The economic fall out due to the coronavirus outbreak and temporary or permanent business closures has hit many American households hard. In this article we’re going to cover three tried and true things you must do to get out of financial hardship faster and put yourself on the road of future success.

How to Know If You’re in Financial Hardship

It sounds like something that would be obvious but some people let the situation go on for so long that they haven’t really realized what’s happening to them.

The signs that you’re experiencing financial difficulty:

- Living paycheck to paycheck with minimal or fast shrinking savings

- Relying on credit cards for bills [and paying credit card interest]

- Missing payments on credit cards or other debts

- Seeing your credit score go down

If you check one or more of the four signs above, here are three steps you need to take to get yourself out of financial hardship.

Step One: Get Your Spending Under Control

This might sound hard but this is the best thing you can do to stop your debt growing even bigger. You can start doing this by making a budget today:

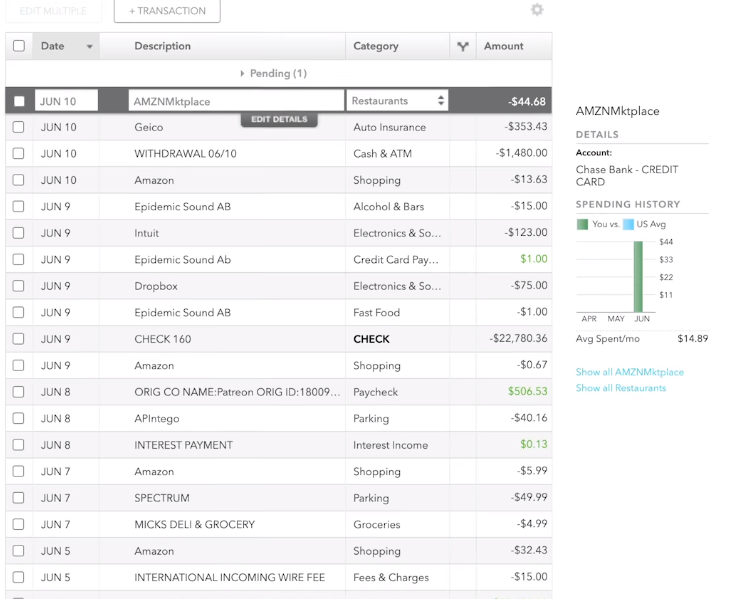

- Go through all of your accounts (bank accounts, credit cards) and note all of your charges. You will basically be tracking all of your spending. Don’t just write down what you think you’re spending, actually go through all of your accounts and see what you’re spending money on. You might be surprised to find out that, for example, you’re still paying $5.99 for CBS All Access for that one show you signed up for a while back, that already ended. But you never cancelled your subscription.

You can use a Google or Excel spreadsheet to write down all of the charges or you can use Mint.com, which brings all of your accounts in one place so that you can see all of your spending.

- Now cut down all unnecessary spending – be ruthless – and make your monthly budget.

If you’re using Mint, it will show if you’re within your monthly budget or not across different categories.

Using this method you can bring your spending in line with the amount of money you’re bringing in each month. If you can’t quite get it down to that amount, you can at least get it down to where you can realistically make up that extra amount with a side hustle or a part time job.

Real Story: When The Credit Shifu and Mrs Credit Shifu had their first daughter, their spending increased dramatically. The Credit Shifu ended up working at Trader Joe’s two to three nights a week. This brought in just enough money to balance their budget.

“It was hard, I’m not saying this is easy. Oftentimes you have to work really hard, albeit for a limited period of time, to get yourself back to financial health. It is tough. But at least I wasn’t accumulating new debt, I had things under control.”

Step Two: Get Your Debt Under Control

We’re mostly talking about credit card debt because that’s what people tend to fall back on first when they get to times of financial hardship. There are, certainly more extreme examples, such as payday loans with much higher interests rates – they can charge $15 – $20 per $100 borrowed every two weeks or APR of 391% – 521%. No matter what type of debt you’ve got, the principals of getting it under control are the same:

- Make another spreadsheet listing out all your debts with the amounts and interest rates on each card and loan product.

- The most efficient way of paying off your debts would be to start paying off the one with the highest interest rate first. This is because it’s costing you the most in interest payments each month.

- For all other debts, just meet the minimum payments until you paid off the highest interest debt.

- Once you got that really high interest debt paid off, apply the same principal to the remaining debts– paying off the debts with the highest APR first.

Quick tip: With credit cards, you can lower your interests by transferring your debt to a balance transfer card. Balance transfer cards will give you 0% APR on balances transferred over for 12-21 months depending on the card. You might not be able to get a credit limit on the balance transfer card that covers all your debts, though. You might be able to transfer only, say, half of your high interest credit card debt. In this case, pay off the remaining half of the highest interest debt on your credit card first and then move on to the next credit card debt that has the highest interest among the remaining debts.

This way you pay off your debts in the most optimized way with the least amount of interest paid.

Step Three: Build Your Financial Foundation Back up

- Improve your credit score, as this is an indicator of your financial health and how various companies evaluate you. If your credit score is low, you’re pretty much guaranteed to be ripped off on future loan products and might have to pay deposits for things as simple as signing a contract for a cellphone or a utility service.

How to Build Your Credit Score FAST! 0 to 700 in Under 6 Months

- Start accumulating savings. 59% of Americans are living paycheck to paycheck. If you have even a little bit of savings, you’re already more financially stable than 59% of the country. Most financial advisors suggest having 3-6 times your monthly expenses in the savings account.

Now that you have your spending and debts under control and started building your financial foundation by setting aside enough money to cover 3-6 month of your living expenses, it’s still a good idea to maintain that budget and healthy credit practices just to keep this going. You don’t want to fall back into the debt trap again.

If you do have some extra money lying around and you’re interested in getting into the stock market, we have a great deal with Webull where you get two FREE stocks: one for just opening your account and a second for funding your account with $100. The second stock could be valued up to $1,400.