The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

It is generally recommended to maintain a credit utilization rate of 30% and lower if you’re working on boosting your credit score, especially if you’re planning to apply for a mortgage, auto loan, etc. This article dives into how much credit an average American uses, and how much lower you should go in order to insure your credit score is at its healthiest.

Credit reporting agencies – TransUnion, Equifax, and Experian – collect information relevant to your credit and financial history. When you apply for a loan, request an increase on your credit limit or even apply for a new job, your credit report comes into play. Credit reports also serve as an archive for select personal information – public records, current and former address(es), employers, etc.

Each of the three credit bureaus offer slightly different services. For example, TransUnion offers Identity Lock, a service that none of the other two bureaus provide. Not all vendors report to all three credit agencies. This means that the information on your credit report can vary from agency to agency, resulting in different scores.

Credit Utilization Is at Its Lowest Since 2009

Equifax data covers 222 million consumers, giving a detailed credit file on 97% of the pulls. According to Equifax, the average credit utilization as of June 15, 2020, is 19.2% — a historical low since Equifax began tracking data in 2009. Credit card utilization has remained between 20% and 22% of total credit limits since the spring of 2011.

TransUnion also reported that the average credit utilization rate in Q1 2020 was 20.4%.

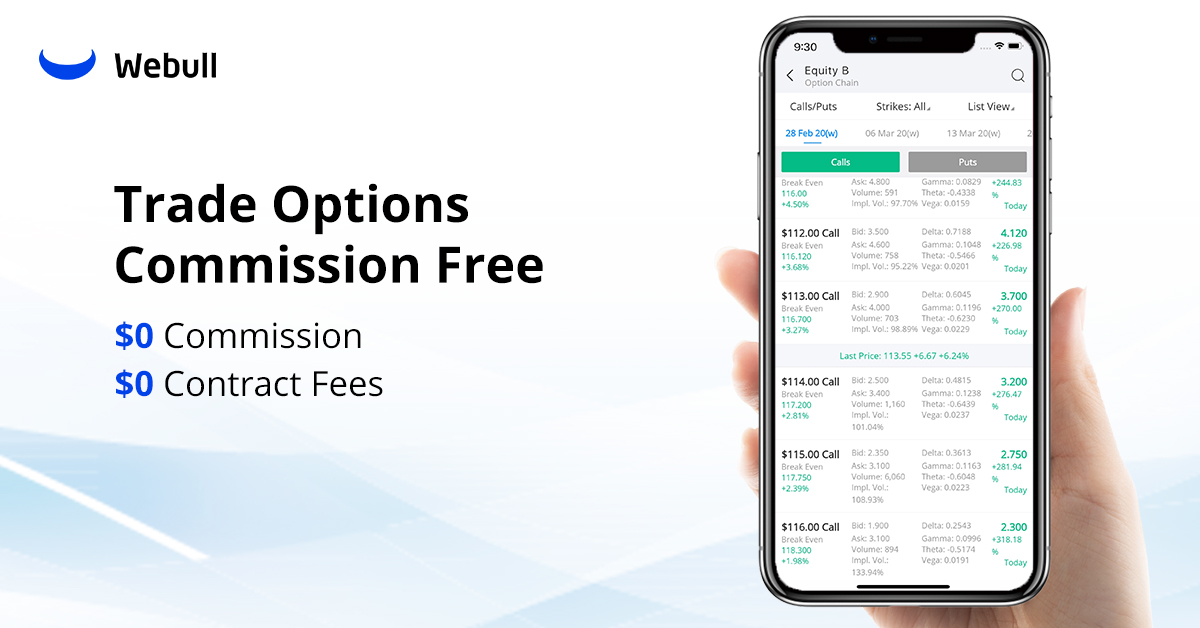

Your utilization rate makes up 30% of your credit score and is one of the deciding factors of whether you will be denied or approved for a loan or a new credit card with sizable rewards. For example, Chase Sapphire Preferred offers 100,000 welcome bonus points – that’s $1250 toward travel when redeemed through Chase Ultimate Rewards and is a great way to offset a good part of your next vacation. However, Sapphire Preferred is a tier three credit card and in order to be approved for a tier three card you need to have:

- A Credit score of at least 700

- A reasonable income. As a rule of thumb, it should not be more than 15% lower than the median household income in America ($61,937)

- A Credit history of at least 8-12 months

To determine a risk, before approving your credit application, lenders and creditors, among other things, look at your credit utilization rate. A high utilization indicates that you may have trouble paying back your credit card bill because you already have a lot of debt. Low utilization rate signals that you’re able to manage your finance and credit responsibly.

If you’re planning on applying for a mortgage or any other credit product, the best practice is to lower your credit utilization rate at or below 9%. In other words, your credit utilization should be at least 50% lower than current national average credit utilization rate. The closer you can get to having a single-digit credit utilization rate, the better for your credit score.

When to Consider a Credit Limit Increase

Lenders like to see a wide variety of credit types on your credit reports as it shows you’re able to balance multiple commitments simultaneously. If you already have multiple cards, it’s probably best to request a credit limit increase rather than open a new credit card because managing on-time monthly payments could get confusing, especially if the accounts have different due dates.

Though increasing your credit limit will hurt your credit score slightly in the short term, it can improve your credit utilization ratio as long as you resist the urge to spend up to that limit.

How to Get a Credit Limit Increase