On Monday, Senate Majority Leader Mitch McConnell announced the Health, Economic Assistance, Liability Protection and Schools (HEALS) Act. While the CARES Act aimed to preserve liquidity for businesses and households during lockdowns, the HEALS Act – Phase 4 legislation proposal – focuses on safe re-opening, providing support to schools, hospitals, and additional relief to businesses. Another round of stimulus checks is also included in the new proposal.

Here is an outline of what’s in the HEALS Act.

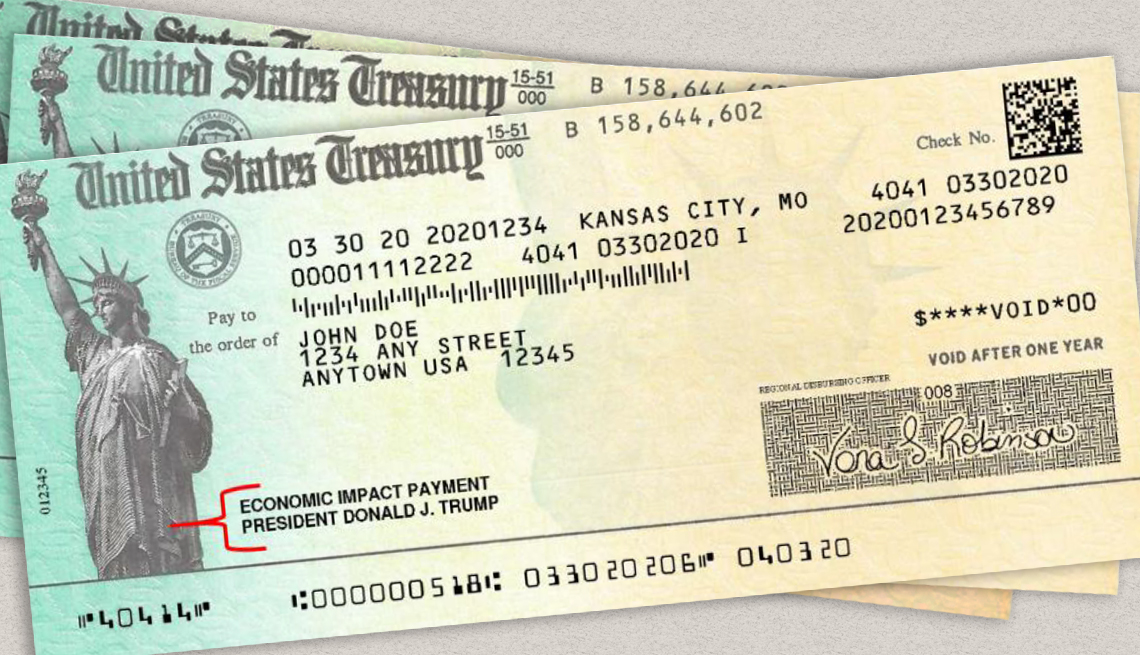

Additional Round of Stimulus Payments

HEALS Act proposes a second round of economic impact payments – stimulus checks – structured identically to the rebates sent to Americans in the spring:

- $1,200 for single taxpayers and heads of household

- $2,400 for those married filing jointly.

The credit will phase out identically to the first round, at 5% per dollar of qualified income above:

- $75,000 for singles

- $112,500 for heads of household

- $150,000 for joint taxpayers.

Taxpayers’ income will be determined using 2019 or 2018 tax returns.

$500 Additional Payment for Eligible Dependents

One difference from the CARES Act stimulus payments is that the $500 additional payment for eligible dependents will be expanded beyond qualified children (aged 17 and under) to include other dependents excluded from payment in the CARES Act, such as adult dependents (including those with no income).

Excluded from the Second Round of Stimulus Checks

- Anyone deceased prior to January 1, 2020

- Prisoners.

The stimulus payment would be protected from federal and state debt collection and bank garnishment with the exception of past due child support payments.

Unemployment Compensation

The Federal Pandemic Unemployment Compensation (FPUC) benefit provided $600 per week on top of state-level compensation through July 25th under the CARES Act. The HEALS Act proposes a supplemental FPUC benefit of $200 per week through September 2020, and starting in October, this would be replaced with a payment that is equivalent to 70% of a recipient’s lost wages when combined with state UI compensation up to $500 per week.

Expansion of the Paycheck Protection Program

The HEALS Act proposes to provide small businesses with $190 billion to support second draw loans from the PPP, restricted to firms with fewer than 300 employees that have experienced at least a 50 % reduction in gross revenues. This is to preserve cash flow for these small businesses and help prevent additional layoffs. These businesses will be able to take out a second loan equal to 2.5 times total monthly payroll costs up to $2 million. The loans are forgivable if at least 60% of the loan is used to cover payroll costs.

The HEALS Act expands forgivable expenses to include worker protection costs and covered supplier costs, simplifies the forgiveness process for smaller loans, and expands PPP eligibility to certain 501(c)(6) organizations.

An Increased Employee Retention Tax Credit

The employee retention tax credit (ERTC), which currently provides a 50% refundable payroll tax credit on certain wages paid by employers to employees during the crisis, would be raised to 65%.

The amount of wages the ERTC can be claimed for is increased to $30,000 per year (from $10,000 per year).

The Work Opportunity Tax Credit

The HEALS Act would temporarily expand the work opportunity tax credit (WOTC) to employers hiring individuals in qualified groups, and would include a new targeted group defined as 2020 qualified COVID-19 unemployment recipients. The maximum credit would be expanded to $5,000.

A New Refundable Payroll Tax Credit for Coronavirus Expenses

The HEALS Act would create a new refundable payroll tax credit equal to 50% of an employer’s qualified employee protection expenses, including coronavirus testing, cleaning supplies, and protective personal equipment (PPE). The maximum amount of qualified expenses is:

- $1,000 for each of the first 500 employees

- $750 for each employee between 500 and 1,000

- $500 for each employee over 1,000.

The credit would apply to expenses paid after March 12, 2020 and before January 1, 2021.

Full Deduction for Business Meals

The HEALS Act would temporarily allow a full deduction for business meals—up from currently 50%—through December 31, 2020 to stimulate demand for meals at restaurants.

This would raise the deduction to pre-1986 levels, according to Tax Foundation.

Emergency Appropriations

The HEALS Act includes $306 billion in emergency appropriations for coronavirus health response, including $105 billion to help students return to school in the fall.

Liability Protection

Liability protection would be provided to health-care providers, schools, and employers that would limit lawsuits brought against them for exposure to the coronavirus.

Gross negligence would still be subject to legal claims.

***

The HEALS Act will require Democratic support in both chambers to be passed. The negotiations are happening right this moment. Follow TheCreditShifu for timely updates.