new members of Marriott Bonvoy Boundless™ Credit Card and Marriott Bonvoy Bold™ Credit Card with increased sign up bonuses since Jan 13th, 2020. This limited time offer of 100K and 50K point bonuses is now coming to a close — the deals are set to expire on March 4, 2020.

If you were thinking of applying for either of the two cards and just never got around evaluating if these are worth the while, below are the benefits and fees breakdown for your convenience.

Marriott Bonvoy Boundless™ Credit Card offers 100,000 welcome points after you spend $5,000 in the first three months (previously, you could earn 75,000 points after spending $3,000 in three months). You will earn 6X Bonvoy points per $1 spent at over 7,000 participating Marriott Bonvoy hotels and 2X Bonvoy points for every $1 spent on all other purchases. If you’re traveling abroad with this card it’s good to note that there are no foreign transaction fees.

This credit card has an annual fee of $95. However, Marriott Bonvoy Boundless offers an additional Free Night Award (valued up to 35,000 points) every year after account anniversary. Considering this free stay bonus, the annual fee is more than offset, in fact you will probably be up $50 to $100.

Silver status and 15 Elite Night Credits each calendar year are included with your card membership benefits. This bumps you up significantly on the status ladder. For example, Gold Elite status requires 25 nights stay per year. The included 15 Elite Night Credits brings you closer to the gold elite status where you will enjoy higher point earning rates per every $1 spent, will have access to enhanced room upgrades, 2 p.m. late checkout, and a welcome gift of points.

100,000 Welcome Bonus – Value Breakdown

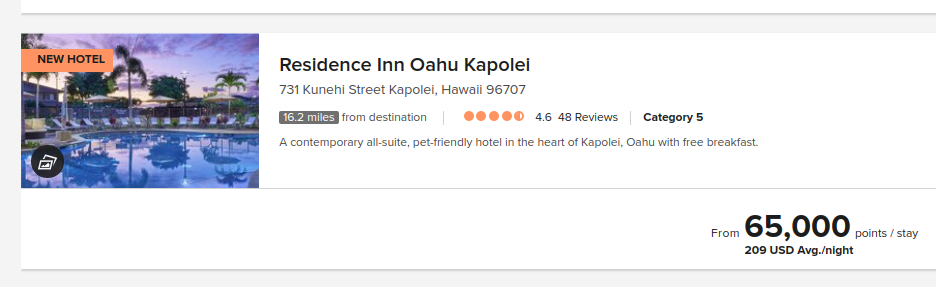

In addition to its standard redemption rates, Marriott recently introduced peak and off-peak award pricing. The number of points required for a free night at Marriott’s 7,600+ properties worldwide will depend on demand, much like with airline tickets. In other words, the 100K bonus can give you 10-15 nights at category 2 hotels or 1-5 free nights at Category 4 hotels (these are located in big city centers, resorts and include Renaissance Sao Paulo hotel in Brazil, W Abu Dhabi Yas Island, United Arab Emirates, etc) or between 1 and 3 free nights at category 5, such as the Residence Inn Oahu.

Marriott Bonvoy Bold™ Credit Card offers 50,000 points after you spend $2,000 in the first three months (previously, you could earn 30,000 points after spending $1,000 in three months).

You will earn 3X Bonvoy points per $1 spent at over 7,000 participating Marriott Bonvoy hotels and 1X Bonvoy points for every $1 spent on all other purchases. If you’re traveling abroad with this card, like the Marriott Bonvoy Boundless card it also has no foreign transaction fees.

This credit card has NO annual fee.

You will receive 15 Elite Night Credits annually, qualifying you for Silver Elite Status (restrictions apply).

There are plenty of hotel options for you to redeem your welcome points for. depending on the destination, chosen property, and time of the year, your 50,000 points could add up to a value over $400 of hotel stays.

Many hotels can be booked for 35,000 points per night, here is a video on a Marriott property The Credit Shifu stayed at recently, in Taiwan

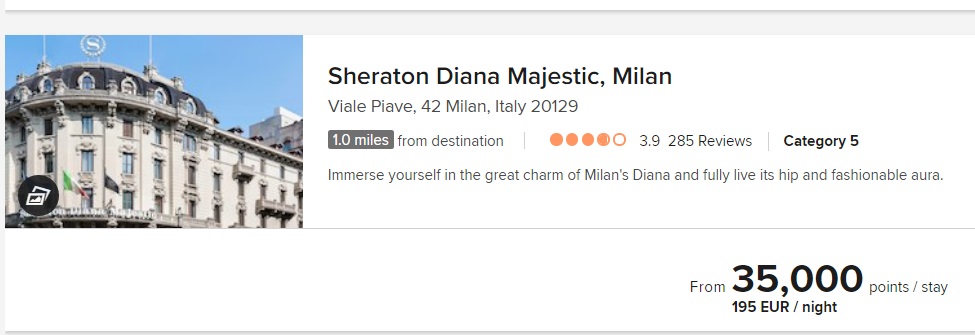

or you could also book the hotel below in Milan, Italy for the same price.

Both the Marriott Bonvoy Boundless™ Credit Card and Marriott Bonvoy Bold™ Credit Card offer interesting perks for travelers. If you were thinking of applying for either one of the cards, this limited offering of 100K and 50K welcoming points is a good incentive to do so before March 4. In other words you have one week left to apply.