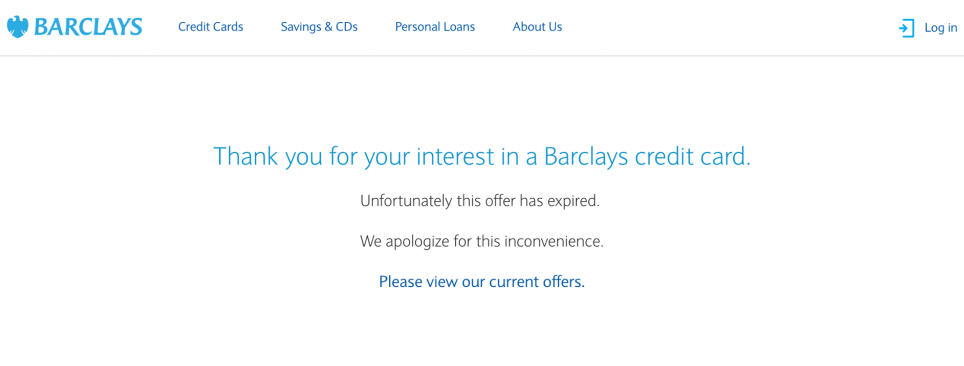

The Barclays Uber credit card is no longer accepting new applications. The page that was previously available to apply for the card shows a message that reads “this offer has expired”, and the card isn’t mentioned in the Uber app as either.

According to Barclays, this is a temporary removal due to the current state of the economy and market conditions. It’s not clear at the moment when the Uber credit card will resume accepting applications. Barclays did not provide a timeframe for when the card would be available again.

Existing Uber credit cardmembers “can continue to use their cards with confidence,” according to Barclay’s press statement. The Uber card now earns 5% back in Uber cash on Uber, Uber Eats and JUMP. The card itself generated a lot of interest when it was first introduced. However, last October, Barclay’s made changes to the Uber credit card — Uber Cash instead of statement credit and got rid of the popular 4% cash back on dining — and for many consumers the card was no longer worth it.

Other Credit Cards You Currently Can Not Apply for

Other credit cards that have fallen victim to the economy’s downward spiral due to the coronavirus outbreak, include Chase Slate (only available through targeted mailer), United Club Business Card, and Southwest Rapid Rewards Premier Business Credit Card.

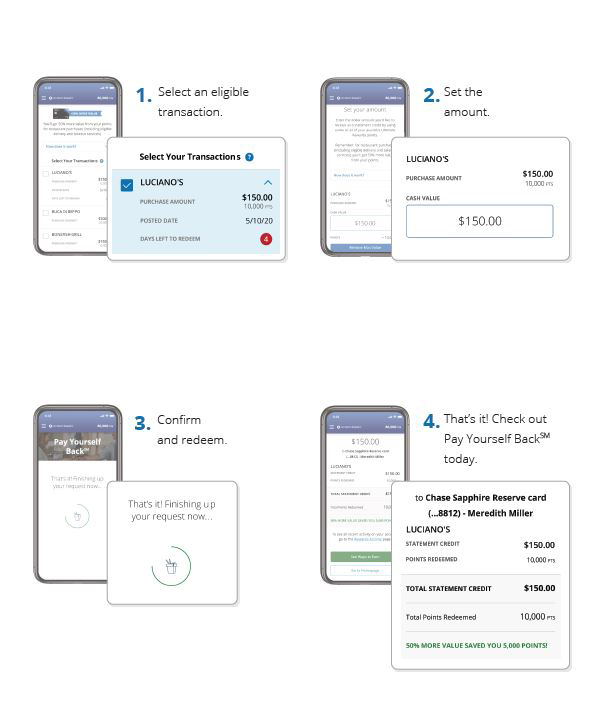

If you’re looking for a card that earns a bonus on dining, the U.S. Bank just rolled out the Altitude Go Visa Signature Credit Card that offers 4% cashback on dining and has no annual fee. Chase Sapphire Reserve offers 3X points on dining plus comes with a 50K welcome bonus. That’s $750 toward travel when you redeem through Chase Ultimate Rewards. The card has a $550 annual fee that is partially offset by the annual $300 Travel Credit as reimbursement for travel purchases charged to your card.